Students of the market know that October has a reputation for increased volatility.

Cutting to the chase, this October is certainly living up to that reputation, as we've seen wild swings in the major indices each and every day this month.

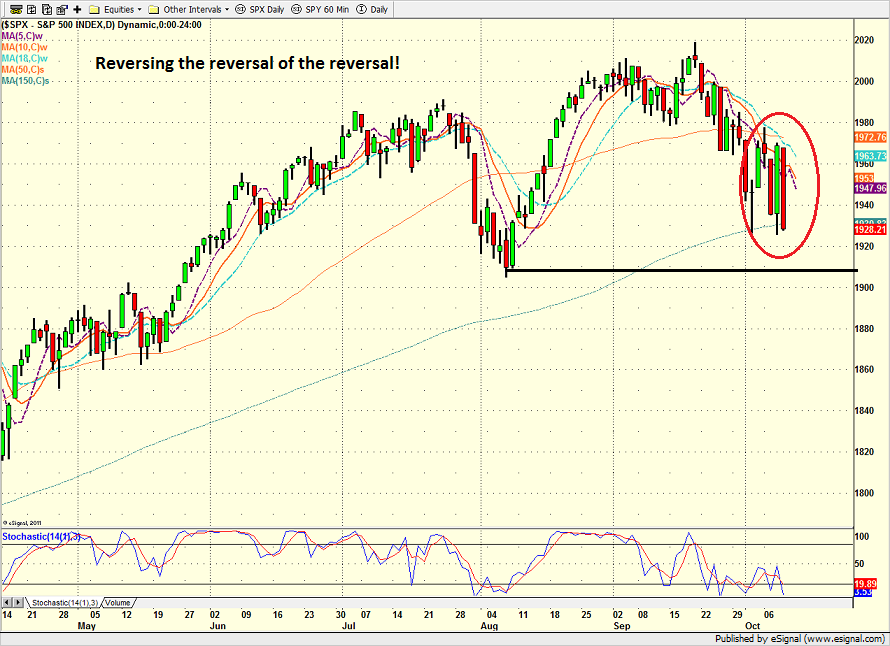

Shorter term, it is interesting to note that Monday and Tuesday saw declines as traders began to fret about global growth and the potential economic impact of an Ebola outbreak.

The two-day drop wound up erasing all of the gains seen from last week's strong bounce. On Wednesday, stocks enjoyed a joyride to the upside in response to the Fed saying rates were not likely to rise any sooner than projected.

That romp erased the entirety of the Mon/Tues decline. Then on Thursday, stocks got hit hard, which reversed all of the reversal, which, of course, had reversed the prior reversal.

S&P 500 - Daily

The problem on Thursday was simple. Traders and their fancy computers began to realize that if the Fed was worried about the potential impact of #GrowthSlowing, then maybe they should be worried too.

Anyone following the economic data in the U.S. may be wondering what all the fuss is about. However, the U.S. isn't the problem. No, the concern is global. Despite the massive QE program and "Abenomics," Japan's economy is struggling mightily right now.

In China, the economic growth rate is slowing enough (current projections are for a 7.3 percent annualized GDP) that there is talk of system-wide stimulus. In Europe, even Germany is weakening more than analysts expect, and the R-word is being used with increased regularity. Lest ye forget, this week the IMF downgraded their forecast for global growth.

Here at home, the fear is that either the global economic slowdown or the potential Ebola problem will wind up hitting the U.S. economy -- just as the Fed is about to start "exiting" their stimulative stance.

Therefore, the question of the day is, if the Fed's ZIRP (zero interest rate policy) will be enough to offset these concerns? Put another way, can U.S. investors really expect the American economy to continue to motor along if the major economies of the globe are slumping?

What's Different This Time

As has been discussed ad nausea, this market has seen a #BTFD strategy implemented each and every time the S&P 500 has dipped a couple percentage points. This has been going on for years now. However, so far at least, the dip buyers have been overrun.

