NorthStar Realty Finance Corp. NRF has been growing from multiple acquisitions so far during 2014. NorthStar Realty growth has historically been accretive. The company has rewarded shareholders with a 19 percent compounded annual return since its 2004 IPO -- according to a recent August 2014 company presentation.

So it should come as no great surprise that on Sept. 18, 2014 this extremely diverse and dynamic REIT announced a $1.1 billion 90/10 JV with Chatham Lodging Trust CLDT to acquire 52 upscale extended stay and select service hotels totaling ~7,000 rooms from non-traded Inland American Real Estate Trust.

Inland American is controlled by Chatham Chairman and CEO Jeffrey H. Fisher, as is Island Hospitality, the entity expected to manage the hotels in this portfolio. Additionally, Chatham announced that it had entered into a non-binding letter of intent to acquire four hotels from the JV.

After the JV deal closes, NorthStar Realty is slated to own interests in 159 hotel properties with ~20,000 room keys. The majority of these hotel properties will fly either the Marriott or Hilton flag.

Why This Is Not Such a Big Deal

This follows on the heels of a NorthStar Realty announcement on Aug. 4, 2014 of a ~$4 billion deal to acquire non-traded Griffin-American Healthcare REIT II, Inc. The Griffin-American healthcare portfolio is primarily composed of medical office buildings (MOBs) 43 percent, and 30 percent senior housing facilities, which are located in the U.S. and United Kingdom.

The Griffin-American asset portfolio has a weighted average lease term of 9.1 years and was acquired at an approximate 6.4 percent cap rate; which is expected to be neutral to NorthStar cash available for distribution (CAD).

NorthStar Publicly Traded External Manager

NorthStar Asset Management Group Inc. NSAM was recently split off from NorthStar Realty Finance and earns a base asset management fee, as well as performance incentive fees from NRF.

So even if a large NorthStar Realty acquisition such as Griffin-American is neutral to CAD, the external manager will earn additional fees. This is one reason why Mr. Market tends to value externally managed REITs lower than internally managed peers.

NSAM announced a $0.10 quarterly dividend per common share, or $0.40 annually, back on August 11, 2014.

On Sept. 19, 2014 MLV & Co. initiated coverage on NSAM as a Hold, with a $20.50 price target, representing an 8.5 percent upside based upon the previous day closing price of $18.90.

Dividend Confusion

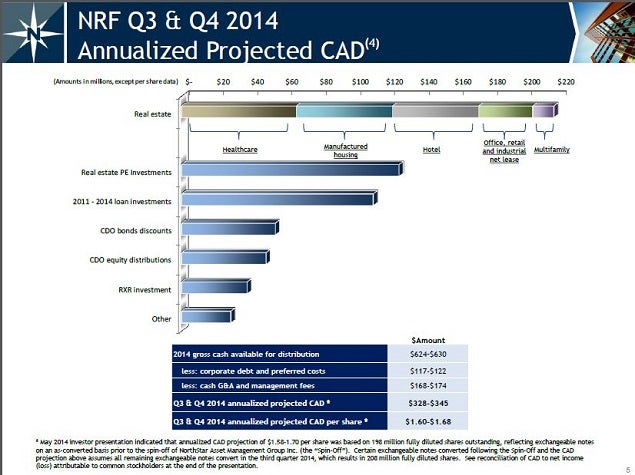

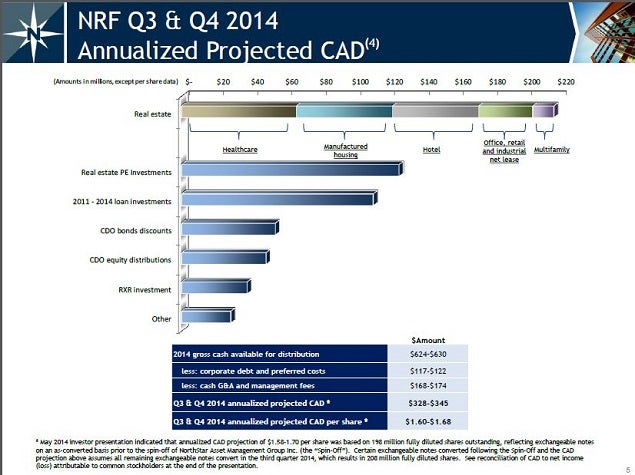

Most major online financial portals such as Yahoo Finance and Finviz have yet to update the NorthStar Realty annual dividend to $1.60 per year reflecting the $0.40 announced dividend moving forward for Q3 and Q4 2014.

