Last May, I advised you to consider buying an American sugar producer.

Here's what I said,

“I'm looking for a 12 cent per pound floor. If sugar hits that price, or even dips lower, I'll be on the lookout for an entry point into a sugar company.

There's really only one publicly traded company that's a pure play on sugar prices: Imperial Sugar IPSU.”

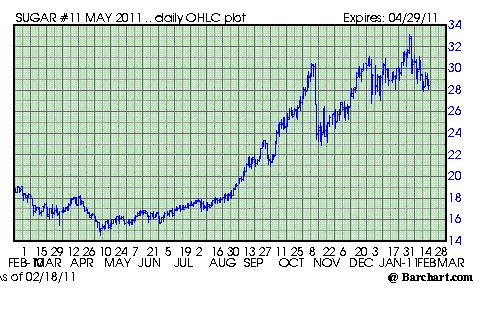

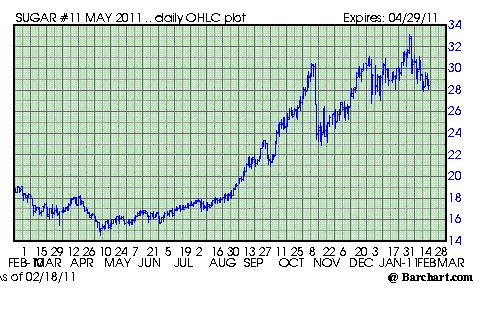

My reasoning? Sugar prices were dropping below 15 cents a pound – a crucial inflection point for this commodity.

*****Amazingly, sugar then sold for 1/3 the 1981 highs of 40 cents a pound.

Anytime you can buy a commodity cheaper than it cost you 30 years ago, it's time to give the purchase serious consideration.

And since May, sugar prices nearly doubled from just under 15 cents a pound, to 28 cents per pound today.

But as I frequently note, it's not enough to be right on the trend – you also have to buy the right investment.

For instance, anyone could (and many did) predict that higher oil prices were on the horizon in early 2009 when a barrel cost $35, and gasoline sold for less than $2 a gallon.

But knowing that prices will go up and knowing what to do about it are two different things.

So…what happened to my “favorite” sugar company since May?

In a nutshell: not much.

Okay, so I didn't completely blow it. Just over a month later in June, I recommended buying this company at a pretty good entry point:

*****“My recommendation would be to nibble at shares under $12, and to take bigger bites under $10.50.”

If you had averaged in to this stock between $10 and $12, you'd probably be breaking even on the recommendation. That's still not very good, especially considering what happened with the broad market between June and last week.

But, I was able to pick the 52 week bottom for this company within 5% - not too bad of an entry point.

So, why has this company not been able to take advantage of a near doubling of sugar prices?

I'm glad to say that it doesn't happen too frequently, but my initial analysis on this company was off target. This company has a very limited upside when sugar prices increase.

That's because they aren't a sugar producer. They're a refiner. So they have to buy sugar cane from producers. Higher sugar prices can only help this company if it's able to absorb, avoid, or otherwise out-maneuver the competition with some advantage.

I initially liked this company because it seemed as though it was coming out of a period of bad luck, including an explosion at one of their silos, as well as losses incurred in the sugar futures market.

I thought they'd emerge from the ashes (literally) of these unlucky events with a renewed profitability.

But they haven't. They posted a loss of 75 cents per share in the first quarter of 2011.

Higher sugar prices are hurting this company.

If you bought this company on my advice, I'm changing my current recommendation to 'sell'.

John Septor, the company's CEO recently said, “We are anxious to continue the ramp-up in production in Port Wentworth once the silos are on line.”

He's referring to the silos that were damaged in the 2008 explosion and fire that have since been off-line. But it's tough to see how this company will be able to turn the profitability around, especially if sugar prices continue to rise.

Here's the thing: I expect sugar prices to rise, likely reaching the old 1981 highs of 40 cents per pound sometime in the next year or so.