One of the concerns is that the current bout of volatility is different than anything investors have seen lately. You see, this time there is no crisis to freak out about. No, this time, stocks are going down on fundamental fears.

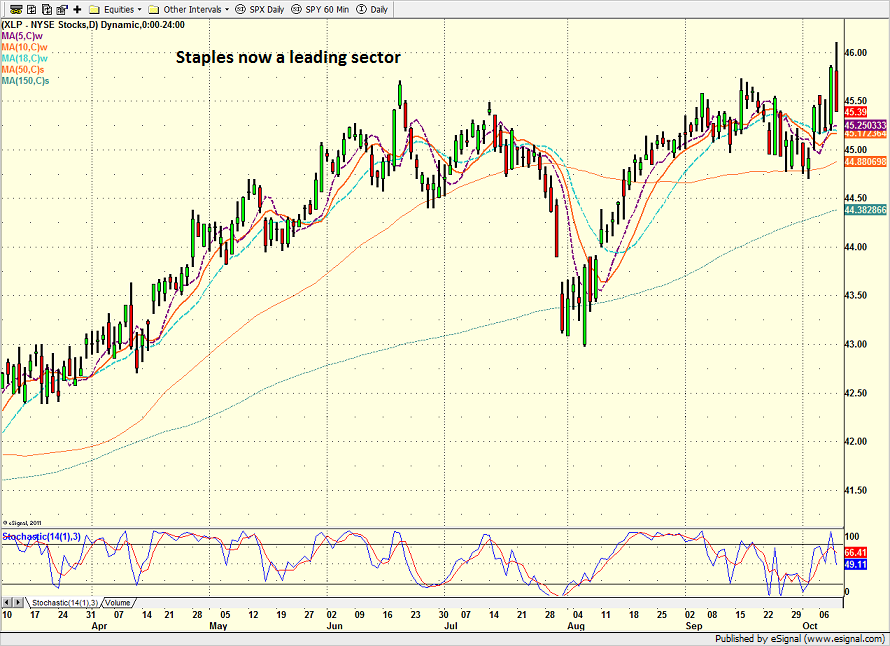

Another issue that could be placed in the "It's different this time" category is the fact that market leadership has been narrowing dramatically and has now shifted to defensive areas. (Don't look now, but staples and utilities are leading the pack.)

