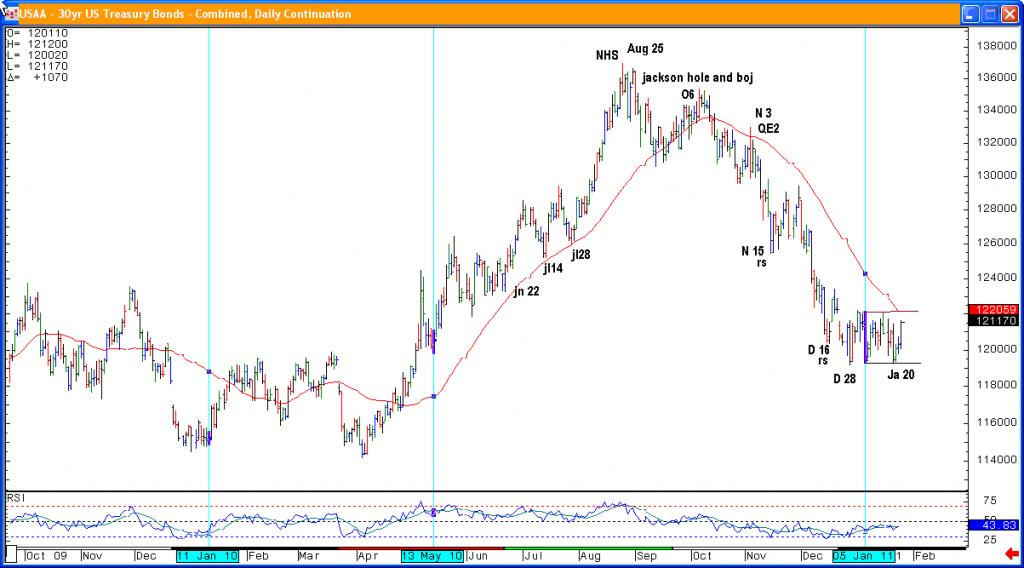

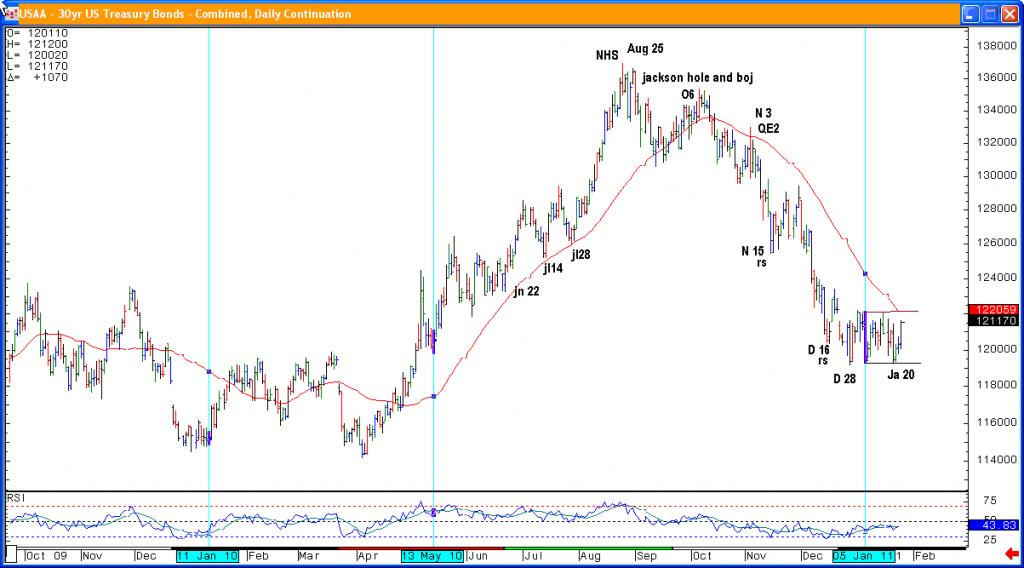

With the trend in US jobless claims improving and the economic recovery not losing its foothold in 2H 2010 on the back of QE2, the 30 yr treasury has been in an intermediate decline since August 25. The decline accelerated after the QE2 announcement on Nov 3.

