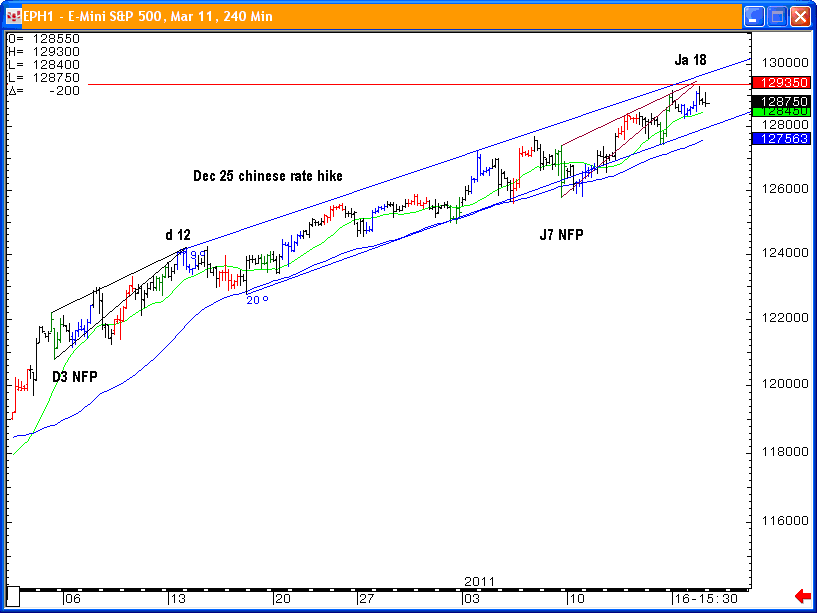

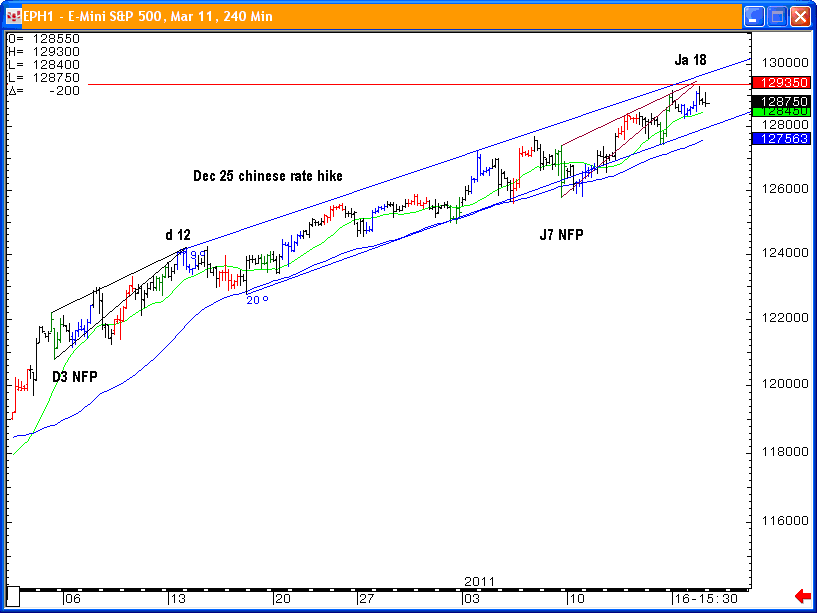

Over the weekend, I noted a strong correlation off the Jan 7 NFP high and low to the Dec 3 NFP high and low. That low to high and high to high correlation targeted 1293. The SP500 reached that overnight ahead of the anti-climactic earnings announcements from Apple AAPL after the mkt close today and Goldman Sachs GS before the mkt opens tomorrow. Whatever rosy numbers or not Apple puts up, it will be partially offset by Steve Jobs leave of absence announced on Monday.

