The Mad Hedge Fund Trader Interviews Adrian Day [40:00m]:

Play Now |

Play in Popup |

Download

Featured Trades: (ADRIAN DAY ON HEDGE FUND RADIO),

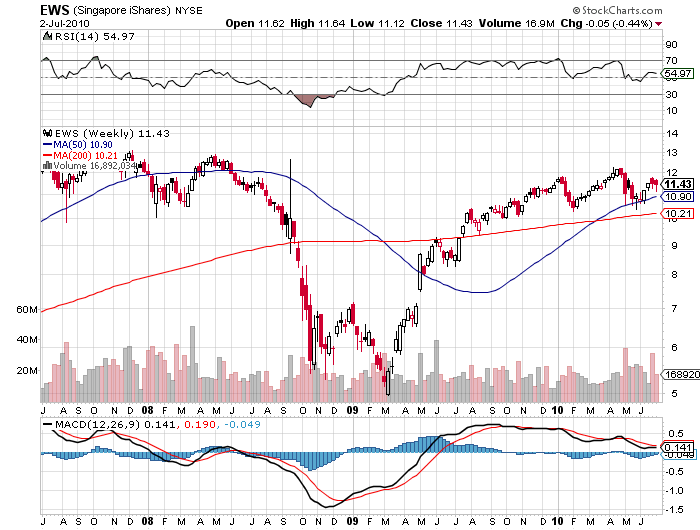

(UDN), (CYB), (EWZ), (GFA), (EWS), (FCX),

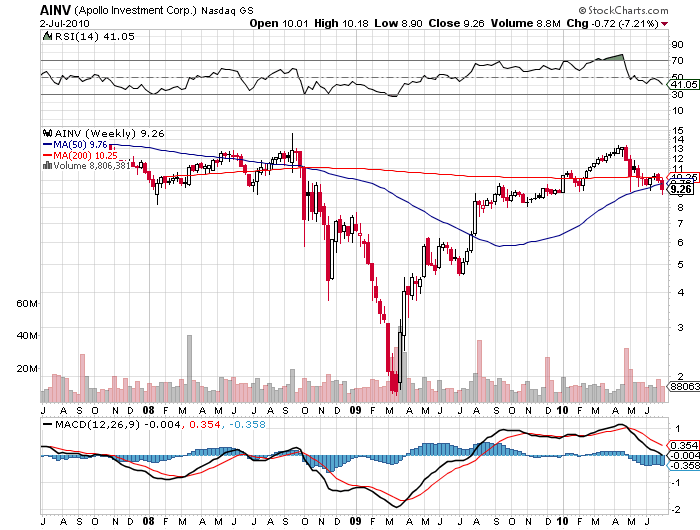

(CORN), (POT), (PHO), (AINV), (ARCC),

(JUNE NONFARM PAYROLL),

(US CITIZENSHIP)

PowerShares DB US Dollar Index Bearish ETF

Wisdom Tree Dreyfus Chinese Yuan ETF

Brazil iShares ETF

Singapore iShares ETF

SPDR Gold Trust Shares

Tecrium Commodity Trust Corn ETF

PowerShares Water Resources Portfolio ETF

1) Investing for the Fall of the American Empire. Adrian Day of Adrian Day Asset Management says that you should be restructuring your portfolio to reflect the ongoing economic decline of the West and the rise of the East. The US is now in a period that historically parallels Great Britain at the end of WWII, when a pound cost $5, on its way to $1, some 37 years later.

