On April 14, Citi Research published a note, "A More Positive Reality than Perceptions Would Imply," updating Puerto Rico leasing and sales activity for shopping centers and malls owned by four U.S. REITs.

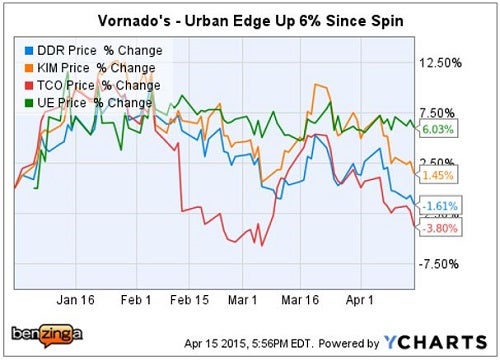

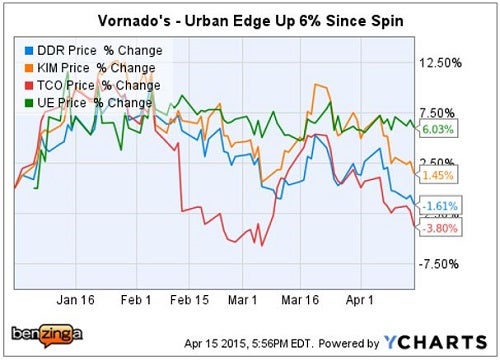

DDR Corp. DDR - $6.5 billion cap, 3.8 percent yield.

Kimco Realty KIM - $10.5 billion cap, 3.75 percent yield.

Taubman Company TCO - $4.6 billion cap, 3 percent yield.

Urban Edge UE - $2.5 billion cap, 3.3 percent yield.

Tale of The Tape - 2015 YTD

Citi - Puerto Rico Economy: Challenges/Silver Lining

Puerto Rico is a U.S. territory which is burdened by ~$75 billion in debt. The island has basically been in an ongoing recession since 2006; which coincides with the phase out of a federal tax exemption, which led to a reduction in the manufacturing sector.

Unemployment is an unhealthy ~15 percent, with manufacturing still representing a major part of the island economy; and tourism only accounting for 6 to 7 percent.

However, one plus for retailers, (and therefore landlords), is that there is a hearty "underground" economy which Citi estimates to be in the range of 50 percent.

This cash, along with the permitting and construction challenges which limit new supply, may help explain the healthier than expected occupancies, rent per SF, and returns on redevelopment cap-ex spending which Citi reported.

Citi - DDR: PR Big Picture

DDR owns 15 shopping centers in Puerto Rico, "representing 13.5% of the company's NOI at share and ~8% of DDR's asset value."

Citi noted that DDR's "top 3 malls on the island generate sales of $500psf+ and comprise 60% of the value of DDR's PR portfolio;" and the entire 4.1 million SF PR portfolio is 96 percent leased.

Citi - Puerto Rico Economy: Challenges/Silver Lining

Puerto Rico is a U.S. territory which is burdened by ~$75 billion in debt. The island has basically been in an ongoing recession since 2006; which coincides with the phase out of a federal tax exemption, which led to a reduction in the manufacturing sector.

Unemployment is an unhealthy ~15 percent, with manufacturing still representing a major part of the island economy; and tourism only accounting for 6 to 7 percent.

However, one plus for retailers, (and therefore landlords), is that there is a hearty "underground" economy which Citi estimates to be in the range of 50 percent.

This cash, along with the permitting and construction challenges which limit new supply, may help explain the healthier than expected occupancies, rent per SF, and returns on redevelopment cap-ex spending which Citi reported.

Citi - DDR: PR Big Picture

DDR owns 15 shopping centers in Puerto Rico, "representing 13.5% of the company's NOI at share and ~8% of DDR's asset value."

Citi noted that DDR's "top 3 malls on the island generate sales of $500psf+ and comprise 60% of the value of DDR's PR portfolio;" and the entire 4.1 million SF PR portfolio is 96 percent leased.

Source: DDR Corp. - Plaza Del Sol aerial photo

DDR has "meaningfully upgraded the appearance and tenant mix of many of its San Juan assets… in recent years;" including a $45 million redevelopment of its Plaza Del Sol mall.

Citi noted that while DDR PR sales growth is flat, "SS NOI growth is ~2-3%," primarily due to better margins and tenant mix.

