Credit Suisse analysts recently met with the management team of Vivint Solar Inc VSLR and came away impressed with the prospects of this relatively new kid on the block in the publicly-traded solar arena.

The Vivint Solar business model targeting residential solar customers is most similar to the Elon Musk-backed SolarCity Corp SCTY.

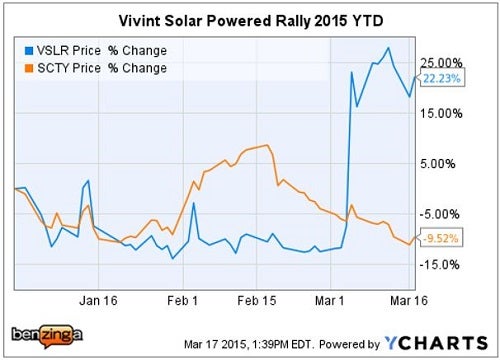

Tale Of The Tape - 2015 YTD

Shares of Solar City have rewarded early shareholders with returns of ~300 percent. However, despite growing revenues at an impressive clip, the company is still not profitable.

Notably, both Vivint Solar and Solar City have a very high short interest.

Blackstone Sponsorship

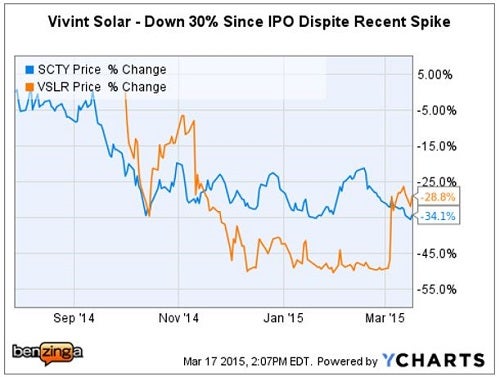

The Blackstone Group LP BX spun Vivint Solar out of its Vivint operating company in October 2014 and still owns a 78 percent interest in Vivint.

Blackstone purchased Vivint, the second largest U.S. home automation/security firm for ~$2 billion back in 2012. Vivint has ~850,000 residential customers and employs more than 7,000, including a large door-to-door sales force, as of October 2014.

Vivint has a three year agreement to share leads exclusively with VSLR. So, is the Vivint Solar glass half-full or half-empty for investors?

Notably, Credit Suisse was one of the underwriters of the Vivint Solar IPO.

Credit Suisse - Vivint Solar: Maintain Outperform, PT Raised $21 to $22

The revised CS price target represents a 100 percent upside from the current VSLR $11 trading range and is based upon a discounted cash flow (DCF) model.

The CS model assumes Vivint Solar will see growth rates of:

- 93 percent in 2015

- 94 percent in 2016

- 43 percent in 2017; which implies total MWs deployed by the end of 2017 to be 1.9 GWs.

The CS DCF model is based on a 12 percent discount rate and assumes that half of the VSLR customers renew at the end of the initial 20-year lease.

Credit Suisse Rationale - Key Takeaways

1. Diversified Sales Efforts:

- Currently Vivint Solar obtains 95 percent of its customers from door-to-door sales efforts and related referrals.

- The company has plans to diversify its sales efforts to include: retail kiosks, direct mail and social media platforms.

- Credit Suisse indicated that the door-to-door initiative remains quite successful, but its related commission structure is a relatively expensive way to grow sales above current levels.

2. Improve Operations - Technology:

- Vivint Solar is investing $50 million in systems to make the sales to installation cycle more efficient.

- The new systems are currently being beta-tested in three markets, with Vivint Solar planning to roll it out company-wide in 2015 to all 39 sales offices.

3. Product Offerings:

- Vivint currently does not have a loan program in place for customers who would prefer to own their roof-top solar installation vs. leasing.

- Rolling out a loan program should lead to increased customer share for Vivint from its current sales efforts.

4. Commercial & Industrial:

- Vivint initially intends to target 0.5 to 1.0 MW systems.

- The company 2015 guidance does not include any revenues from this initiative, but could bump up 2016 revenues by ~10 percent.

- Buying for larger commercial/industrial projects could provide a cost reduction for buying a larger volume of power components.

5. Capital Strategies:

- Looking forward to 2016, Credit Suisse expects Vivint to diversify how it funds projects.

- A securitized debt offering, similar to SolarCity, could significantly reduce the amount of equity required for VSLR projects.

- CS sees the cost of Vivint tax equity partner funds becoming a near-term tailwind, rather than a drag on earnings, citing SolarCity's post-IPO experience.

Credit Suisse - VSLR Risk Factors

- Adverse Regulations - limitations on net-metering, etc.

- Future Growth - continued growth rate after 2017 when Federal ITC is reduced from 30 to 10 percent.

- Capital - both cost and availability.

- Competitive Environment

- Customer Default & Renewal Rates

- Blackstone Ownership - overhang on shares from 78 percent stake.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.