The sell signal was generated on the 50x4 point and figure chart when the SP500 printed 1187.00. The initial sell signal is not working too well, having traded down to 1186.50 before backfilling to 1291.00. The breach of 1290.50 and print of 1291 produced a minor buy signal which negated the initial sell signal.

Short term, ahead of the earnings announcement from Apple, minor buy and sell signals are apt to be weak. As it stands right now, the next minor buy signal will be elected on a print of 1291.50 and the next sell signal will be generated on a print of 1287.00.

It is typical for anti-climactic crests to occur in the stock market during peak earnings season. We are their now. Knowing this biases my short term outlook towards a market correction being due. This is the ideal time to end the Santa Claus rally that began on Nov 26.

The Dec-Jan trend support on the 50x4 chart below is sloping through the swing low near 1274-1275. Any initial flushes should find support there, because there is a bull gap window (not shown) still open between 1271-1276 from last week in the pit session only. Moreover, the 10 day average (not shown) is sloping into 1272 at present.

The sell signal was generated on the 50x4 point and figure chart when the SP500 printed 1187.00. The initial sell signal is not working too well, having traded down to 1186.50 before backfilling to 1291.00. The breach of 1290.50 and print of 1291 produced a minor buy signal which negated the initial sell signal.

Short term, ahead of the earnings announcement from Apple, minor buy and sell signals are apt to be weak. As it stands right now, the next minor buy signal will be elected on a print of 1291.50 and the next sell signal will be generated on a print of 1287.00.

It is typical for anti-climactic crests to occur in the stock market during peak earnings season. We are their now. Knowing this biases my short term outlook towards a market correction being due. This is the ideal time to end the Santa Claus rally that began on Nov 26.

The Dec-Jan trend support on the 50x4 chart below is sloping through the swing low near 1274-1275. Any initial flushes should find support there, because there is a bull gap window (not shown) still open between 1271-1276 from last week in the pit session only. Moreover, the 10 day average (not shown) is sloping into 1272 at present.

Market News and Data brought to you by Benzinga APIs The sell signal was generated on the 50x4 point and figure chart when the SP500 printed 1187.00. The initial sell signal is not working too well, having traded down to 1186.50 before backfilling to 1291.00. The breach of 1290.50 and print of 1291 produced a minor buy signal which negated the initial sell signal.

Short term, ahead of the earnings announcement from Apple, minor buy and sell signals are apt to be weak. As it stands right now, the next minor buy signal will be elected on a print of 1291.50 and the next sell signal will be generated on a print of 1287.00.

It is typical for anti-climactic crests to occur in the stock market during peak earnings season. We are their now. Knowing this biases my short term outlook towards a market correction being due. This is the ideal time to end the Santa Claus rally that began on Nov 26.

The Dec-Jan trend support on the 50x4 chart below is sloping through the swing low near 1274-1275. Any initial flushes should find support there, because there is a bull gap window (not shown) still open between 1271-1276 from last week in the pit session only. Moreover, the 10 day average (not shown) is sloping into 1272 at present.

The sell signal was generated on the 50x4 point and figure chart when the SP500 printed 1187.00. The initial sell signal is not working too well, having traded down to 1186.50 before backfilling to 1291.00. The breach of 1290.50 and print of 1291 produced a minor buy signal which negated the initial sell signal.

Short term, ahead of the earnings announcement from Apple, minor buy and sell signals are apt to be weak. As it stands right now, the next minor buy signal will be elected on a print of 1291.50 and the next sell signal will be generated on a print of 1287.00.

It is typical for anti-climactic crests to occur in the stock market during peak earnings season. We are their now. Knowing this biases my short term outlook towards a market correction being due. This is the ideal time to end the Santa Claus rally that began on Nov 26.

The Dec-Jan trend support on the 50x4 chart below is sloping through the swing low near 1274-1275. Any initial flushes should find support there, because there is a bull gap window (not shown) still open between 1271-1276 from last week in the pit session only. Moreover, the 10 day average (not shown) is sloping into 1272 at present.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in