These block and tackle industrial REITs include: DCT Industrial Trust Inc DCT, EastGroup Properties Inc EGP, Monmouth R.E. Inv. Corp. MNR, STAG Industrial Inc STAG and Terreno Realty Corporation TRNO.

Related Link: 5 Unique REITs Yielding Over 8%: Trick Or Treat?

Industrial Strength

Each of these industrial landlords are executing a unique strategy in order to grow their portfolios of assets as the U.S. economic recovery continues.

Monmouth REIT - FedEx & E-Commerce Growth

Monmouth continues to add to its investment grade tenant roster which is heavily weighted toward FedEx Corporation FDX. This concentration in one tenant is both the good news and the bad news for investors, since FedEx provides approximately half of Monmouth's annual revenues.

During the first two weeks of October, $587 million cap Monmouth has announced two new FedEx facility acquisitions:

- FedEx Ground - Tyler, Texas: ~$10 million acquisition of a 1 new 63,378 square foot build-to-suit facility located on ~18 acres, with an initial lease term of 10 years.

- FedEx Ground - St. Louis, Missouri: ~$15 million acquisition of a new 198,773 SF Class-A build-to-suit facility located on 33 acres, with an initial lease term of 15 years.

Both of these locations contain land for future on-site expansions. These two acquisitions increased the Monmouth industrial portfolio to 84 properties, containing 11.6 million square feet (SF) located in 28 states. Monmouth's dividend is currently yielding 5.77 percent.

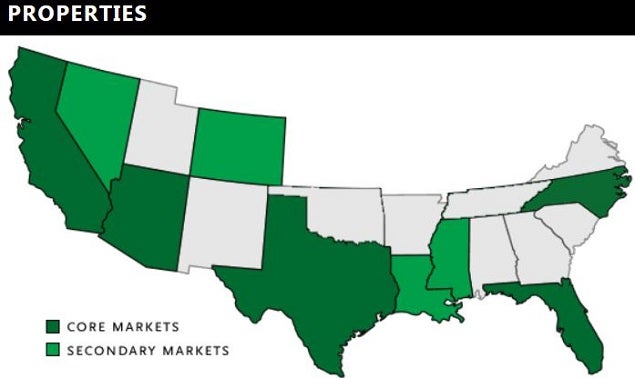

STAG Industrial - Targets Secondary Markets

STAG Industrial CEO Ben Butcher has repeatedly stated in interviews and presentations that he is geographically agnostic when it comes to adding single-tenant net-lease properties to his industrial portfolio.

STAG Industrial typically announces its acquisitions on a monthly basis. During September STAG Industrial acquired a record 14 buildings -- 12 distribution and two light manufacturing facilities -- for an aggregate cost of ~$150 million.

Year to date, STAG Industrial has acquired 31 industrial buildings consisting of approximately 6.6 million square feet for approximately $292.6 million. The Company has entered into contracts to acquire nine additional industrial buildings for a purchase price of approximately $98 million.

By primarily focusing on Class-B industrial facilities, located in secondary markets, $1.2 billion cap STAG Industrial has shown the ability to steadily grow by acquisitions that are accretive to funds from operations. STAG Industrial is currently paying out a dividend yield of 6.1 percent.

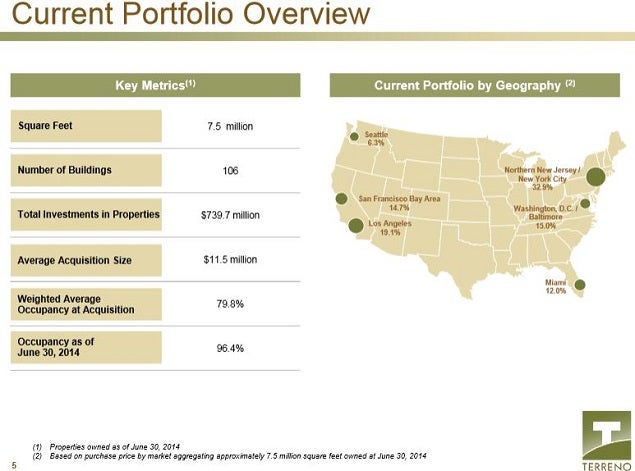

Terreno Realty - Major U.S. Ports of Entry

Terreno has a laser-like focus on six of the top coastal markets in the U.S., targeting in-fill, densely populated locations surrounding the ports of Los Angeles/Long Beach, Northern New Jersey/New York City, Miami, Seattle, San Francisco Bay Area and Washington D.C./Baltimore.

