Global private equity firm $38 billion market cap Blackstone Group LP BX rarely does anything in a small way.

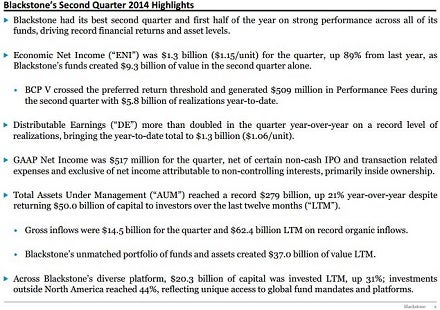

It is the largest alternative asset manager ranked by total assets under management with $279 billion of AUM.

Blackstone has the largest portfolio of real estate AUM -- more than $80 billion as of June 30, 2014. Blackstone's single-family rental business, Texas based Invitation Homes, has the largest portfolio of single-family homes for rent at 50,000 plus, and growing.

Blackstone Reports Best Q2 In Company History

In 2012, The Blackstone Group acquired Vivint for more than $2 billion, enabling Vivint to accelerate the development of new services and enter new markets.

Now Vivint is currently recognized as the country's leader in home automation, the second largest security company and the second largest provider of residential solar.

(August - 2014 Company presentation)

So when a Blackstone-backed residential solar company announces plans for a NYSE IPO, prudent investors should take note. Blackstone has demonstrated time and again an exceptional knack of knowing just when to realize gains on its private equity portfolio of companies.

A New Choice For Investors Interested In Residential Solar

According to an Aug. 27, 2014 24/7 Wall St. report, Vivint describes itself and strategy as:

"We offer distributed solar energy — electricity generated by a solar energy system installed at customers' locations — to residential customers based on 20-year contracts at prices below their current utility rates. Our customers pay little to no money upfront, typically realize savings of 15% to 30% relative to utility generated electricity immediately following system interconnection to the power grid and continue to benefit from guaranteed energy prices over the term of their contracts, insulating them against unpredictable increases in utility rates."

Vivint had approximately 850,000 subscribers at the end of June. Its total revenue was $6.17 million for the successor company in 2013. Revenue rose to $10 million in the first half of 2014 from the previous year's revenue of $1.9 million.

Since Vivint was created in May 2011, it has experienced rapid growth to the point of becoming the second-largest installer of solar energy systems — approximately 8 percent market share in 2013 — in the U.S. residential market, according to GTM Research. Vivint operates in seven states, including California and New York.

What Investors Need To Know About This Sector

Investor Takeaway

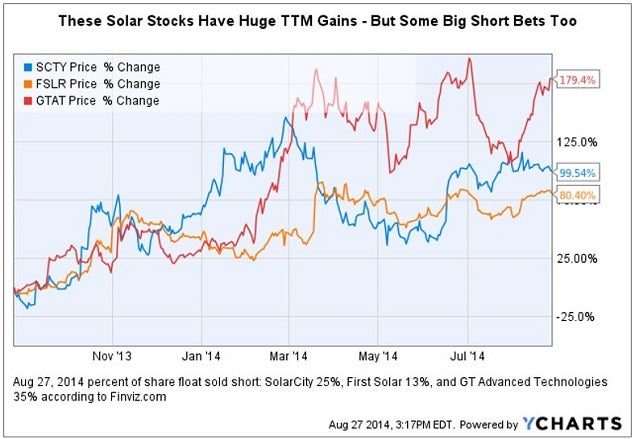

It remains to be seen if the Vivint IPO announcement will be viewed as just another reason to short the other solar firms in this sector, or as a reason to exit the short position for investors who see the timing of this new Blackstone backed IPO as a vote of confidence for the entire sector. Caveat emptor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.