Citi - Kimco: PR Big Picture

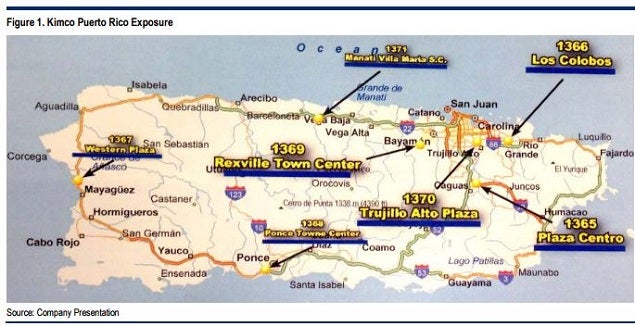

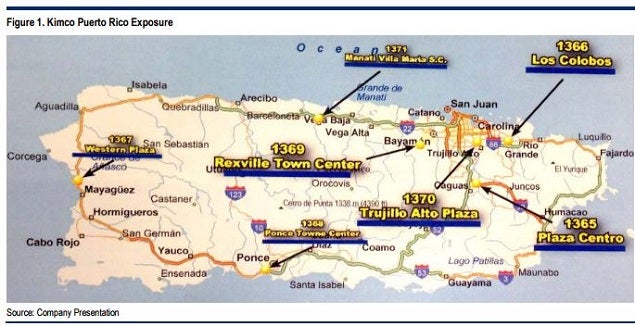

Kimco owns seven PR shopping centers purchased in 2006, totaling 2.2 million SF, which is 97% leased, and represents ~3.3 percent of KIM's ABR.

Source: DDR Corp. - Plaza Del Sol aerial photo

DDR has "meaningfully upgraded the appearance and tenant mix of many of its San Juan assets… in recent years;" including a $45 million redevelopment of its Plaza Del Sol mall.

Citi noted that while DDR PR sales growth is flat, "SS NOI growth is ~2-3%," primarily due to better margins and tenant mix.

Citi - Kimco: PR Big Picture

Kimco owns seven PR shopping centers purchased in 2006, totaling 2.2 million SF, which is 97% leased, and represents ~3.3 percent of KIM's ABR.

Kimco had double-digit releasing spreads on the portfolio in 2014; and notably, KIM is getting 15 to 20 percent higher rents/SF in Puerto Rico compared with its mainland U.S. assets.

Citi reported that KIM small shop rents average in the mid $30's per SF, "along with 3-4% contractual annual rent bumps."

Anchor tenant rents run from the mid-teens to low $20's per SF, with outparcel rents roughly $50 to $60+ per/SF, on average.