*****Back in June, I also recommended looking into buying the sugar futures ETF, the iPath DJ-UBS Sugar Subindex fund SGG.

I said, “I'd look to pick up some units of this fund under $50…”

Hopefully you've bought a few shares of SGG, in which case you would more than offset any losses on Imperial Sugar.

SGG currently sells for over $88 a unit, handing you a nice 69% return – nearly identical to the change in the price of sugar.

So, do more of what's working.

I'd look to add to any SGG position, or to build one on dips.

Sugar prices are going higher over the coming months and years.

Kevin McElroy, Editor, Resource Prospector

Market News and Data brought to you by Benzinga APIs“I'm looking for a 12 cent per pound floor. If sugar hits that price, or even dips lower, I'll be on the lookout for an entry point into a sugar company.

There's really only one publicly traded company that's a pure play on sugar prices: Imperial Sugar IPSU.”

My reasoning? Sugar prices were dropping below 15 cents a pound – a crucial inflection point for this commodity.

*****Amazingly, sugar then sold for 1/3 the 1981 highs of 40 cents a pound.

Anytime you can buy a commodity cheaper than it cost you 30 years ago, it's time to give the purchase serious consideration.

And since May, sugar prices nearly doubled from just under 15 cents a pound, to 28 cents per pound today.

But as I frequently note, it's not enough to be right on the trend – you also have to buy the right investment.

For instance, anyone could (and many did) predict that higher oil prices were on the horizon in early 2009 when a barrel cost $35, and gasoline sold for less than $2 a gallon.

But knowing that prices will go up and knowing what to do about it are two different things.

So…what happened to my “favorite” sugar company since May?

In a nutshell: not much.

Okay, so I didn't completely blow it. Just over a month later in June, I recommended buying this company at a pretty good entry point:

*****“My recommendation would be to nibble at shares under $12, and to take bigger bites under $10.50.”

If you had averaged in to this stock between $10 and $12, you'd probably be breaking even on the recommendation. That's still not very good, especially considering what happened with the broad market between June and last week.

But, I was able to pick the 52 week bottom for this company within 5% - not too bad of an entry point.

So, why has this company not been able to take advantage of a near doubling of sugar prices?

I'm glad to say that it doesn't happen too frequently, but my initial analysis on this company was off target. This company has a very limited upside when sugar prices increase.

That's because they aren't a sugar producer. They're a refiner. So they have to buy sugar cane from producers. Higher sugar prices can only help this company if it's able to absorb, avoid, or otherwise out-maneuver the competition with some advantage.

I initially liked this company because it seemed as though it was coming out of a period of bad luck, including an explosion at one of their silos, as well as losses incurred in the sugar futures market.

I thought they'd emerge from the ashes (literally) of these unlucky events with a renewed profitability.

But they haven't. They posted a loss of 75 cents per share in the first quarter of 2011.

Higher sugar prices are hurting this company.

If you bought this company on my advice, I'm changing my current recommendation to 'sell'.

John Septor, the company's CEO recently said, “We are anxious to continue the ramp-up in production in Port Wentworth once the silos are on line.”

He's referring to the silos that were damaged in the 2008 explosion and fire that have since been off-line. But it's tough to see how this company will be able to turn the profitability around, especially if sugar prices continue to rise.

Here's the thing: I expect sugar prices to rise, likely reaching the old 1981 highs of 40 cents per pound sometime in the next year or so.

*****Back in June, I also recommended looking into buying the sugar futures ETF, the iPath DJ-UBS Sugar Subindex fund SGG.

I said, “I'd look to pick up some units of this fund under $50…”

Hopefully you've bought a few shares of SGG, in which case you would more than offset any losses on Imperial Sugar.

SGG currently sells for over $88 a unit, handing you a nice 69% return – nearly identical to the change in the price of sugar.

So, do more of what's working.

I'd look to add to any SGG position, or to build one on dips.

Sugar prices are going higher over the coming months and years.

Kevin McElroy, Editor, Resource Prospector

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in