On July 7, Wells Fargo analyst Joel Houck published a research note, "Sell-off Overdone; Upgrading mREITs to Overweight."

Most investors are attracted to the mortgage REIT (mREIT) sector because of the high dividend yields; however, there are many variables which can lead to losses in book value per share (BVPS), which in turn can lower share prices.

The Wells Fargo rating system includes a "V" for volatility to help alert investors the there is a high potential for price volatility.

"A stock is defined as volatile if the stock price has fluctuated by +/-20% or greater in at least 8 of the past 24 months or if the analyst expects significant volatility."

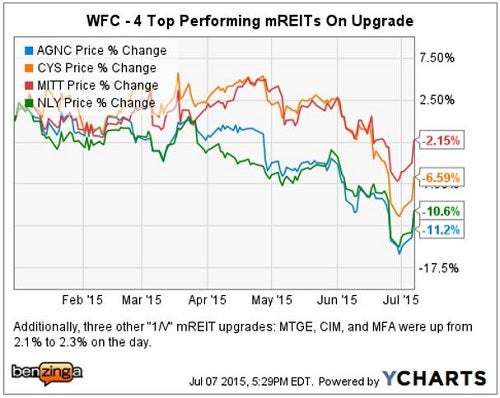

Notably all seven of the mREITs which were upgraded by Houck from Market Perform (2) to Outperform (1) also carry the "V" designation, including four trading up ~3 percent:

- American Capital Agency AGNC $6.8 billion cap, 12.4 percent yield

- CYS Investments CYS $1.3 billion cap, 13.75 percent

- AG Mortgage Investments MITT $516 million cap, 13.2 percent yield

- Annaly Capital Management NLY $9.2 billion cap, 12.4 percent yield

High mREIT dividend yields are achieved by the use of leverage being applied to interest rate spreads. Therefore, small changes in rates can have a large impact on mREIT payouts and valuations.

Tale Of The Tape - 2015 YTD

Despite today's 3 percent gains, the chart below illustrates how these four mREIT shares are still in the red for the year.

Notably, declines in American Agency and Annaly Capital share prices have completely wiped out the dividend gains YTD, a "real world" illustration of mREIT volatility.

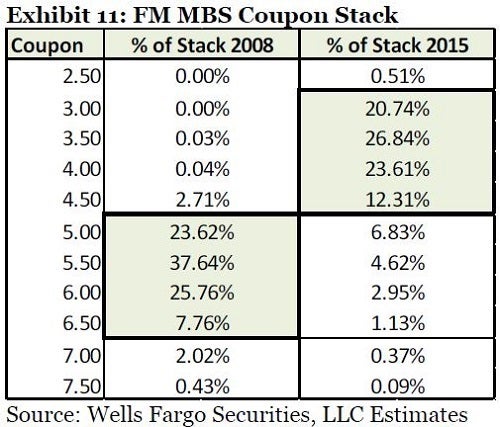

Prepayment Risks Have Lessened

One of the biggest concerns for mREIT investors in a flat to lower rate environment is the prepayment of higher rate mortgages by homeowner refinancing at lower rates.

Houck pointed out how that risk has been mitigated by a shift in portfolio composition from 2008 to 2015, resulting from the "refi boom" in prior years.

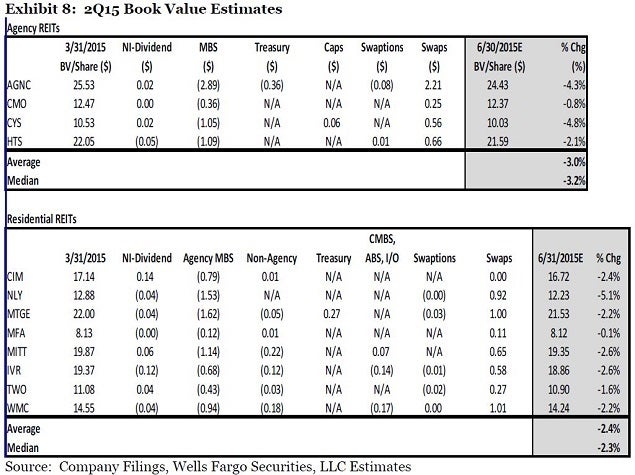

Wells Fargo - BVPS Declines Priced In Shares

The table above shows how mREIT book value estimates have already been lowered sequentially during 2Q15, compared with Q1 estimates.

Wells Fargo - mREITs Favorable Risk Reward

The Wells Fargo mREIT thesis "…is largely predicated on a gradual tightening cycle, starting with a 25 basis point lift-off in September, and a flattening bias to the yield curve."

Wells Fargo looked at a "…total return potential under adverse (10% price/book valuation haircut) and favorable scenarios (10% appreciation), assuming stable dividends based on 2Q15 levels. [Wells Fargo estimated] that these scenarios would yield total returns of 2.6% and 24.6% for the mREIT space in aggregate."

Houck also noted "…lower leverage and narrower duration gaps since the taper tantrum, along with dividend cuts in recent quarters… [and] relatively stable payout levels should contribute to valuation stability."

Investor Takeaway

In addition to the seven mREIT upgrades, Wells Fargo retained Outperform ratings on three additional mREITs under its coverage.

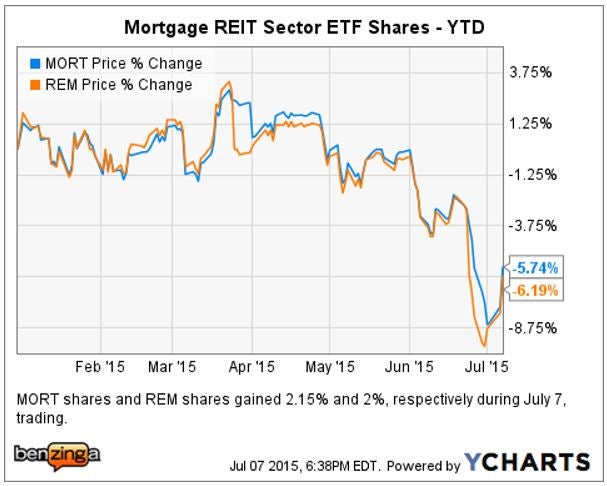

Given the Wells Fargo broad mREIT sector upgrade to Overweight, another way for investors to take advantage of this valuation call would be through sector ETFs.

The Market Vectors Mortgage REIT ETF MORT and iShares Mortgage Real Estate Capped ETF REM provide investors broad mREIT sector exposure, without having to research individual stocks and analyze a variety of complex strategies.

The MORT ETF and REM ETF are currently paying dividends yielding 9.4 percent and 12.5 percent, respectively.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.