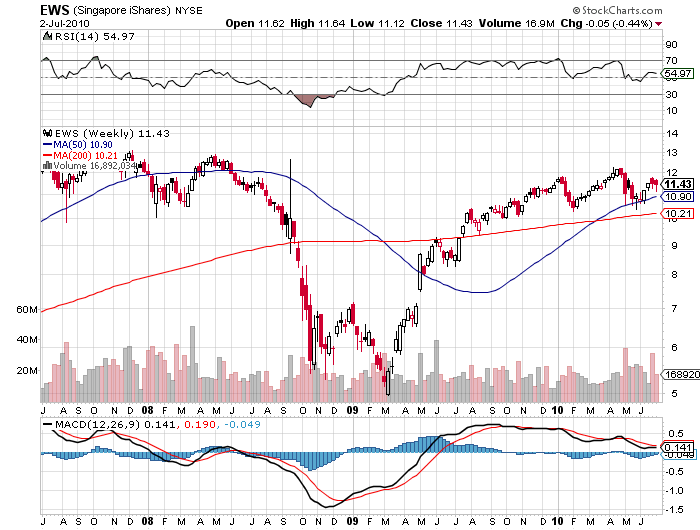

While we are seeing some dollar strength now, this is only a fleeting move in a secular bear market UDN. Central banks have cut their holdings of the greenback from 70% to 65%, and we could be on our way to 50% or lower. They no longer wish to hold such a heavy weighting of the currency of a country with such a large and worsening structural deficit. This will not be achieved through some great cataclysmic sell off, but a slow and steady diversion of new money into other assets. Adrian especially likes the Singaporean and Hong Kong dollars and the Chinese Yuan CYB. Ownership of Canadian and Australian dollars, and gold, is rising. He is not a fan of the yen or the euro.

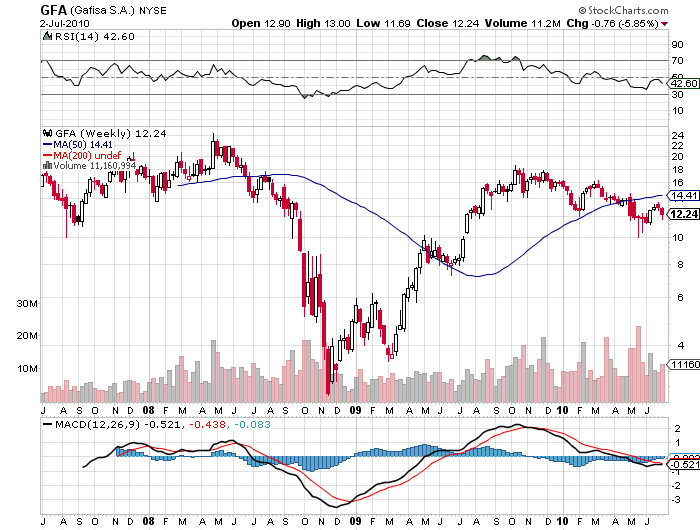

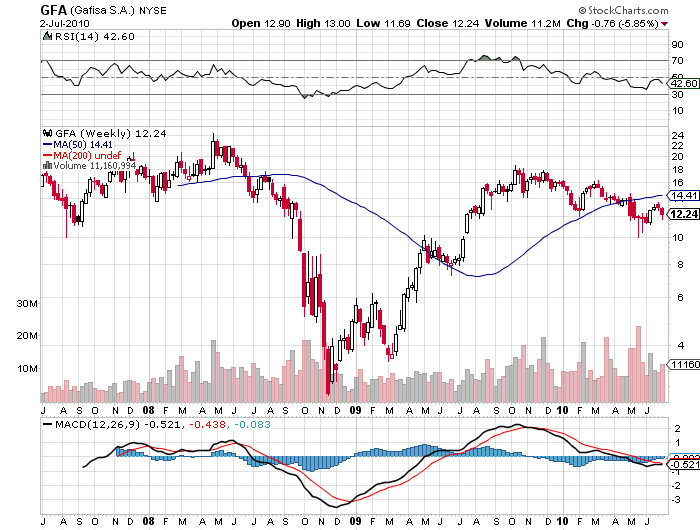

Day is extremely cautious about global stock markets for the time being, but likes emerging markets long term, which will be driven by a rising middle class in the decades to come. Brazil EWZ is a top choice, with vast improvements in governance since the bad old days of the eighties, and one of the world’s strongest currencies. He’s out now, awaiting an election that could bring a leftist tilt. He likes real estate mortgage lender Gafisa GFA, in which Chicago mogul San Zell is the largest investor (click here for more depth ). Adrian clearly adores Singapore EWS, where companies have believable accounting and super strong balance sheets. Day has nothing in Africa or Eastern Europe.