Consumer Staples Select Sector SPDR - Daily

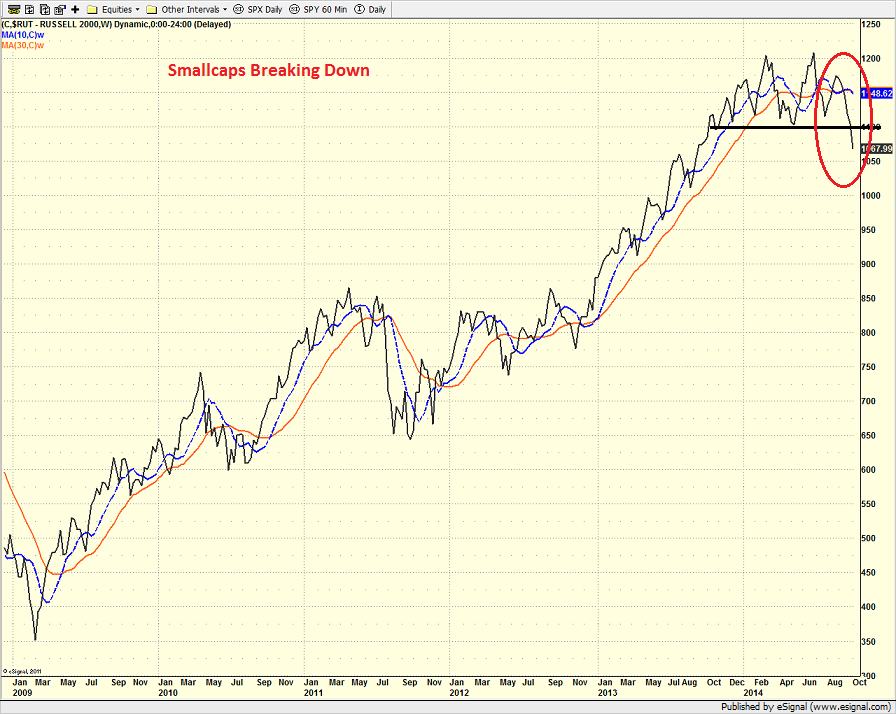

Then there are the technical divergences. As you may recall, something on the order of 50 percent of all stocks in the NASDAQ are down 20 percent or more from their highs. Then the well-publicized divergence between the blue chips and the small caps is getting worse.

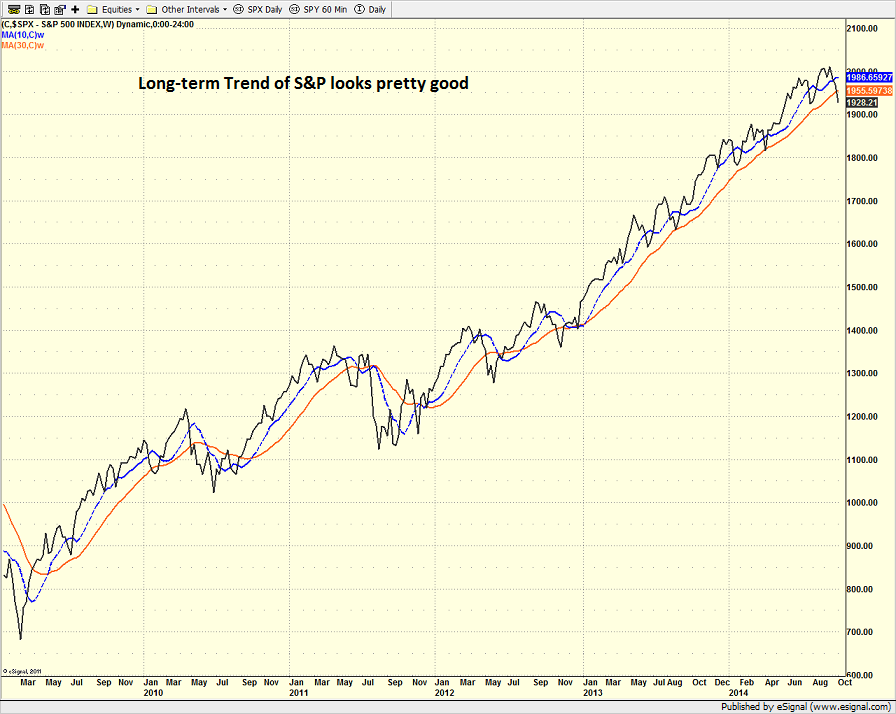

S&P 500 - Weekly

Russell 2000 - Weekly

The key here is that the combination of fundamental concerns, narrowing leadership and technical divergences tend to be classic behavior for a market that is in the midst of a topping process.

Sure, stocks could turn around today and reverse the reversal of the reversals once again. Remember, market tops can take an exceptionally long time to play out. After all, there is no recession in sight and seasonality definitely favors the bulls for the next six months. Plus, it is important to recognize that bear markets tend to be triggered by recessions, the Fed or external events.

One More Thing

There is one more item to discuss on the topic of the increased volatility. Word has it that there is a new HFT algo in town. Apparently this algo is a bigger, badder version of anything that is out there currently and is basically causing liquidity in the S&P futures market to crater. Reports from Nanex indicate that the current liquidity is at the lowest levels seen since 2011.

While only conspiracy theorists would blame this decline on the computers, it is worth knowing that there may be additional factors at work on an intraday basis.

The Bottom Line

The final point for today is this: Given the current action, it is probably a good idea to recognize that risk levels are elevated and that investors should play the game accordingly here.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.