But since Dec 28 and Jan 20, a double bottom price base has formed. Still there is formidable resistance this week at 12204, where the red 2 month average (that defined most of the trend in 2010) slopes into the Jan 5 yr high at 12205. Note that Wednesday Nov 3 was an FOMC spike high that could not sustain a trade above the 2 month average. Wednesday Jan 26 features new home sales (NHS) and another FOMC statement.

The year high in 2010 was set on the Aug 25 NHS announcement, and the Nov 3 high was of course an FOMC date. Wednesday Jan 26 features both of those lovelies. Realistically, we should surmise that the high in the treasury market this week should be set on Wednesday followed by further weakness on Thursday's jobless claims and Friday's Q4 GDP report. I will go along with that scenario that calls for a midweek high in the 122 handle that may spike the 30 yr above the yr high and 2 month average. However, will the push back down into Friday's GDP report be sufficient to push the 30 yr to new move lows.

If not, perhaps a short-covering rally might push the 30 yr back into and above the 122 handle during next week NFP report. Note the Jan 20 low double bottom on the Jan 5 yr low. A breakout above the Jan 5 yr high at 12205 will cause some serious short-covering. Now look back to May 13, the reaction low following the May 6 2010 stock market crash. The 30 yr hasn't been able to sustain a trade below the May 13 low since Dec 28. Now look back to initial rally off the Jan 11 2010 low. A similar move in price off the Jan 20 2011 low projects the 30 yr approximately back to the May 6 2010 stock market crash high in the 124 handle in the first half of Feb.

The breakout of the Jan 5 box that the 30 has been in this entire month will be a fast move. If it is to the upside as I suspect it will be at this juncture (after a pullback into Friday following a spike high tomorrow), it could be an indication of a potential flight to safety into fixed income and out of equities.

Equities are due a correction and a “fast trade” down as well. Unwinds from the QE2 trades in the second half of 2010 have occurred in the metals, basic materials, and transports. But as yet, a short term unwind has not occurred in the broad market. I suggest you use the box pattern in the 30 to gauge a potential short term unwind in the broad equity mkt in the coming days and weeks.

But since Dec 28 and Jan 20, a double bottom price base has formed. Still there is formidable resistance this week at 12204, where the red 2 month average (that defined most of the trend in 2010) slopes into the Jan 5 yr high at 12205. Note that Wednesday Nov 3 was an FOMC spike high that could not sustain a trade above the 2 month average. Wednesday Jan 26 features new home sales (NHS) and another FOMC statement.

The year high in 2010 was set on the Aug 25 NHS announcement, and the Nov 3 high was of course an FOMC date. Wednesday Jan 26 features both of those lovelies. Realistically, we should surmise that the high in the treasury market this week should be set on Wednesday followed by further weakness on Thursday's jobless claims and Friday's Q4 GDP report. I will go along with that scenario that calls for a midweek high in the 122 handle that may spike the 30 yr above the yr high and 2 month average. However, will the push back down into Friday's GDP report be sufficient to push the 30 yr to new move lows.

If not, perhaps a short-covering rally might push the 30 yr back into and above the 122 handle during next week NFP report. Note the Jan 20 low double bottom on the Jan 5 yr low. A breakout above the Jan 5 yr high at 12205 will cause some serious short-covering. Now look back to May 13, the reaction low following the May 6 2010 stock market crash. The 30 yr hasn't been able to sustain a trade below the May 13 low since Dec 28. Now look back to initial rally off the Jan 11 2010 low. A similar move in price off the Jan 20 2011 low projects the 30 yr approximately back to the May 6 2010 stock market crash high in the 124 handle in the first half of Feb.

The breakout of the Jan 5 box that the 30 has been in this entire month will be a fast move. If it is to the upside as I suspect it will be at this juncture (after a pullback into Friday following a spike high tomorrow), it could be an indication of a potential flight to safety into fixed income and out of equities.

Equities are due a correction and a “fast trade” down as well. Unwinds from the QE2 trades in the second half of 2010 have occurred in the metals, basic materials, and transports. But as yet, a short term unwind has not occurred in the broad market. I suggest you use the box pattern in the 30 to gauge a potential short term unwind in the broad equity mkt in the coming days and weeks.