During the quarter ended September 30, Terreno acquired three industrial facilities totaling 158,000 SF for an aggregate of $20.8 million. After the quarter's end, $645 million cap Terreno announced the acquisition of two additional industrial distribution buildings for $17.2 million.

These purchases bring the total of YTD acquisitions to ~$118 million comprised of 1.1 million square feet as of October 9. Terreno Realty's current dividend yields 2.8 percent.

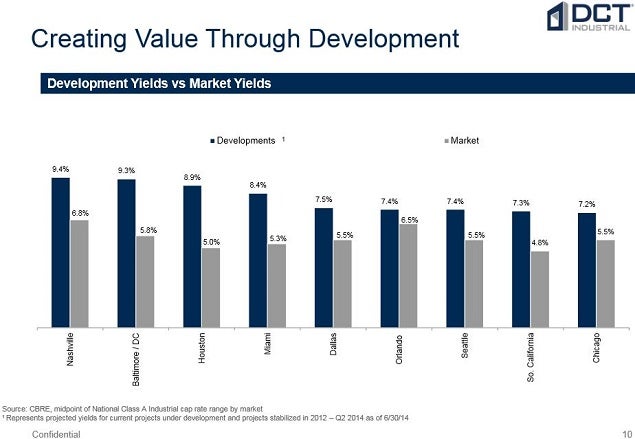

DCT Industrial - Pruning and Developing

Over the past few years, DCT Industrial has exited nine markets, including five in Mexico, and refocused the company on 21 core U.S. distribution markets. In addition to development, $2.5 billion cap DCT Industrial is also focused on acquisitions in key markets as evidenced by two recent announcements:

- Carlsbad - North San Diego, California: a "value-add," Class-A 111,000 SF building located in the 560-acre Carlsbad Research Center on October 8. At time of purchase the facility was 44 percent occupied.

- Central Valley - Tracey, California: a 750,000 SF Class-A, bulk-distribution facility 100 percent leased to a credit tenant on a long-term lease, announced on October 9. Including this acquisition, DCT Industrial owns just under 4 million square feet of space in Northern California.

Although DCT Industrial is actively involved in creating value through development, the company does not bank large tracts of land for future development. As of June 30, DCT Industrial owns ~74 million square feet of properties leased to ~900 customers. DCT Industrial currently pays a dividend yielding 3.7 percent.

EastGroup Properties - Smaller Tenants In Key Sunbelt Markets

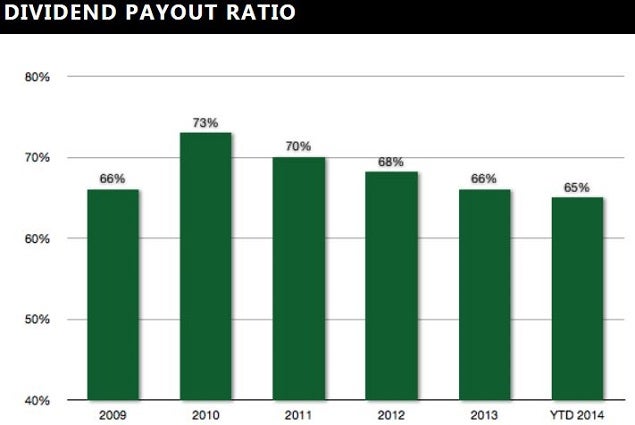

EastGroup develops and acquires industrial properties focused primarily on the multi-tenant office/industrial "flex" space, leased out to customers in the 5,000 to 50,000 SF range.

The typical EastGroup building is 80,000 to 90,000 SF with 24 foot high ceilings and sufficient parking to allow for office build-outs which average 15 percent of the space.

This multi-tenant focus has been a very dependable business model which has resulted in shareholders receiving 139 consecutive dividend distributions. On September 4, EastGroup announced a 5.5 percent dividend increase.

The company has raised its dividend in 19 of the past 22 years, while maintaining a very conservative payout ratio of cash available for distribution. EastGroup sports a market cap of just under $2 billion and owns a portfolio totaling ~35 million square feet. EastGroup shareholders are currently receiving an annual dividend of $2.28, yielding 3.7 percent.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.