Shares of Snap Inc SNAP, the parent of ephemeral photo and video sharing platform Snapchat, jumped more than 51 percent on its debut trading on New York Stock Exchange.

Snap's IPO

Snap, which priced its IPO at $17, raised $3.4 billion at a valuation of $24 billion, which is the largest tech IPO since Alibaba Group Holding Ltd BABA’s debut in 2014.

The Volatility Of Tech IPOs

The trading debuts of major Silicon Valley giants can be extremely volatile and closely monitored, especially if an IPO of Snap’s size comes after a year of dry run. The year 2016 was marred by weak stock market, political uncertainty that made many firms hold back their IPO plans.

An Ernst & Young report said compared with 2015, deal volume decreased by 36 percent in 2016 with 112 IPOs, while capital raised was down 37 percent with $21.3 billion.

Related Link: Munster, Calacanis Talk The Bull-Bear Case On Snap

2017: The Year Of The IPO

But, the 2017 could be the year of IPOs, especially on the technology front, and the success of Snap IPO could revive the tech IPOs, in general. If Snap’s IPO goes well, other potential IPO candidates such as Uber, Pinterest and Airbnb may follow suit.

Also, the macro environment and regulatory backdrop seem favorable for IPOs in 2017 in the United States. A Trump presidency triggers hope of a business-friendly era coupled with less regulation and lower corporate taxes.

In addition, the bullish market may attract more firms to go public this year, as unicorns may begin to find a successful place in the public markets. Note that, Dow Jones Industrial Average touched 21,000 levels recently following a speech by President Donald Trump.

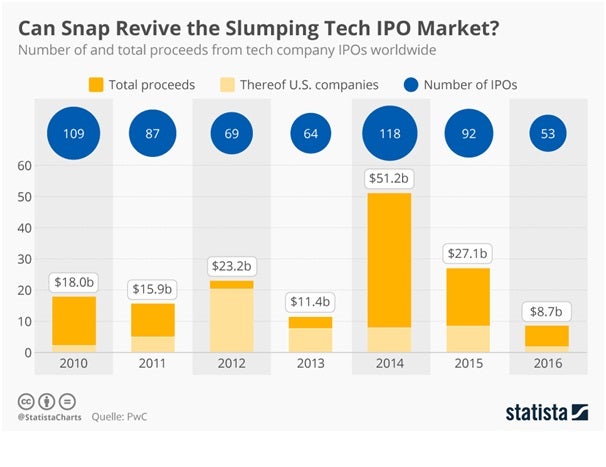

The following chart released by Statista shows how the global market for tech IPOs has developed since 2010.

At last check, shares of Snap were up 3.43 percent at $25.32 in Friday's pre-market session.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.