This results in an overstatement from an already high ~9.5 percent yield, to as much as over 12 percent, (another source of confusion regarding an already complicated NorthStar Realty story).

The Big Picture

NorthStar Realty Finance is a very complicated diversified REIT. It is currently operating in so many REIT sectors, that it actually has no peers whatsoever.

(August - NRF Investor Presentation)

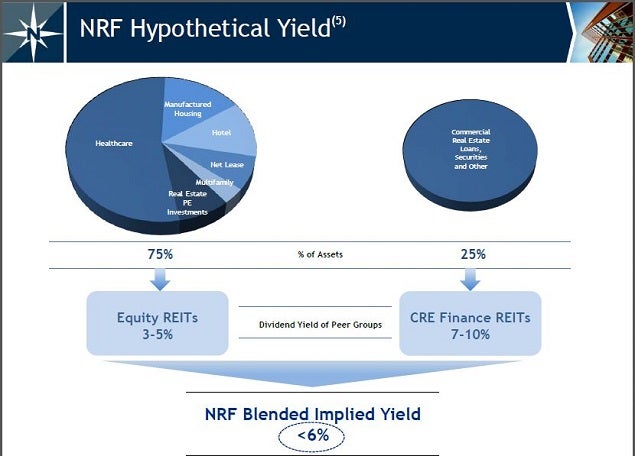

The $4 billion Griffin-American Healthcare acquisition increased the NRF real estate owned on the balance sheet to 75%. Recently announced acquisitions will increase real estate holdings even more vs NorthStar Realty Finance commercial real estate lending activities.

However, commercial lending aside, NorthStar Realty is still operating in five equity REIT sectors: healthcare, manufactured housing, lodging, triple-net industrial/office/retail, and multi-family apartments.

(August - NRF Investor Presentation)

The $4 billion Griffin-American Healthcare acquisition increased the NRF real estate owned on the balance sheet to 75%. Recently announced acquisitions will increase real estate holdings even more vs NorthStar Realty Finance commercial real estate lending activities.

However, commercial lending aside, NorthStar Realty is still operating in five equity REIT sectors: healthcare, manufactured housing, lodging, triple-net industrial/office/retail, and multi-family apartments.

(August - NRF Presentation)

Special Situation - Show Me the Money

Here is the best argument why NorthStar Realty Finance might be considered a "Special Situation" REIT. NorthStar management is suggesting that Mr. Market will one day wake up and see that the company has transformed itself into an opportunistic equity REIT which also makes a few carefully underwritten commercial real loans.

If NRF were to trade more in line with equity REIT peers, it would result in a higher Price to FFO multiple, much higher stock price and still pay a competitive ~6% dividend yield. The potential upside would be huge if this were to come to pass -- in excess of 50 percent.

Investor Takeaway

NorthStar Realty Finance is a very complex REIT to try and model and understand. It is growing its balance sheet at an incredibly fast pace. REIT investors tend to reward pure-play REITs that are transparent and internally managed.

NorthStar Realty Finance is a hybrid REIT -- both mortgage and equity -- as well as a highly diversified REIT, operating in multiple industries and sectors. NorthStar is externally managed, paying large fees over time to NSAM.

Today NRF offers investors a high, (albeit still misunderstood), 9.5% dividend yield to wait and see how the market will view its management, balance sheet and strategy moving forward.

(August - NRF Presentation)

Special Situation - Show Me the Money

Here is the best argument why NorthStar Realty Finance might be considered a "Special Situation" REIT. NorthStar management is suggesting that Mr. Market will one day wake up and see that the company has transformed itself into an opportunistic equity REIT which also makes a few carefully underwritten commercial real loans.

If NRF were to trade more in line with equity REIT peers, it would result in a higher Price to FFO multiple, much higher stock price and still pay a competitive ~6% dividend yield. The potential upside would be huge if this were to come to pass -- in excess of 50 percent.

Investor Takeaway

NorthStar Realty Finance is a very complex REIT to try and model and understand. It is growing its balance sheet at an incredibly fast pace. REIT investors tend to reward pure-play REITs that are transparent and internally managed.

NorthStar Realty Finance is a hybrid REIT -- both mortgage and equity -- as well as a highly diversified REIT, operating in multiple industries and sectors. NorthStar is externally managed, paying large fees over time to NSAM.

