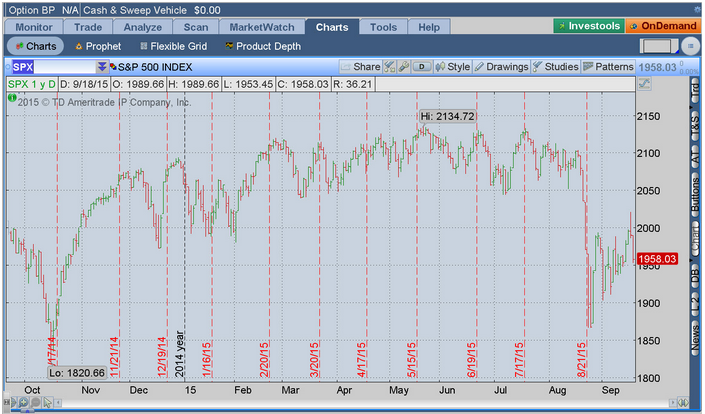

FIGURE 1: NEW RANGE? The S&P 500 (SPX) fell in a broad-market retreat late last week as the Fed's inaction raised some concern about its view of global economic health. SPX did hold the closely watched 1950 line. Data source: Standard & Poor's. Chart source: TD Ameritrade's thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

FIGURE 1: NEW RANGE? The S&P 500 (SPX) fell in a broad-market retreat late last week as the Fed's inaction raised some concern about its view of global economic health. SPX did hold the closely watched 1950 line. Data source: Standard & Poor's. Chart source: TD Ameritrade's thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

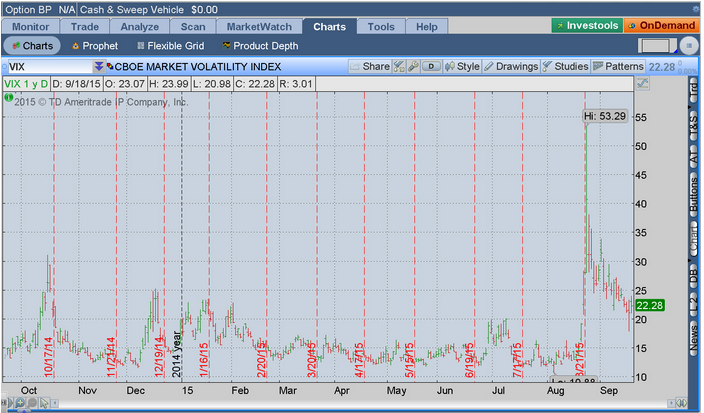

FIGURE 2: VIX MOVES NARROWING. The CBOE Volatility Index (VIX), the market's "fear gauge," continues to churn below 25 as the broader stock market has steadied. VIX is logging smaller intra-day moves in recent sessions. Data source: CBOE. Chart source: TD Ameritrade's thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

FIGURE 2: VIX MOVES NARROWING. The CBOE Volatility Index (VIX), the market's "fear gauge," continues to churn below 25 as the broader stock market has steadied. VIX is logging smaller intra-day moves in recent sessions. Data source: CBOE. Chart source: TD Ameritrade's thinkorswim® platform. For illustrative purposes only. Past performance does not guarantee future results.

New-Home Demand Picks Up, Says Builder

One of the week's few earnings reports has already hit. Lennar LEN—the second-largest U.S. homebuilder diversified across entry-level, plus planned communities, and financing—beat Street analyst expectations with its $0.96 per share in Q3 profit. That's also up from $0.78 per share a year earlier. Executives noted pent up new-home demand and stronger rental markets. LEN shares are up some 15% so far this year. This week also includes data on existing home sales from the National Association of Realtors, expected to have slowed to a 5.45 million-unit clip from 5.59 million a month earlier. New home sales figures are also on tap; they're thought by Street economists to have hit a 500,000 sales pace last month, just off the 507,000 in the prior month.Nike: A Peak at China Effect?

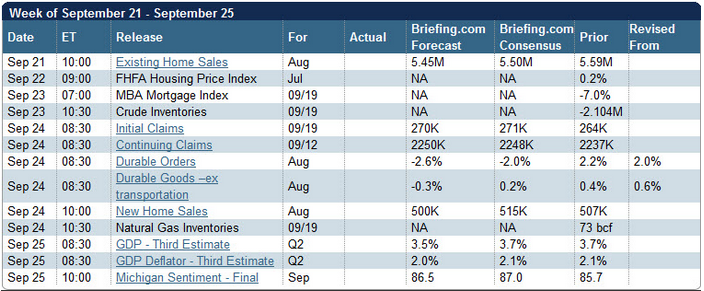

Another earnings report could give investors a sense of consumer confidence, China's economic stumble, and the strong dollar's continued sting for multinational earnings—all important stock market drivers of late and likely to continue to drive trading. Nike NKE, a Dow component, generates just over 40% of its sales in domestic markets, according to company data. But it depends on a not-so-insignificant 10% of its revenue in China. That's Nike's second largest single-country segment. Plus, China represented the biggest regional sales jump for Nike in fiscal 2015, an 18% rise to $3.07 billion, the company reported. Nike reports earnings on Thursday. Good trading, JJ @TDAJJKinahan FIGURE 3: ECONOMIC AGENDA. This week's U.S. economic report calendar. Source: Briefing.com.

This piece was originally posted here by JJ Kinahan on September 21, 2015.

FIGURE 3: ECONOMIC AGENDA. This week's U.S. economic report calendar. Source: Briefing.com.

This piece was originally posted here by JJ Kinahan on September 21, 2015.

Market volatility, volume, and system availability may delay account access and trade executions.

Past performance of a security or strategy does not guarantee future results or success.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Options trading subject to TD Ameritrade review and approval. Please read Characteristics and Risks of Standardized Options before investing in options.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

The information is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2015 TD Ameritrade IP Company, Inc. All rights reserved. Used with permission.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.