U.S. auto sales hit a record high 17.47 million in 2015, and industry leaders Ford Motor Company F and General Motors Company GM appear to be firing on all cylinders heading into this year’s Detroit Auto Show.

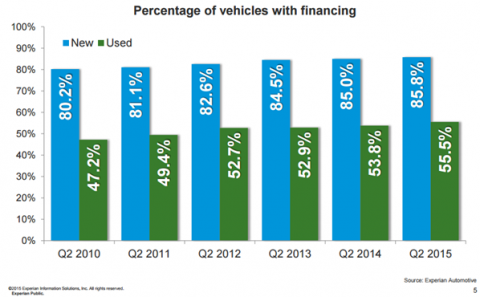

However, the percentage of vehicles requiring financing has been steadily on the rise in recent years, up to nearly 86% for new vehicles and 56% for used vehicles.

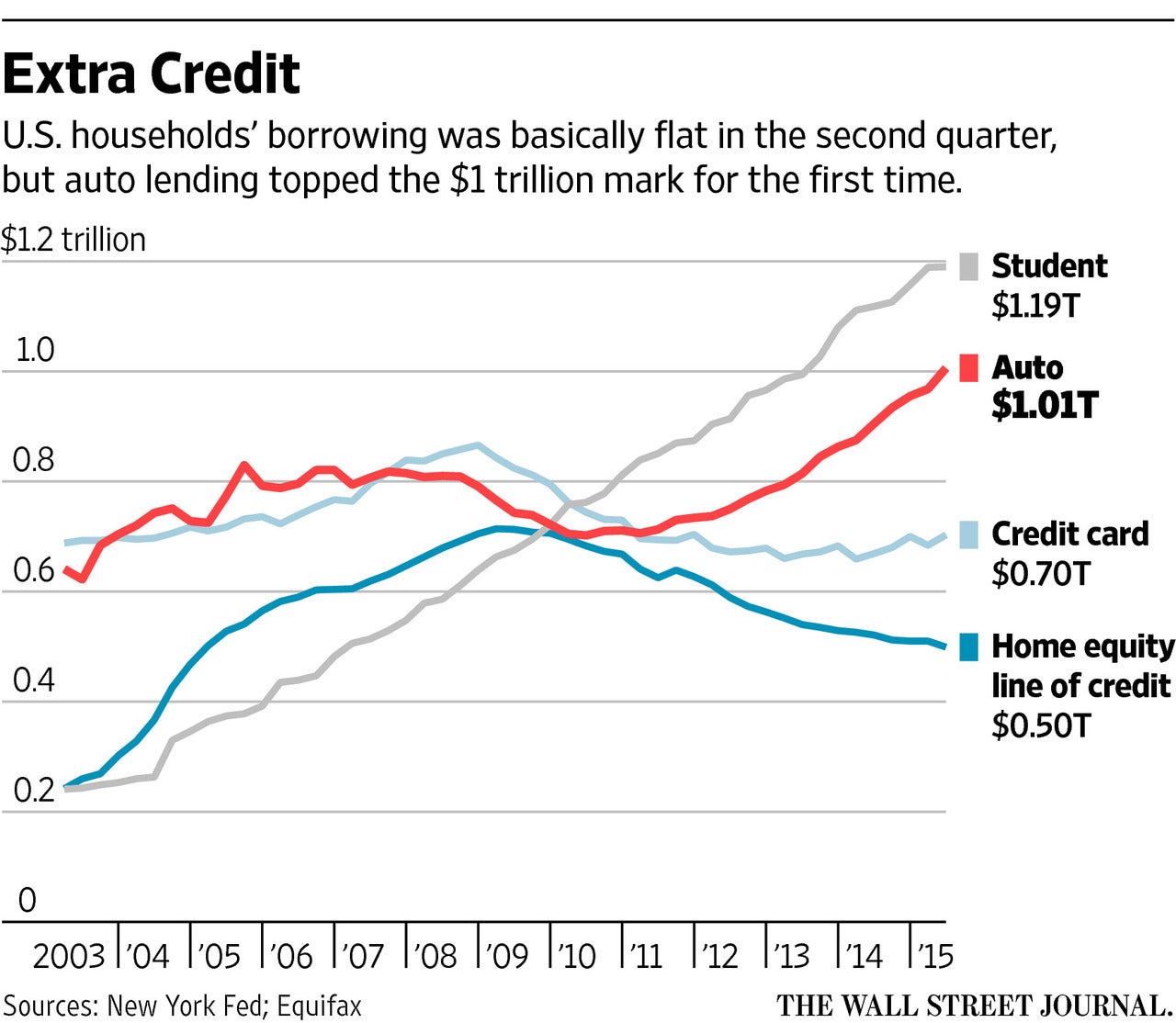

Total U.S. auto debt hit a new all-time high of $1 trillion in 2015. While many Americans seem to have learned their lesson from the Financial Crisis when it comes to mortgage debt and credit card debt, auto debt and student loan debt are still headed in the wrong direction.

U.S. Comptroller of the Currency Thomas Curry addressed the auto loan elephant in the room in a speech last year, saying it “reminds me of what happened in mortgage-backed securities in the run-up to the crisis.”

Related Link: Why Did Ford Restructure Its Accounting For Pension And Other Post-Retirement Benefits?

Richard Cordray, director of the Consumer Financial Protection Bureau, says, “Subprime [auto] borrowers may be more vulnerable to predatory practices, so direct oversight of their lending practices is essential.”

The Department of Justice has already subpoenaed Capital One Financial Corp. COF, Ally Financial Inc ALLY and others regarding subprime auto lending.

Disclosure: the author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.