The minutes of the top-secret Fed meeting were released 10 minutes early on Wednesday due to some sort of leak. No, it didn't have to do with the Ashley Madison leakage, however it succeeded in creating a somewhat similar chaos among forex couples, especially the ones paired up with Ms. USA aka the US dollar.

The minutes gave investors a glimpse of what really went down during July's FOMC meeting and naturally had an impact on the Ms. USA,)but she handled her dance moves against some currencies better than the others. She most certainly didn't handle the EUR/USD forex party very well.

So let's dig in and find out what went down during the meeting of Janet Yellen and her gang, and what could be expected next.

Fundamental Stuff

The US economy was printing disappointing numbers even before the minutes were released, and as I covered yesterday, we had already started seeing a shift in the forex market sentiment among the majors including the NZD/USD. The US building permits came in negative at 1.12M versus the 1.23M expected and on Tuesday. Consumer Price Index (CPI) also came in lower than expected at 0.1%, a disappointment comparing to last month's printing of 0.3%.

Then came the FOMC minutes, and as it turns out, one FOMC member (who shall be unnamed) already wanted to hike interest rates during the July meeting but “was willing to wait for additional data to confirm a judgment to raise the target range.”

Here are the major points taken from the minutes:

Majority of the committee members assessed that economic conditions weren’t ripe for a liftoff just yet, especially since downside risks to inflation are still present.

When it comes to the labor market, Fed officials acknowledged that the U.S. economy is making good progress in moving closer to maximum employment. In particular, they cited increases in payroll gains and job openings, as well as declines in the unemployment rate and broader measures of labor underutilization.

However, many also highlighted the slow pace of growth in wages, as this suggests that there’s some slack left to be absorbed and that there’s still room for improvement.

To sum it up, the July FOMC minutes revealed that Fed officials are pleased with the progress in the U.S. economy but would like to see the numbers reaching goals. It’s an interest rate hike we’re talking about here, after all, so they can’t really afford to make any mistakes that might wind up ruining the ongoing recovery.

But does this mean the rate hike will NEVER happen? Com' on dude, it most likely WILL happen. The outlook is good, and the US economy is among the few economies out there doing well. Whatever happened to seeing the glass half full?

Well, this certainly wasn't the case for the dollar bulls as the overall reaction to the minutes was a bearish one. I admit, I wasn't immune from the "glass half empty" syndrome either and as Tweeted yesterday, I readjusted our bearish targets for major pairs to get out of the positions earlier than previously planned.

Today, we will be looking at the jobs numbers and if they come out disappointing as well, we could see further pressure on the US dollar and therefore more rallies in the EUR/USD pair.

Chances are, Ms. USA will bounce back up again after yesterday's losses, but the bounce might not be high enough to reach our long-term targets within August or even September. So I thought, better be safe than sorry, and better get out of the positions with profit (albeit smaller profit than anticipated) than wait another 3 months... What do you think?