Market News and Data brought to you by Benzinga APIs But since Dec 28 and Jan 20, a double bottom price base has formed. Still there is formidable resistance this week at 12204, where the red 2 month average (that defined most of the trend in 2010) slopes into the Jan 5 yr high at 12205. Note that Wednesday Nov 3 was an FOMC spike high that could not sustain a trade above the 2 month average. Wednesday Jan 26 features new home sales (NHS) and another FOMC statement.

The year high in 2010 was set on the Aug 25 NHS announcement, and the Nov 3 high was of course an FOMC date. Wednesday Jan 26 features both of those lovelies. Realistically, we should surmise that the high in the treasury market this week should be set on Wednesday followed by further weakness on Thursday's jobless claims and Friday's Q4 GDP report. I will go along with that scenario that calls for a midweek high in the 122 handle that may spike the 30 yr above the yr high and 2 month average. However, will the push back down into Friday's GDP report be sufficient to push the 30 yr to new move lows.

If not, perhaps a short-covering rally might push the 30 yr back into and above the 122 handle during next week NFP report. Note the Jan 20 low double bottom on the Jan 5 yr low. A breakout above the Jan 5 yr high at 12205 will cause some serious short-covering. Now look back to May 13, the reaction low following the May 6 2010 stock market crash. The 30 yr hasn't been able to sustain a trade below the May 13 low since Dec 28. Now look back to initial rally off the Jan 11 2010 low. A similar move in price off the Jan 20 2011 low projects the 30 yr approximately back to the May 6 2010 stock market crash high in the 124 handle in the first half of Feb.

The breakout of the Jan 5 box that the 30 has been in this entire month will be a fast move. If it is to the upside as I suspect it will be at this juncture (after a pullback into Friday following a spike high tomorrow), it could be an indication of a potential flight to safety into fixed income and out of equities.

Equities are due a correction and a “fast trade” down as well. Unwinds from the QE2 trades in the second half of 2010 have occurred in the metals, basic materials, and transports. But as yet, a short term unwind has not occurred in the broad market. I suggest you use the box pattern in the 30 to gauge a potential short term unwind in the broad equity mkt in the coming days and weeks.

But since Dec 28 and Jan 20, a double bottom price base has formed. Still there is formidable resistance this week at 12204, where the red 2 month average (that defined most of the trend in 2010) slopes into the Jan 5 yr high at 12205. Note that Wednesday Nov 3 was an FOMC spike high that could not sustain a trade above the 2 month average. Wednesday Jan 26 features new home sales (NHS) and another FOMC statement.

The year high in 2010 was set on the Aug 25 NHS announcement, and the Nov 3 high was of course an FOMC date. Wednesday Jan 26 features both of those lovelies. Realistically, we should surmise that the high in the treasury market this week should be set on Wednesday followed by further weakness on Thursday's jobless claims and Friday's Q4 GDP report. I will go along with that scenario that calls for a midweek high in the 122 handle that may spike the 30 yr above the yr high and 2 month average. However, will the push back down into Friday's GDP report be sufficient to push the 30 yr to new move lows.

If not, perhaps a short-covering rally might push the 30 yr back into and above the 122 handle during next week NFP report. Note the Jan 20 low double bottom on the Jan 5 yr low. A breakout above the Jan 5 yr high at 12205 will cause some serious short-covering. Now look back to May 13, the reaction low following the May 6 2010 stock market crash. The 30 yr hasn't been able to sustain a trade below the May 13 low since Dec 28. Now look back to initial rally off the Jan 11 2010 low. A similar move in price off the Jan 20 2011 low projects the 30 yr approximately back to the May 6 2010 stock market crash high in the 124 handle in the first half of Feb.

The breakout of the Jan 5 box that the 30 has been in this entire month will be a fast move. If it is to the upside as I suspect it will be at this juncture (after a pullback into Friday following a spike high tomorrow), it could be an indication of a potential flight to safety into fixed income and out of equities.

Equities are due a correction and a “fast trade” down as well. Unwinds from the QE2 trades in the second half of 2010 have occurred in the metals, basic materials, and transports. But as yet, a short term unwind has not occurred in the broad market. I suggest you use the box pattern in the 30 to gauge a potential short term unwind in the broad equity mkt in the coming days and weeks.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in