Stock traders don’t need to be options experts to get profitable trading ideas from the options market.

Lots of stock traders watch the options market every day. They may not be trading options, but they want to know what options traders are thinking.

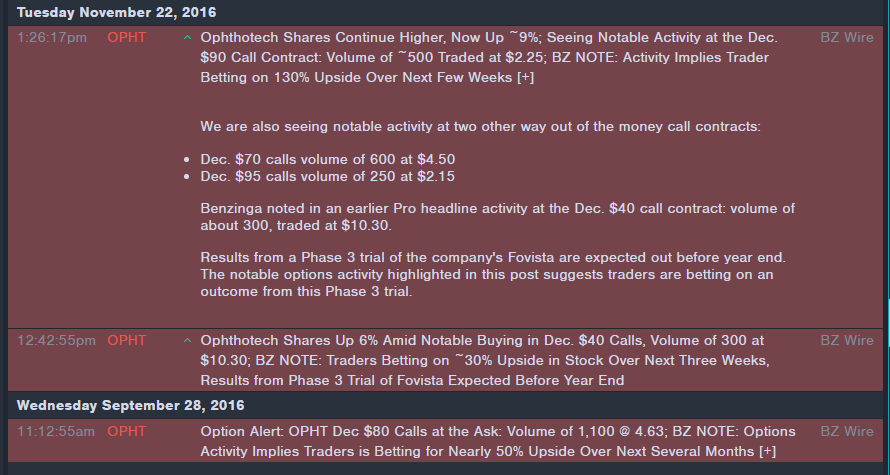

Benzinga Pro provides real-time alerts to subscribers about potentially market-moving options activity. Here’s an example of some recent options trading activity surrounding Ophthotech Corp OPHT, which has major Phase 3 drug data for Fovista coming out in December.

Options traders have been making large bets on whether or not the data will be positive and what that could mean for the stock.

Opthotech currently trades at around $32/share, but heavy volume in $80 Ophthotech December call options on September 28 indicated that some traders with deep pockets saw nearly 50 percent upside for the stock by the end of the year.

On November 22, Benzinga Pro reported heavy volume in the December $90 Opthotech calls, suggesting that certain traders remain optimistic about the data. In addition, there has been recent activity in December $40, $70 and $95 contracts as well.

Options traders are typically seen as more sophisticated and advanced than the average stock trader. That generalization is particularly considered to be true when it comes to options traders who place extremely large orders. In other words, when somebody makes a huge bet in the options market that a stock is going to go up or down, stock traders take it seriously.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.