Citi - Taubman: PR Big Picture

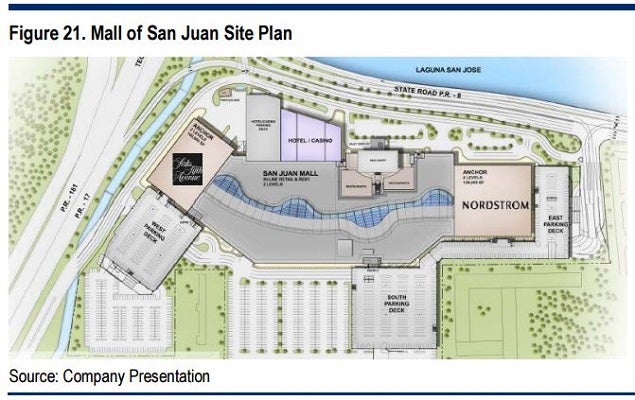

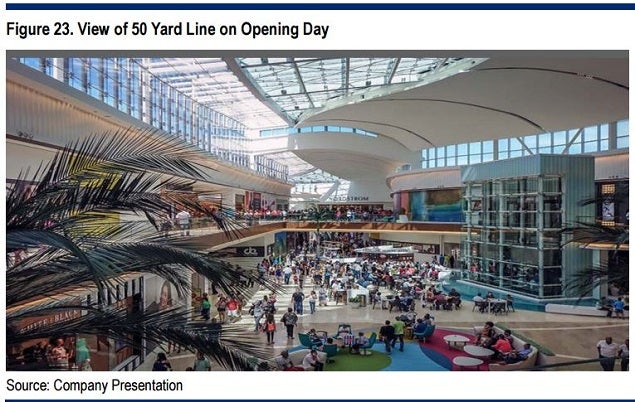

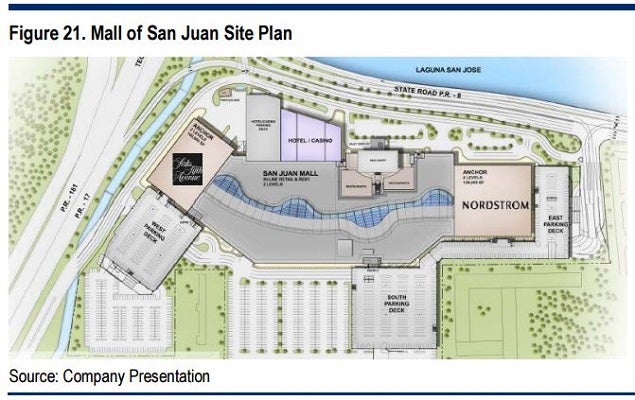

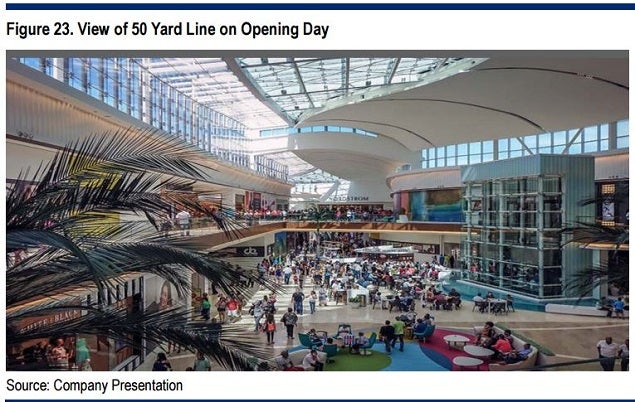

Detroit based mall developer Taubman, is in the process of completing Mall of San Juan, bringing anchors Nordstrom and Saks, and many other high-end retailers including: Bulgari, Coach, Tommy Bahama and Versace, to PR for the first time.

Kimco had double-digit releasing spreads on the portfolio in 2014; and notably, KIM is getting 15 to 20 percent higher rents/SF in Puerto Rico compared with its mainland U.S. assets.

Citi reported that KIM small shop rents average in the mid $30's per SF, "along with 3-4% contractual annual rent bumps."

Anchor tenant rents run from the mid-teens to low $20's per SF, with outparcel rents roughly $50 to $60+ per/SF, on average.

Citi - Taubman: PR Big Picture

Detroit based mall developer Taubman, is in the process of completing Mall of San Juan, bringing anchors Nordstrom and Saks, and many other high-end retailers including: Bulgari, Coach, Tommy Bahama and Versace, to PR for the first time.

Citi feels that this new Taubman mall when complete, will fill "a void in the market – more upscale than Plaza Las Americas, and more of a critical mass of retailers than the Condado district in Old San Juan."

Citi feels that this new Taubman mall when complete, will fill "a void in the market – more upscale than Plaza Las Americas, and more of a critical mass of retailers than the Condado district in Old San Juan."

Taubman's project share is $375 million, and Citi noted that "the project has seen some hiccups, on costs, expected yields, and leasing. The mall is expected to have a 0% yield in 2015 given a low occupied versus leased rate, with the bulk of remaining stores opening in Fall 2015."

Citi - Urban Edge: PR Big Picture

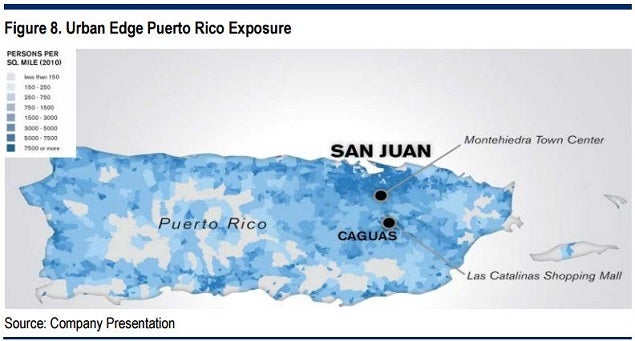

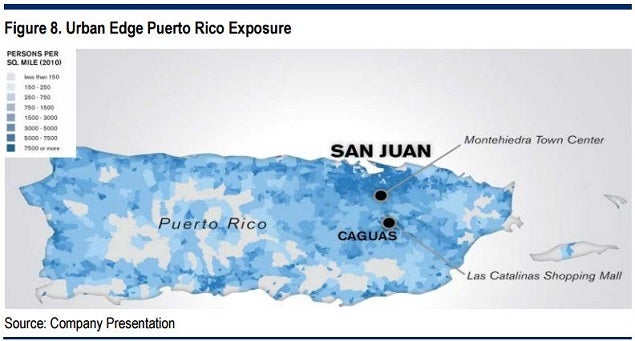

Urban Edge was created in January 2015, when Vornado Realty VNO spun out 79 shopping centers, a warehouse park, and 3 malls including Las Catalinas Mall and Montehiedra Town Center in PR.

http://www.benzinga.com/analyst-ratings/analyst-color/15/03/5343130/real-estate-investors-watch-this-spin-off

Taubman's project share is $375 million, and Citi noted that "the project has seen some hiccups, on costs, expected yields, and leasing. The mall is expected to have a 0% yield in 2015 given a low occupied versus leased rate, with the bulk of remaining stores opening in Fall 2015."

