Biotech IPOs have long been alluring for investors because of how difficult it is to resist buying into the opportunity for a major biotech breakthrough. Shareholders of the company that finally cures cancer will likely all be instant millionaires, so why not take a stake in the next hot biotech IPO?

Evercore Partners analysts Pankaj Patel and Abhra Banerji recently took a look back at biotech IPOs in recent years and compiled a wealth of statistics dating all the way back to 2000. Here’s a summary of what they found.

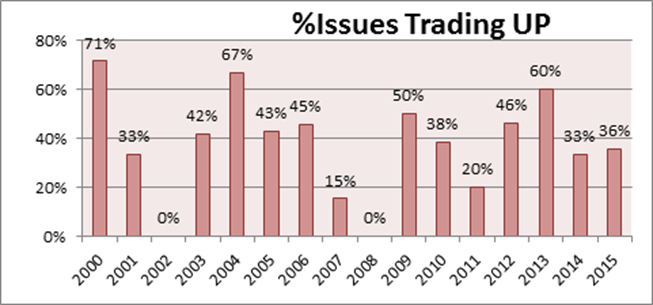

First Day Of Trading

Unfortunately for many biotech IPO buyers looking for a quick flip, Evercore’s data shows that first-day profits have been hard to come by.

In only three of the past 16 years have more than half of the biotech IPOs finished their first day of public trading above their issue price. The only year in the past eleven years biotech IPOs saw more day-one gains than losses was 2013.

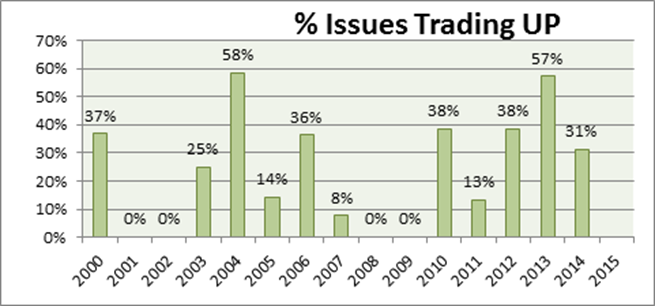

First Six Months

The numbers get even worse when Evercore extends the time horizon to six months.

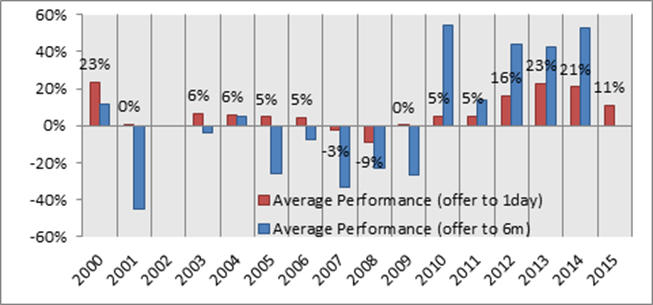

Overall Returns

Finally, Evercore looked at the overall returns generated by biotech IPOs during their first six months of trading.

Takeaway

The numbers seem to indicate that a small number of biotech IPOs are generating a large amount of the positive returns in the space, at least within the first six months. Investors should be aware that, while there are certainly plenty of big winners, there are more than enough big losers to make investing in biotech IPOs an overall risky endeavor. Image Credit: Public Domain© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.