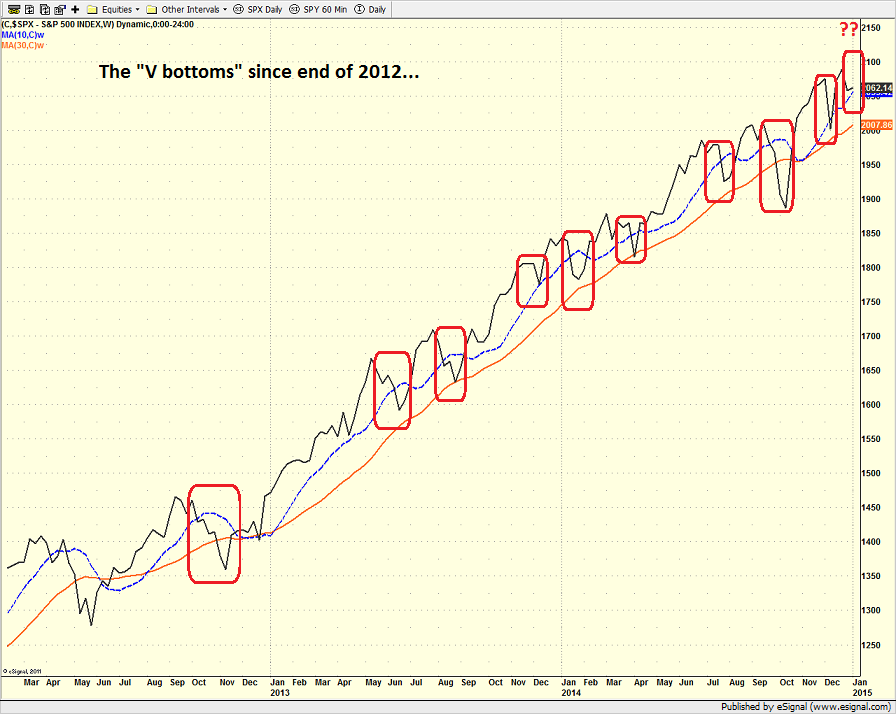

There has been a lot of talk about the fact that the S&P 500 has displayed a remarkable tendency to produce a "V bottom" during the majority of the pullbacks seen over the last couple of years.

Including Thursday's action, the blue chip index has put in a total of 10 such "V bottoms" since the end of 2012. Doing the math, this means that the market has "V-ed" about five times a year in the last two years whereas in the prior 62 years, the "Vs" were seen only about once every year and a half.

The obvious point here is that something has clearly changed in the market over the last two years. And then the obvious questions include: What has changed? And is this a permanent change in the market's behavior?

Should investors blame this new pattern on HFT? Automated millisecond trend following? The proliferation of ETF trading? Or is there something else to consider?

S&P 500 SPY - Weekly

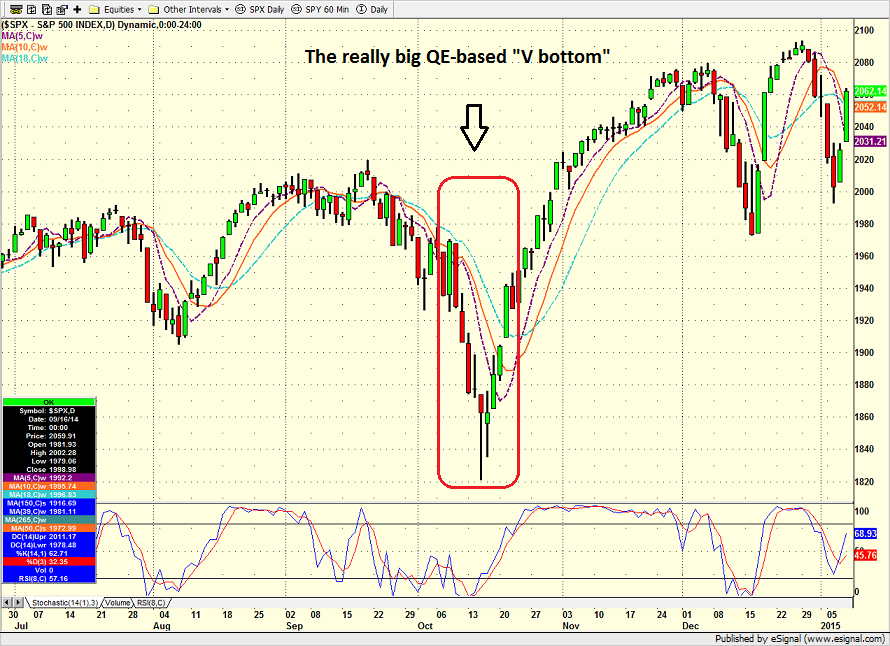

While what follows is merely conjecture and could easily be proved wrong at any time, one thought is that QE is actually to blame for the huge increase in "V bottoms."

The Mere Mention of QE Causes...

We've seen it over and over again lately. Stocks pull back on some new fear/concern/worry but then, just about the time things start to get hairy, a central bank official starts talking about QE (or monetary stimulus in the case of China).

Bam! At the drop of an algo, the fears in the market are instantly forgotten and the computers fall all over each other to jump back on the bull train.

The best example of this phenomenon was seen in mid-October. Stocks were in the process of putting in what appeared to be the first "meaningful" correction since the end of the European debt crisis and on October 15th, the S&P appeared to breach the -10 percent level for the pullback on an intraday basis.

But then it happened - a flood of QE news. First there was St. Louis Fed President James Bullard, a noted inflation hawk, who came out and said that the Fed could always halt the taper process and/or hold off on raising rates if things get bad again. Next, the Bank of Japan got into the act and upped their QE program by 60 percent. And finally Mario Draghi started openly talking about a QE program in Europe.

S&P 500 - Daily

Before you could figure out whether Mr. Bullard was a voting member of the FOMC that year, stocks were off to the races. In a matter of two days the market's mood went from one of extreme fear, to something closer to jubilation. And within a matter of 2 weeks, the "meaningful" correction had turned into a new leg higher for bulls, replete with fresh new all-time highs.

QE Strikes Again

In the latest example, it was the confirmation that a QE plan in Europe will actually happen that seems to have stopped the bears in their tracks and returned the ball to the bulls.

More specifically, word that ECB President Mario Draghi had sent a letter to Eurozone Parliament members yesterday outlining the banks plans for a sovereign bond buying program gave rise to hopes that the ECB would act sooner rather than later. And since the next ECB meeting is January 22, well...

What's the Allure?

Why does QE matter, you ask? The bottom line is that the fresh cash printed by the QE programs has to go somewhere. Yes, the banking math is rather complex to follow. But as investors have learned, those new dollars, yen and euros tend to go where they are treated best.

And as we've discussed prior, the key is that over the past couple of years, the U.S. stock and bond market have received the lion's share of that new "fund flow."

So, with the ECB readying to launch a QE plan - regardless of whether it is this month or next - investors are thinking that the new cash flow trumps any worry about the crash in oil, the potential for disinflation, and/or the global slowdown. At least for now, anyway...

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.