The U.S. stock market has struggled to find its footing so far in 2016, but DeMark Analytics founder Tom DeMark believes that things will get much uglier in March. DeMark is now calling for the S&P to drop 8-10 percent from current levels in the short-term, down to around 1,786.

DeMark currently has a high level of confidence that his prediction will play out in coming weeks. “I’m pretty confident even though 90 percent of the stock market has already bottomed,” he said.

Related Link: The Auto Loan Market Is Beginning To Look Like 2008's Housing Bubble

Unfortunately for bulls, several of DeMark’s recent calls have been spot-on, including his call for an oil rally on Feb. 11 his prediction that the S&P 500 had reached a short-term bottom on Jan. 20 and his prediction last August that Chinas stock market has more downside ahead.

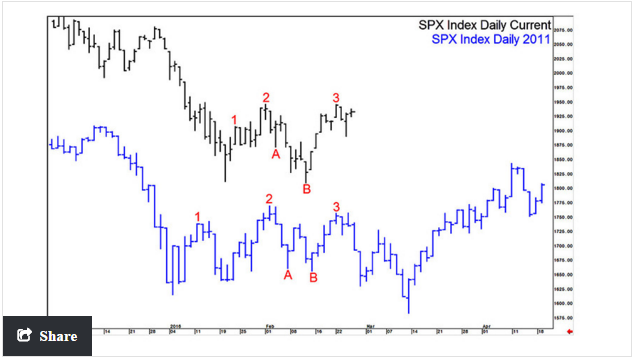

DeMark identified three prior periods in which the U.S. stock market demonstrated extremely similar trading patterns to its 2016 action. The most recent similar trading period, pictured below, came during the 2011 market selloff on European debt fears.

Traders who want to play DeMark’s prediction should consider the ProShares Short S&P500 (ETF) SH.

Market bulls hoping that DeMark finally got one wrong should pay close attention to Friday’s trading session. According to DeMark, Friday’s session is critical and could determine whether or not he sticks to his call. The S&P 500 has opened up slightly higher on the day.

Disclosure: the author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.