Citi - Urban Edge: PR Big Picture

Urban Edge was created in January 2015, when Vornado Realty VNO spun out 79 shopping centers, a warehouse park, and 3 malls including Las Catalinas Mall and Montehiedra Town Center in PR.

http://www.benzinga.com/analyst-ratings/analyst-color/15/03/5343130/real-estate-investors-watch-this-spin-off

The Montehiedra property is being repositioned from a traditional regional mall to an outlet/value concept, the "Outlets at Montehiedra," expected to open Spring 2016.

The Montehiedra property is being repositioned from a traditional regional mall to an outlet/value concept, the "Outlets at Montehiedra," expected to open Spring 2016.

Citi noted that this niche is currently served by only two competitors, and that this new outlet mall format could "fill a hole in the market."

Urban Edge management indicated that these two projects currently represent ~12 percent of NOI, and that the company expects to hold them for at least five years due to tax considerations.

Citi noted that this niche is currently served by only two competitors, and that this new outlet mall format could "fill a hole in the market."

Urban Edge management indicated that these two projects currently represent ~12 percent of NOI, and that the company expects to hold them for at least five years due to tax considerations.

Market News and Data brought to you by Benzinga APIs Citi - Puerto Rico Economy: Challenges/Silver Lining

Puerto Rico is a U.S. territory which is burdened by ~$75 billion in debt. The island has basically been in an ongoing recession since 2006; which coincides with the phase out of a federal tax exemption, which led to a reduction in the manufacturing sector.

Unemployment is an unhealthy ~15 percent, with manufacturing still representing a major part of the island economy; and tourism only accounting for 6 to 7 percent.

However, one plus for retailers, (and therefore landlords), is that there is a hearty "underground" economy which Citi estimates to be in the range of 50 percent.

This cash, along with the permitting and construction challenges which limit new supply, may help explain the healthier than expected occupancies, rent per SF, and returns on redevelopment cap-ex spending which Citi reported.

Citi - DDR: PR Big Picture

DDR owns 15 shopping centers in Puerto Rico, "representing 13.5% of the company's NOI at share and ~8% of DDR's asset value."

Citi noted that DDR's "top 3 malls on the island generate sales of $500psf+ and comprise 60% of the value of DDR's PR portfolio;" and the entire 4.1 million SF PR portfolio is 96 percent leased.

Citi - Puerto Rico Economy: Challenges/Silver Lining

Puerto Rico is a U.S. territory which is burdened by ~$75 billion in debt. The island has basically been in an ongoing recession since 2006; which coincides with the phase out of a federal tax exemption, which led to a reduction in the manufacturing sector.

Unemployment is an unhealthy ~15 percent, with manufacturing still representing a major part of the island economy; and tourism only accounting for 6 to 7 percent.

However, one plus for retailers, (and therefore landlords), is that there is a hearty "underground" economy which Citi estimates to be in the range of 50 percent.

This cash, along with the permitting and construction challenges which limit new supply, may help explain the healthier than expected occupancies, rent per SF, and returns on redevelopment cap-ex spending which Citi reported.

Citi - DDR: PR Big Picture

DDR owns 15 shopping centers in Puerto Rico, "representing 13.5% of the company's NOI at share and ~8% of DDR's asset value."

Citi noted that DDR's "top 3 malls on the island generate sales of $500psf+ and comprise 60% of the value of DDR's PR portfolio;" and the entire 4.1 million SF PR portfolio is 96 percent leased.

Source: DDR Corp. - Plaza Del Sol aerial photo

DDR has "meaningfully upgraded the appearance and tenant mix of many of its San Juan assets… in recent years;" including a $45 million redevelopment of its Plaza Del Sol mall.

Citi noted that while DDR PR sales growth is flat, "SS NOI growth is ~2-3%," primarily due to better margins and tenant mix.

Citi - Kimco: PR Big Picture

Kimco owns seven PR shopping centers purchased in 2006, totaling 2.2 million SF, which is 97% leased, and represents ~3.3 percent of KIM's ABR.