Technical Stuff

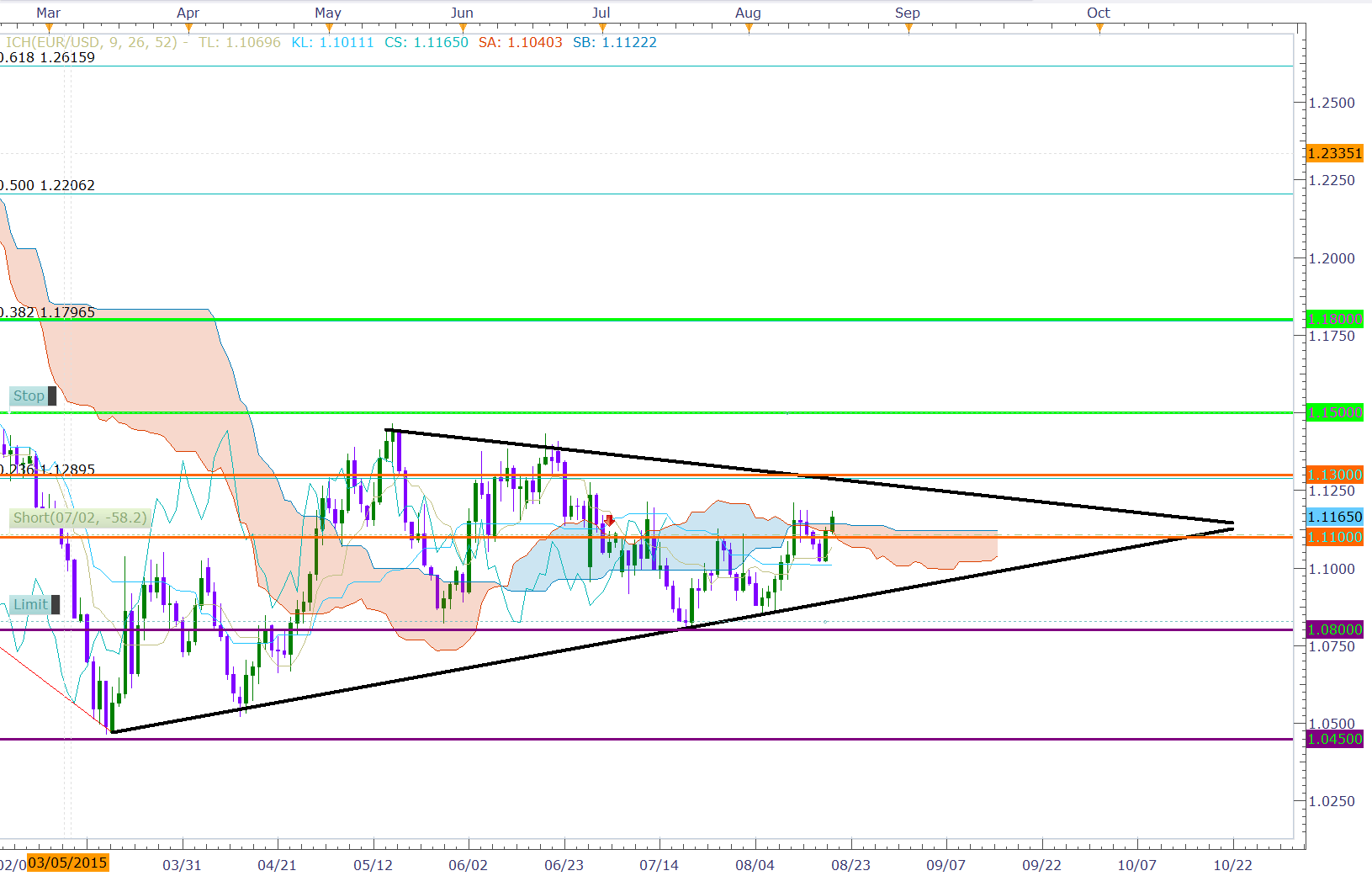

The EUR/USD pair broke above our pivot level of 1.11 as well as the Ichimoku cloud (uh-oh) however it still remains inside a triangle chart pattern. Mr. Ichimoku is flattening and the pair is ranging in general. The next stop could be the key resistance at 23% Fibonacci at 1.13, however the range is still not over and we could see pullbacks towards the support level at 1.08. level. as any solid triangle pattern would suggest, this could only be the calm before the storm.

What direction do you think the pair will break out after the range in over?

Long Term Outlook

The pair has clearly been consolidating on the monthly chart but has yet to complete the Saucer chart pattern, so in a long run, chances of the saucer being completed is still there. Patience, people!

Trading Idea

If you are not in a EUR/USD position, look into taking advantage of the range within the triangle. If you are a EUR/USD bear already in a position targeting 1.04, it could be smart to readjust your target higher up to 1.08 or 1.09.

Where I'm setting my stops and limits:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.