The Office for National Statistics out of the UK will be releasing three reports Wednesday, December 16, 2015, at 4:30 AM ET including:

- Average Earnings Index

- Claimant Count Change

- Unemployment Rate

These reports can really make the market move. Based on previous reports and market reaction going back 12 - 24 months, it’s been found that a straddle strategy using Nadex GBP/USD spreads can be a high probability trade. The first report is a three-month moving average of the change in cost of labor for government and businesses. It is released monthly and is compared to the same time period the year before. The Claimant Count Change is the change in the number of people claiming unemployment benefits during the previous month. The third report is the Unemployment rate, a percentage of workforce that is unemployed and seeking work for the past three months.

Straddle Strategy

The straddle strategy uses two spreads to straddle the market; in this case the GBP/USD market. Watching a GBP/USD chart, you want to find two Nadex GBP/USD spreads. Nadex spreads give you a range of a market to trade. The spread has a floor and ceiling. You can trade them long or short but you won’t win or lose past the floor or the ceiling. You can also enter and exit at any time as long as there is another trader on the other side of your trade to fill your order. Nadex is a US based CFTC regulated exchange and can be traded from 49 different countries.

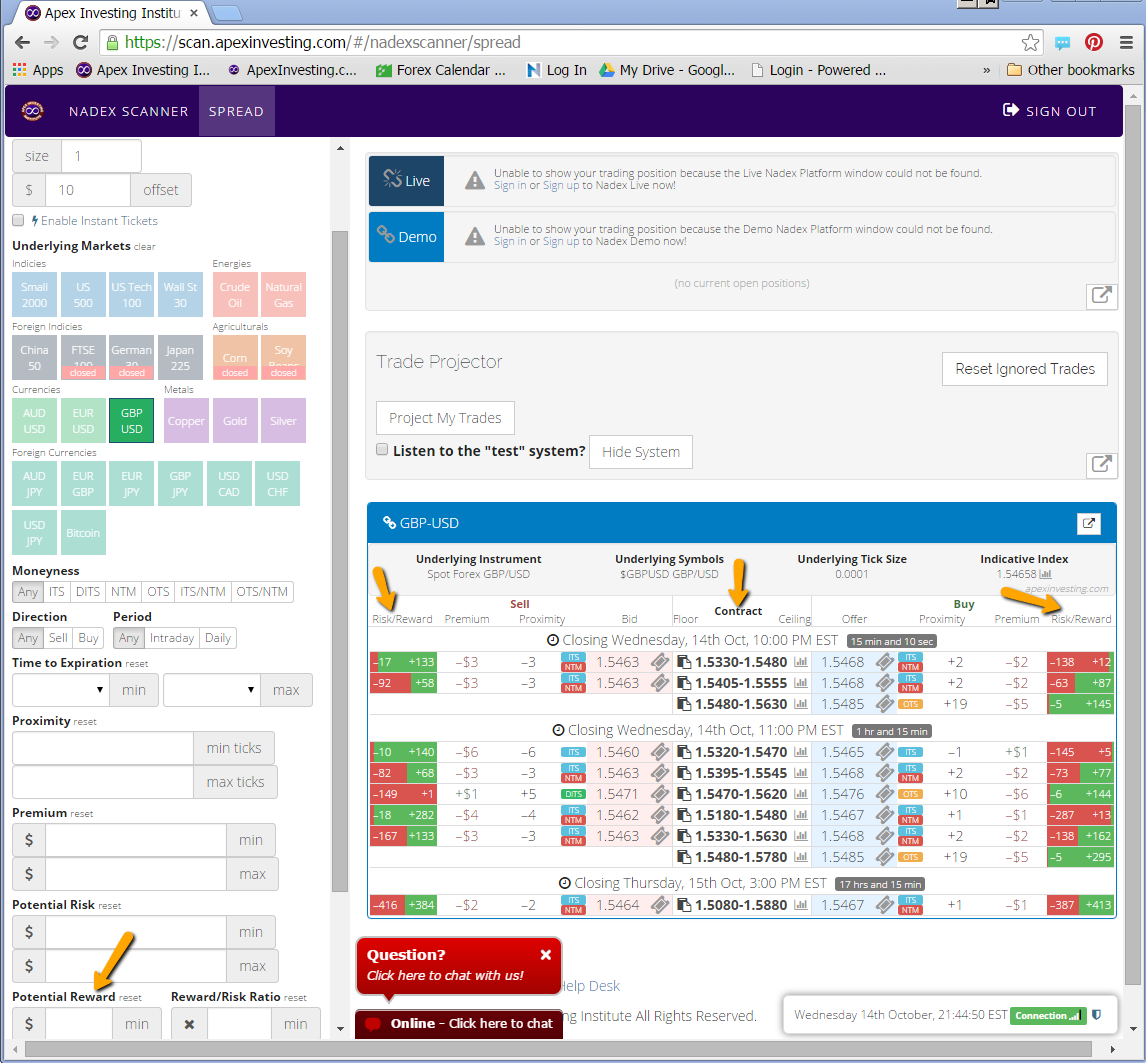

To straddle the market for this strategy, you want to buy a Nadex GBP/USD spread with the floor where the market is trading at the time. You also need to sell a Nadex GBP/USD spread with the ceiling where the market is trading at the time. Since this report comes out in the wee morning hours, the strategy is set up so you can enter as early as 11:00 PM ET the night before on Tuesday for 7:00 AM ET expirations. The max risk to take on this trade is $40 combined between your spreads. How do you do this? You open the spread scanner found at www.apexinvesting.com and at a glance, you can find your spreads for the trade.

To view larger image click HERE.

You must also have a Nadex demo or live account and be logged in. An account with Nadex is quick and easy to open. The spread scanner displays the spreads down the center. First, you click on the market for the spreads you need to see: GBP/USD. Then, at 11:00 PM ET Tuesday evening or earlier, you look under spreads expiring at 7:00 AM ET and find the ones you need for the right direction that have the right ceiling and floor that you need. Next, make sure that the max Risk does not exceed approximately $20 per spread. Once you have met all the requirements, you can enter and be sure to enter both sides.

The wonderful thing about Nadex and a straddle strategy is that to enter a Nadex trade you put up the total risk and with a straddle strategy, max risk going into the trade is low. There is no need for stops. Once the news is released and the market makes a move, one side will normally profit. As one side profits you can leave the other spread on because the market may pull back and the other side may profit some as well. What you are looking for is a 1:1 risk reward ratio. To achieve this, you want the market to move approximately 80 pips up or down. If it moves 40 pips up or down, those are your breakeven points. At 80 pips up or down is where you ideally want to set your take profit orders and exit.

To learn more about trading Nadex spreads and binaries as well as futures, forex and CFDs go to www.apexinvesting.com for free education and access to the spread scanner.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.