It is getting to be that time of year where writers feel compelled to somehow work the words spooky, scary, frightful etc., into their work.

In keeping with tradition, it is time to step back from the blinking lights and the scary corrective phase the market has been in, and review a chart that is just plain spooky.

However, this does not mean that investors should ignore indicators that are based on history or historical patterns. Remember, those who choose to ignore history are doomed to repeat it. In the stock market, experience has taught us that although history doesn't ever repeat exactly, it will often rhyme quite nicely.

Studying Market Cycles

Students of the investing game know that markets tend to travel in cycles and that there are all kinds of cycles to review. There are bull and bear cycles, short-, intermediate- and long-term cycles, secular cycles, seasonal cycles, Presidential cycles, decennial cycles, and so on, and so on. Any or all of these cycles can, at times, be helpful in terms of being prepared for what might come next in Ms. Market's game. The trick, of course, is trying to figure out when cycles are about to turn.

The current market is a perfect example. Investors endured a frightful decline that totaled -9.8% from the intraday high seen on September 19 to the Bullard-based low of October 15. This harrowing decline was followed immediately by a spirited, Fed-speak-induced sugar-high over the past nine days. Thus, the natural question is, what comes next?

Remember that analysis of market cycles should never be used in a vacuum or as a stand-alone indicator. Using only cycle projections (or any other indicator for that matter) to guide your investing decisions is a fool's game.

With that said, however, investors should continue to study what the cycles suggest might happen on a daily, weekly and monthly basis. In fact, this data continues to be an important input into our daily and weekly Market Environment models.

What Is A Cycle Composite?

For anyone new to periodic analysis of the cycles, try utilizing a "mash-up" of various historical cycles to create a composite cycle projection. Specifically, the cycle composite is a combination of the one-year seasonal, the four-year presidential and the 10-year decennial cycles -- all going back to 1928.

By combining these three cycles, a cycle composite is produced. And while expecting the market to follow the composite exactly is just plain silly, it is surprising -- no, make that "spooky" how often the market tends to follow the general direction of the composite when viewed from a longer-term perspective.

What Do The Cycles Say Now?

Step one in the analysis of cycles is to determine whether the current cycle projection is "on" or not. Remember, there are times when the cycle composite is utterly useless, but then there are times when the combination of cycles is scary good, too!

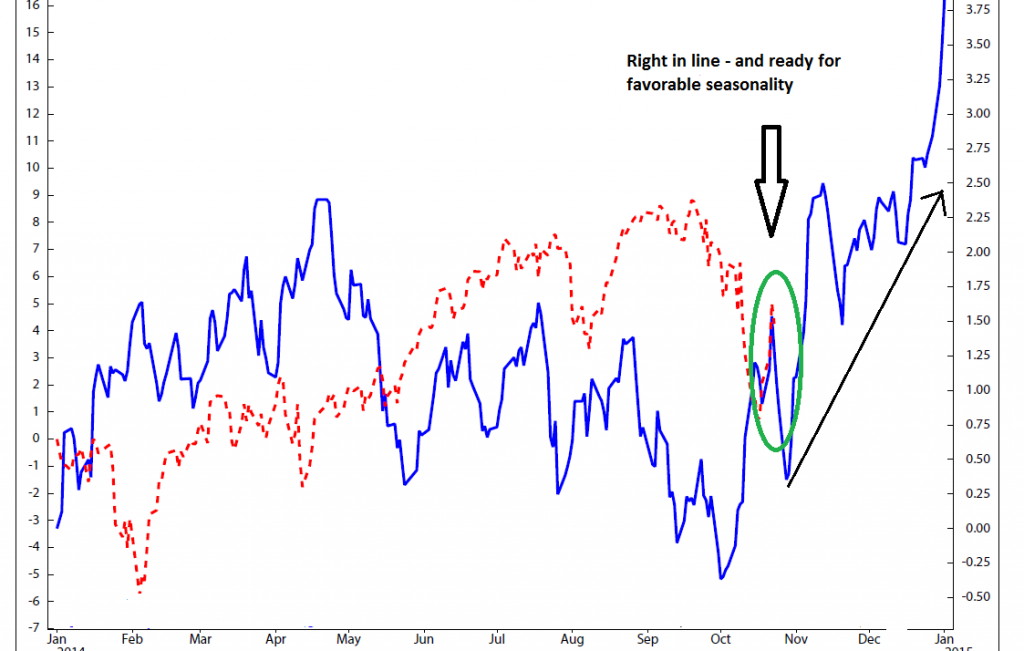

Take a look at the chart below. The red dashed line represents the movement of the S&P 500 SPY and the blue line is the composite projection.

The S&P 500 vs. Cycle Projection

Isn't the fact that the dashed red line and the blue line are at the exact same spot just a little eerie?

Spookier still is the fact that a similar picture is seen when looking at the S&P versus the cycle projection going back to 2010. Yep, that's right; the cycle projection predicted where the market would be more than four and three-quarters years ago. Spooky indeed!

What's Next?

While the two lines on the chart aren't always perfectly in sync and the ride has not always been smooth, it is worth noting what the cycle composite is projecting for the rest of the year.

The bad news is that the cycle composite has been calling for a nightmarish little decline (the chart is now three trading days old) at this time. So, don't be surprised if this market gets dark again in the days leading up to Halloween. But then after that, the cycles suggest that it is time to put on the party hats as the traditional end-of-year rally takes hold.

No, it isn't projected to be a one-way, straight-up affair, and yes, the ride will likely be a bit bumpy at times. The good news is the cycles suggest it is time to put away the fear that this time of year tends to bring and to turn that frown upside-down for the remainder of 2014. Since a great many hedge funds are underperforming the market this year, it would not at all be surprising to see some #FOMO (fear of missing out) set in if the bulls can get something going.

In sum, cycles are more art than science at times and are by no means perfect, but if the general trend plays out as projected between now and New Year's Eve, investors may look back at 2014 with a smile.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.