The recent stock market rally has clearly been one for the record books.

For those of you keeping score at home, the S&P 500 has now closed above its five-day moving average for an eye-popping 29 consecutive days. Given that the old record was 22 straight closes above the five-day, it is clear that this has been a rally that traders needed to participate in.

Whether you were leveraged long or simply holding a healthy level of equity positions over the past month and a half, this appears to be the move that is making the year.

Here is the rub. A great many investors have not participated in the recent joyride to the upside. Don't forget that on October 15, the sky looked like it was indeed falling as the S&P's pullback was quickly approaching the danger zone.

Perhaps more importantly, the impetus behind the dance to the downside was fundamental in nature as investors began to recognize that growth was slowing in all the wrong places around the globe.

S&P 500 - Daily

As everybody knows by now, the bulls then hit the trifecta as Bullard, Draghi and the Bank of Japan started talking QE again.

Then a couple days later, the People's Bank of China got into the act by cutting rates and talking about doing more to stimulate the world's second biggest economy.

So just like that, bad news was good news again for stocks as it meant the flow of freshly printed yen, euros, and maybe even yuan wasn't likely to stop any time soon.

Why Is This Good Again?

The current run for the roses has left many investors scratching their heads. However, the reason behind the move is really pretty simple. Forget about the U.S. economy, earnings, interest rates and inflation as these fundamental factors really don't matter much right now.

No, this move is all about "the liquidity trade."

You see, investors have learned that when central bankers print money, the cash has to go somewhere. The bottom line is that a large percentage of the dollars, yen and pounds that have been printed since 2011 have wound up in the U.S. stock and bond market.

So, the thinking is that while the U.S. and U.K. are ending their QE programs, the Japanese, Europeans and Chinese may just be getting started. Since traders don't really care about the color of the currency being printed these days, well, you get the idea.

Can You Say Overbought?

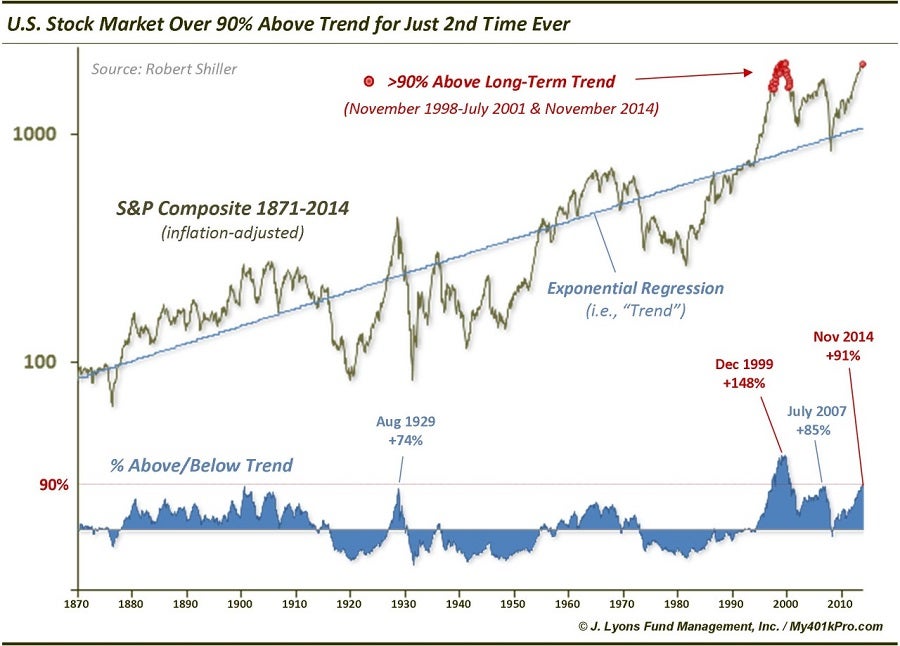

The chart below was created by J. Lyons Fund Management based on work by Robert Shiller. In short, the chart looks at the S&P 500 relative to its regression line since 1870 in an effort to determine if stocks are "overbought" or "oversold" from a long-term perspective.

The key to this chart is the degree to which the S&P is above or below its long-term trend line. As most investors know, when a trend becomes too extreme, it tends to eventually revert back to the mean or long-term trend.

What is interesting to note is that in 1929, the S&P was 74 percent above its long-term regression line. We all know what happened after that. In 1999, the market was a jaw-dropping 148 percent above its trendline.

Of course, the next few years in the stock market weren't exactly pretty. In July 2007, the S&P was 85 percent above the trend, and everybody remembers how that turned out.

The point here is that currently the S&P 500 is 91 percent above the long-term (back to 1870) trend.

The Next Big Move Will Be Mean Reverting

So, while this condition can indeed stick around for quite some time and the bulls may be able to continue to march merrily higher, it is important to recognize that the next REALLY big, REALLY important move could very well be a reversion to the mean.

In this case, a reversion to the mean would create a very big move to the downside or, at the very least, an extended period (think a decade or so) of sideways movement.

This is not to say that stocks will crash and burn in 2015. However, from a long-term perspective, stocks are indeed VERY overbought.

The key takeaway here is to understand that while investors may be getting uber-comfy with the stock market again and the fund companies are back to talking about buy-and-hope, this is NOT the time to fall asleep at the wheel. No, this is the time to begin preparing for the next REALLY big, REALLY important move.

Sure, stocks may continue to melt-up into the end of the year as fund managers try to chase performance. But the big point to today's meandering market missive is if investors don't have a plan for defending against the ravages of a bear market, now might be a great time to start thinking about developing one!

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.