Today NRF offers investors a high, (albeit still misunderstood), 9.5% dividend yield to wait and see how the market will view its management, balance sheet and strategy moving forward.

(August - NRF Investor Presentation)

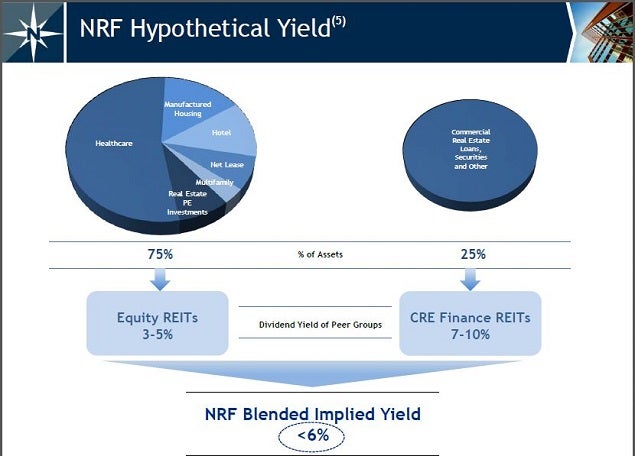

The $4 billion Griffin-American Healthcare acquisition increased the NRF real estate owned on the balance sheet to 75%. Recently announced acquisitions will increase real estate holdings even more vs NorthStar Realty Finance commercial real estate lending activities.

However, commercial lending aside, NorthStar Realty is still operating in five equity REIT sectors: healthcare, manufactured housing, lodging, triple-net industrial/office/retail, and multi-family apartments.

(August - NRF Investor Presentation)

The $4 billion Griffin-American Healthcare acquisition increased the NRF real estate owned on the balance sheet to 75%. Recently announced acquisitions will increase real estate holdings even more vs NorthStar Realty Finance commercial real estate lending activities.

However, commercial lending aside, NorthStar Realty is still operating in five equity REIT sectors: healthcare, manufactured housing, lodging, triple-net industrial/office/retail, and multi-family apartments.

(August - NRF Presentation)

Special Situation - Show Me the Money

Here is the best argument why NorthStar Realty Finance might be considered a "Special Situation" REIT. NorthStar management is suggesting that Mr. Market will one day wake up and see that the company has transformed itself into an opportunistic equity REIT which also makes a few carefully underwritten commercial real loans.

If NRF were to trade more in line with equity REIT peers, it would result in a higher Price to FFO multiple, much higher stock price and still pay a competitive ~6% dividend yield. The potential upside would be huge if this were to come to pass -- in excess of 50 percent.

Investor Takeaway

NorthStar Realty Finance is a very complex REIT to try and model and understand. It is growing its balance sheet at an incredibly fast pace. REIT investors tend to reward pure-play REITs that are transparent and internally managed.

NorthStar Realty Finance is a hybrid REIT -- both mortgage and equity -- as well as a highly diversified REIT, operating in multiple industries and sectors. NorthStar is externally managed, paying large fees over time to NSAM.

Today NRF offers investors a high, (albeit still misunderstood), 9.5% dividend yield to wait and see how the market will view its management, balance sheet and strategy moving forward.

(August - NRF Presentation)

Special Situation - Show Me the Money

Here is the best argument why NorthStar Realty Finance might be considered a "Special Situation" REIT. NorthStar management is suggesting that Mr. Market will one day wake up and see that the company has transformed itself into an opportunistic equity REIT which also makes a few carefully underwritten commercial real loans.

If NRF were to trade more in line with equity REIT peers, it would result in a higher Price to FFO multiple, much higher stock price and still pay a competitive ~6% dividend yield. The potential upside would be huge if this were to come to pass -- in excess of 50 percent.

Investor Takeaway

NorthStar Realty Finance is a very complex REIT to try and model and understand. It is growing its balance sheet at an incredibly fast pace. REIT investors tend to reward pure-play REITs that are transparent and internally managed.

NorthStar Realty Finance is a hybrid REIT -- both mortgage and equity -- as well as a highly diversified REIT, operating in multiple industries and sectors. NorthStar is externally managed, paying large fees over time to NSAM.

Today NRF offers investors a high, (albeit still misunderstood), 9.5% dividend yield to wait and see how the market will view its management, balance sheet and strategy moving forward.

CLDTChatham Lodging Trust

$7.55-%

Edge Rankings

Momentum24.61

Growth42.78

Quality-

Value49.65

Price Trend

Short

Medium

Long

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in