On June 22, Bank of America/Merrill Lynch analyst Kenneth Bruce published a research note downgrading "mREIT" Hannon Armstrong Sustainable Infrastructure HASI from Buy to Neutral.

HASI's lending focus is on projects that increase energy efficiency, offer cleaner energy sources and efficiently use natural resources.

The downgrade was primarily a valuation call, with Bruce noting HASI's "good execution & good run," but sees "valuation expansion limited," in the short-term.

Hannon Armstrong is a somewhat unique REIT, because it "directly originates debt and equity investments for sustainable infrastructure projects." Therefore, Bank of America looks at HASI as being most similar to MLPs and YieldCos.

During the past 52-weeks shares of $665 million cap HASI have traded in a range of $12.65 - $21.32 per share, closing down on Monday almost 4 percent on the day of the Bank of America downgrade.

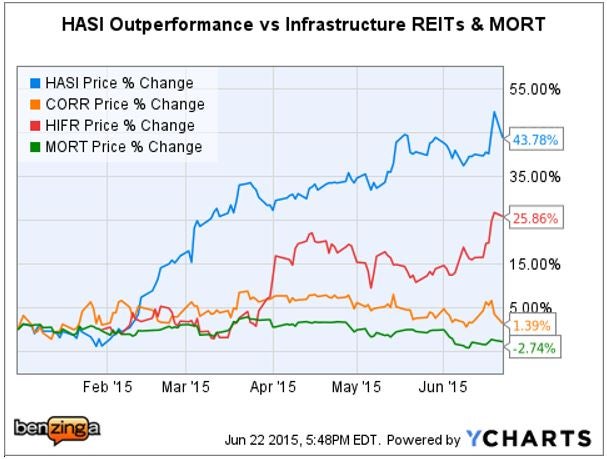

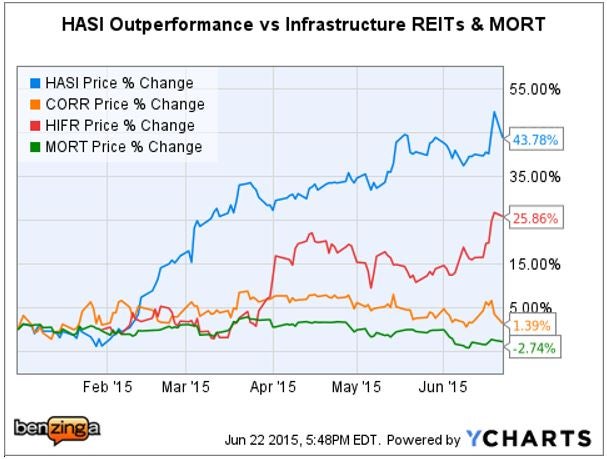

Hannon Armstrong shares are up almost 44 percent so far this year.

During the past 52-weeks shares of $665 million cap HASI have traded in a range of $12.65 - $21.32 per share, closing down on Monday almost 4 percent on the day of the Bank of America downgrade.

Hannon Armstrong shares are up almost 44 percent so far this year.

Market Vectors® Mortgage REIT Income ETF MORT "is a rules based index intended to track the overall performance of publicly traded mortgage REITs."

Hannon Armstrong shares have significantly outperformed the MORT mREIT index ETF, as well as its closest REIT peers so far in 2015.

Bank of America - HASI: Downgrade Buy To Hold, Increase PO To $21

Market Vectors® Mortgage REIT Income ETF MORT "is a rules based index intended to track the overall performance of publicly traded mortgage REITs."

Hannon Armstrong shares have significantly outperformed the MORT mREIT index ETF, as well as its closest REIT peers so far in 2015.

