The most critical aspect of any successful startup is funding. Venture capital (VC) funds are one of the best sources of funding for startups that are lucky enough to woo them.

A new research paper by Harvard Business School professor Paul Gompers entitled "How Do Venture Capital Funds Make Decisions?" includes survey results from 885 institutional venture capitalists. One of the topics the survey covered was how VC funds choose their investments.

How It's Done

The process begins with a pipeline of hundreds of potential investment opportunities. VCs then select only a handful to actually fund.

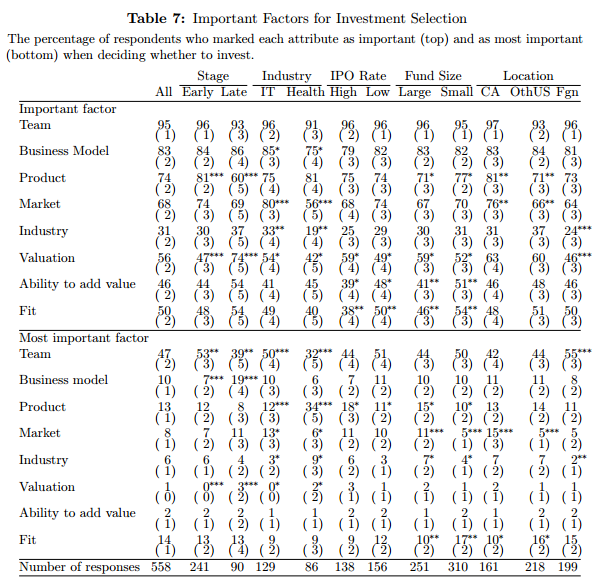

A number of entrepreneurs struggle over coming up with the perfect product idea for their startup. Surprisingly, a startup’s product is not nearly as important to a VC's funding as its management team and its business model.

“The team is more likely to be the most important factor for early-stage investors and IT investors than for late-stage and healthcare investors,” Gompers added.

When he dug deeper to ask exactly what VCs look for in a management team, Gompers found that ability is the leading factor. VCs also value industry experience as the second most-important factor followed by passion, entrepreneurial experience and teamwork.

The paper also included some insightful statistics about the VC decision process. The average VC deal takes 83 days to close, and firms spend an average of 118 hours on due diligence prior to a deal. The due diligence process includes phone calls to an average of 10 references.

In addition to survey results about investment selection, Gompers’ paper also includes data on how VCs handle valuation, deal structure, post-investment value-add, exits, internal organization of firms and relationships with limited partners.

Do you have ideas for articles/interviews you'd like to see more of on Benzinga? Please email feedback@benzinga.com with your best article ideas. One person will be randomly selected to win a $20 Amazon gift card!© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.