Adrian is also a big gold bull GLD, as it now is a defensive holding that does well in every economic scenario. He doesn’t see the retail rush to buy the barbaric relic as a fiat currency replacement any time soon. And then there’s the central bank bidding war. Ben Bernanke and Alan Greenspan are in denial, still don’t understand the Fed’s role in creating the credit bubble, and until they do, investors have no reason to trust in paper currencies.

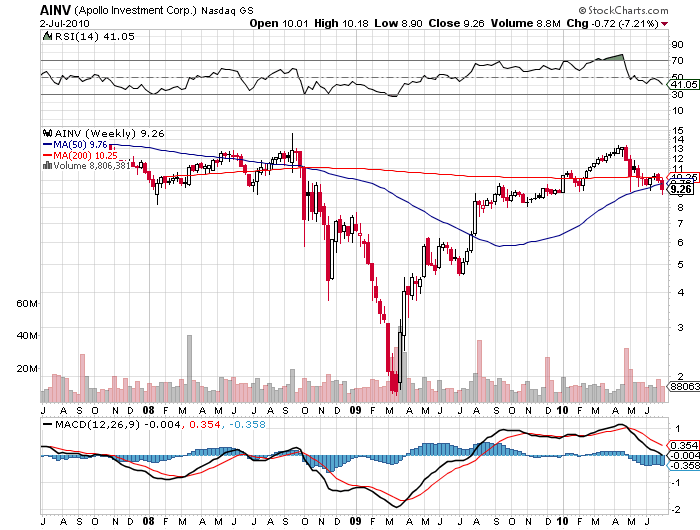

The cerebral Englishman wants to buy oil and gas during the traditional summer weakness, as well as commodity producers. He worships Freeport McMoRan FCX, the top copper miner, as one of the best managed companies in the world. He is bullish on food (CORN), ags like Potash POT, and water PHO (click here for my piece on H2O). He also likes business development companies such as Apollo Investments AINV and Ares Capital ARCC.

After getting a degree from the prestigious London School of Economics, Adrian devoted a lifetime to uncovering undervalued investment opportunities around the world. Today Adrian runs his own money management firm which focuses on global diversification for institutional clients. He is about to release a book entitled Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks. You can learn more about Adrian’s firm by visiting his site at http://www.adriandayassetmanagement.com/ .

To listen to my interview with Adrian on Hedge Fund Radio in full, please click on the “PLAY” arrow above.

Additional Pieces And Charts For Premium Subscribers

2) Proof the Economy is Stalling.

3) Could You Still Qualify to Become a US Citizen? The Fourth of July celebration brought back memories of my late wife’s campaign to become an American citizen, who originally came from Japan. Part of the process required a verbal quiz about US history and government. Our family spent a year energetically prepping her, with nightly grillings over dinner about the finest details of our independent form of government. She took cram courses and read a dozen prep books. By the time the test day came, she was a veritable constitutional law scholar, and any one of us could have qualified for a seat on the Supreme Court. I drove her up to the Federal Building in Santa Rosa, California with the greatest trepidation. As the interviewing officer entered, the tension in the room was so thick, you could cut it with a knife. There were only three questions. No. 1: what colors are in the American flag (answer: red, white, and blue). No. 2: who was the first general of the US army? (answer: George Washington). What are the three branches of government? (answer: legislative, executive, and judicial). I was stunned. All that work, and she gets a test that is a piece of cake. Two months later we were in an auditorium on San Francisco’s posh Nob Hill with 1,500 others to be sworn in, which by tradition is lead by an English applicant. In 2008, the feds revamped the test to make it a little harder. No. 1: who wrote the Articles of Confederation? (answer: Alexander Hamilton). No 2: how many seats are in the House of Representatives? (answer: 435 voting, six nonvoting). No. 3: How many amendments are there to the Constitution? (27) Whoa! I’m not sure I could pass this test. Just as my SAT scores are probably too low to get into a decent school today, I’m not sure that I could meet the standard to become a citizen either. But over one million immigrants did last year.

QUOTE OF THE DAY

“If you survive 100% inflation, you are probably a good manager,” said Adrian Day of Adrian Day Asset Management, about the long term attractiveness of Brazilian companies.