In a recent report, Morgan Stanley analysts took an in-depth look at the e-commerce sector. Despite strong growth in recent years, analysts see even stronger growth coming in the future as convenience becomes more important to consumers than price. The report named Amazon.com, Inc. AMZN as one of Morgan Stanley’s top e-commerce picks.

Scale And Infrastructure Advantages

Analysts believe that free shipping is the most important service to online customers in Amazon’s core markets (U.S., U.K., Germany and Japan). They predict that free shipping will soon be the standard for all online purchases, a service that Amazon already offers to its Prime subscribers.

Amazon has been building a strong global network of distribution centers and storage facilities (at the expense of profits) in recent years, and analysts believe that other online retailers will soon be playing catch-up. They estimate that Amazon’s shipping infrastructure allows for an average shipping cost per unit of about $2.40, whereas United Parcel Service, Inc.'s UPS average cost per domestic package is about $8.00.

Analysts predict that other online retailers will likely have to absorb the higher cost of shipping through either paid customer loyalty plans or higher product prices.

The Strengths And Weaknesses Of Prime

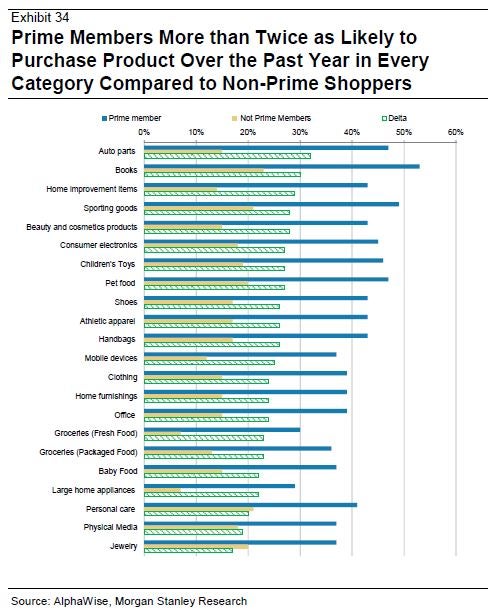

Analysts note that U.S. Prime membership has led to major increases in sales numbers that will continue to drive higher margins.

However, international customers don’t seem to be subscribing to Prime as willingly as Amazon would like.

Projections

Analysts see an attractive setup for Amazon in the near-term. Morgan Stanley has an Overweigh rating on Amazon and a $420 price target for the stock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.