Bank of America - HASI: Downgrade Buy To Hold, Increase PO To $21

Bank of America - HASI Bottom Line

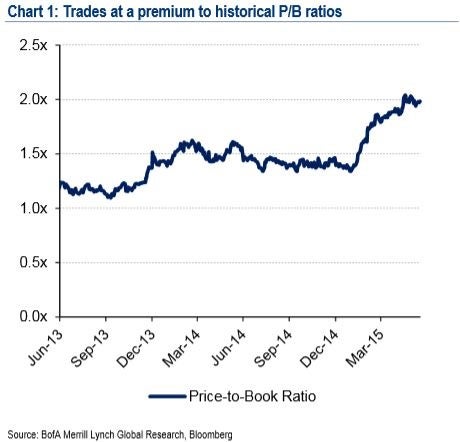

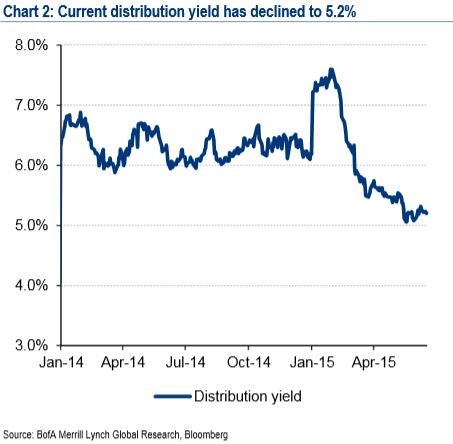

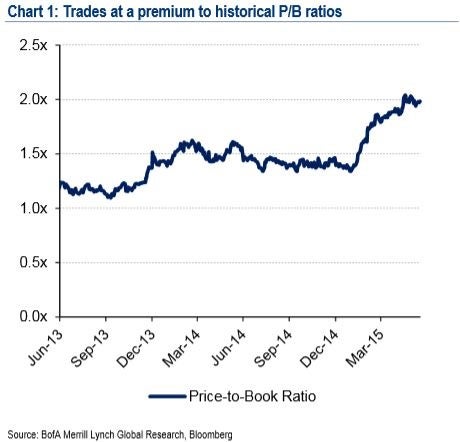

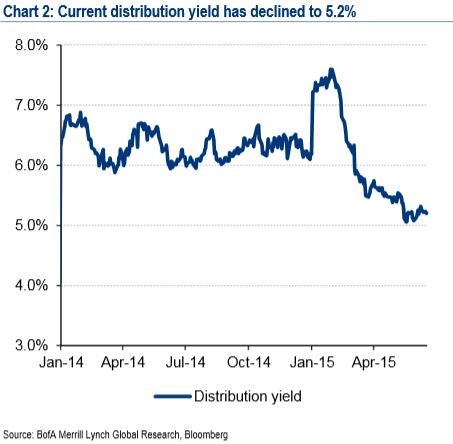

Absent a significant new earnings catalyst, Bank of America believes "…that valuation expansion has largely run its course with a 6% forward distribution yield and P/BV at close to 2.0x, suggesting only limited near-term upside."

HASI shares are currently yielding just over 5 percent.

Bank of America - HASI Bottom Line

Absent a significant new earnings catalyst, Bank of America believes "…that valuation expansion has largely run its course with a 6% forward distribution yield and P/BV at close to 2.0x, suggesting only limited near-term upside."

HASI shares are currently yielding just over 5 percent.

Tale Of The Tape - Past Year

During the past 52-weeks shares of $665 million cap HASI have traded in a range of $12.65 - $21.32 per share, closing down on Monday almost 4 percent on the day of the Bank of America downgrade.

Hannon Armstrong shares are up almost 44 percent so far this year.

During the past 52-weeks shares of $665 million cap HASI have traded in a range of $12.65 - $21.32 per share, closing down on Monday almost 4 percent on the day of the Bank of America downgrade.

Hannon Armstrong shares are up almost 44 percent so far this year.

HASI vs Closest REIT Peers - 2015 YTD

There are two other REITs who enter into net-lease sale-leaseback transactions to fund energy related, (but not necessarily sustainable, or green) infrastructure:- CorEnergy Infrastructure Trust CORR - $312 million cap, 8 percent yield. CORR primarily owns midstream and downstream assets that perform utility-like functions, such as pipelines, storage terminals, and transmission and distribution assets.

- InfraREIT, Inc. HIFR - $2 billion cap, 2.7 percent dividend yield. HIFR is a 2015 IPO, focused on electric utility transmission and distribution (T&D) infrastructure. Currently HIFR leases T&D assets to Sharyland Utilities, L.P., a Texas-based regulated electric utility.

Market Vectors® Mortgage REIT Income ETF MORT "is a rules based index intended to track the overall performance of publicly traded mortgage REITs."

Hannon Armstrong shares have significantly outperformed the MORT mREIT index ETF, as well as its closest REIT peers so far in 2015.

Bank of America - HASI: Downgrade Buy To Hold, Increase PO To $21

Market Vectors® Mortgage REIT Income ETF MORT "is a rules based index intended to track the overall performance of publicly traded mortgage REITs."

Hannon Armstrong shares have significantly outperformed the MORT mREIT index ETF, as well as its closest REIT peers so far in 2015.

Bank of America - HASI: Downgrade Buy To Hold, Increase PO To $21

- The new HASI $21 price objective reflects the current price range of HASI shares which previously closed on June 19, at $21.31 per share.

- The Bank of America $21 PO "is based on a 5.7% distribution rate requirement," and Bank of America's 2016 estimated dividend.

- Bank of America sees HASI being viewed by investors "…somewhere between self-originating specialty lenders currently yielding approximately 9% and YieldCos/MLPs that currently yield approximately 4.5%."

- Noting HASI's "niche focus and low credit risk," Bruce believes that HASI is lumped in more closely with YieldCos & MLPs.

Bank of America - HASI Bottom Line

Absent a significant new earnings catalyst, Bank of America believes "…that valuation expansion has largely run its course with a 6% forward distribution yield and P/BV at close to 2.0x, suggesting only limited near-term upside."

HASI shares are currently yielding just over 5 percent.

Bank of America - HASI Bottom Line

Absent a significant new earnings catalyst, Bank of America believes "…that valuation expansion has largely run its course with a 6% forward distribution yield and P/BV at close to 2.0x, suggesting only limited near-term upside."

HASI shares are currently yielding just over 5 percent.

Investor Takeaway

However, there is also a possibility HASI will attract capital from "socially responsible" investors willing to accept somewhat lower yields moving forward; basically a "green halo" effect from its sustainable energy investing business model. Since HASI is a unique and relatively new publicly traded REIT, only time will tell.Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in