Source: DDR Corp. - Plaza Del Sol aerial photo

DDR has "meaningfully upgraded the appearance and tenant mix of many of its San Juan assets… in recent years;" including a $45 million redevelopment of its Plaza Del Sol mall.

Citi noted that while DDR PR sales growth is flat, "SS NOI growth is ~2-3%," primarily due to better margins and tenant mix.

Citi - Kimco: PR Big Picture

Kimco owns seven PR shopping centers purchased in 2006, totaling 2.2 million SF, which is 97% leased, and represents ~3.3 percent of KIM's ABR.

Kimco had double-digit releasing spreads on the portfolio in 2014; and notably, KIM is getting 15 to 20 percent higher rents/SF in Puerto Rico compared with its mainland U.S. assets.

Citi reported that KIM small shop rents average in the mid $30's per SF, "along with 3-4% contractual annual rent bumps."

Anchor tenant rents run from the mid-teens to low $20's per SF, with outparcel rents roughly $50 to $60+ per/SF, on average.

Citi - Taubman: PR Big Picture

Detroit based mall developer Taubman, is in the process of completing Mall of San Juan, bringing anchors Nordstrom and Saks, and many other high-end retailers including: Bulgari, Coach, Tommy Bahama and Versace, to PR for the first time.

Kimco had double-digit releasing spreads on the portfolio in 2014; and notably, KIM is getting 15 to 20 percent higher rents/SF in Puerto Rico compared with its mainland U.S. assets.

Citi reported that KIM small shop rents average in the mid $30's per SF, "along with 3-4% contractual annual rent bumps."

Anchor tenant rents run from the mid-teens to low $20's per SF, with outparcel rents roughly $50 to $60+ per/SF, on average.

Citi - Taubman: PR Big Picture

Detroit based mall developer Taubman, is in the process of completing Mall of San Juan, bringing anchors Nordstrom and Saks, and many other high-end retailers including: Bulgari, Coach, Tommy Bahama and Versace, to PR for the first time.

Citi feels that this new Taubman mall when complete, will fill "a void in the market – more upscale than Plaza Las Americas, and more of a critical mass of retailers than the Condado district in Old San Juan."

Citi feels that this new Taubman mall when complete, will fill "a void in the market – more upscale than Plaza Las Americas, and more of a critical mass of retailers than the Condado district in Old San Juan."

Taubman's project share is $375 million, and Citi noted that "the project has seen some hiccups, on costs, expected yields, and leasing. The mall is expected to have a 0% yield in 2015 given a low occupied versus leased rate, with the bulk of remaining stores opening in Fall 2015."

Citi - Urban Edge: PR Big Picture

Urban Edge was created in January 2015, when Vornado Realty VNO spun out 79 shopping centers, a warehouse park, and 3 malls including Las Catalinas Mall and Montehiedra Town Center in PR.

http://www.benzinga.com/analyst-ratings/analyst-color/15/03/5343130/real-estate-investors-watch-this-spin-off

Taubman's project share is $375 million, and Citi noted that "the project has seen some hiccups, on costs, expected yields, and leasing. The mall is expected to have a 0% yield in 2015 given a low occupied versus leased rate, with the bulk of remaining stores opening in Fall 2015."

Citi - Urban Edge: PR Big Picture

Urban Edge was created in January 2015, when Vornado Realty VNO spun out 79 shopping centers, a warehouse park, and 3 malls including Las Catalinas Mall and Montehiedra Town Center in PR.

http://www.benzinga.com/analyst-ratings/analyst-color/15/03/5343130/real-estate-investors-watch-this-spin-off

The Montehiedra property is being repositioned from a traditional regional mall to an outlet/value concept, the "Outlets at Montehiedra," expected to open Spring 2016.

The Montehiedra property is being repositioned from a traditional regional mall to an outlet/value concept, the "Outlets at Montehiedra," expected to open Spring 2016.

Citi noted that this niche is currently served by only two competitors, and that this new outlet mall format could "fill a hole in the market."

Urban Edge management indicated that these two projects currently represent ~12 percent of NOI, and that the company expects to hold them for at least five years due to tax considerations.

Citi noted that this niche is currently served by only two competitors, and that this new outlet mall format could "fill a hole in the market."

Urban Edge management indicated that these two projects currently represent ~12 percent of NOI, and that the company expects to hold them for at least five years due to tax considerations.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Posted In: Analyst ColorNewsREITRetail SalesAnalyst RatingsGeneralReal EstateCiti ResearchPuerto Rico

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in