Good news for Blue Apron Holdings Inc APRN? Oppenheimer, one of the five firms to issue a positive rating on Blue Apron, analyst Jason Helfstein issued an Outperform rating with an $11 price target as he eyes nearly a 50 percent return.

“As the largest vertical operator in the "subscription meal kit" industry, Blue Apron will attempt to use its scale, expertise, and newfound capital depth to maintain share in a fast-growing market. Meanwhile, the company's already attractive gross margin profile should continue to improve. With shares now at 0.9x 2018E sales, we see risk/ reward weighted to the upside,” Helfstein wrote.

Blue Apron Has A Huge Market Opportunity

Helfstein believes Blue Apron’s market opportunity is about $524 billion. “This large market should buoy the growth of the meal kit industry, which should drive Blue Apron's revenue growth over time,” he said.

Differentiation Is Going To Be Key

Blue Apron has started to unveil new recipe options for both its Southern and Western markets; Helfstein sees these additions as key if Blue Apron wants to remain competitive.

“However, product differentiation remains challenging. Our experience with meal kits has led us to believe preference is subjective, not objective. Over time, Blue Apron will rely on investments in brand spending to create differentiation from other vertical players in the space,” he noted.

Blue Apron Is Trading At A Discounted Valuation

Since its IPO, shares of Blue Apron are down over 30 percent.

Relative to its peers, Blue Apron is trading significantly lower than both Shutterfly and Cimpress, yet it is growing much faster. Ultimately, overestimating the impact of Amazon stating it was entering the meal kit market, among other concerns, has led to Blue Apron becoming undervalued.

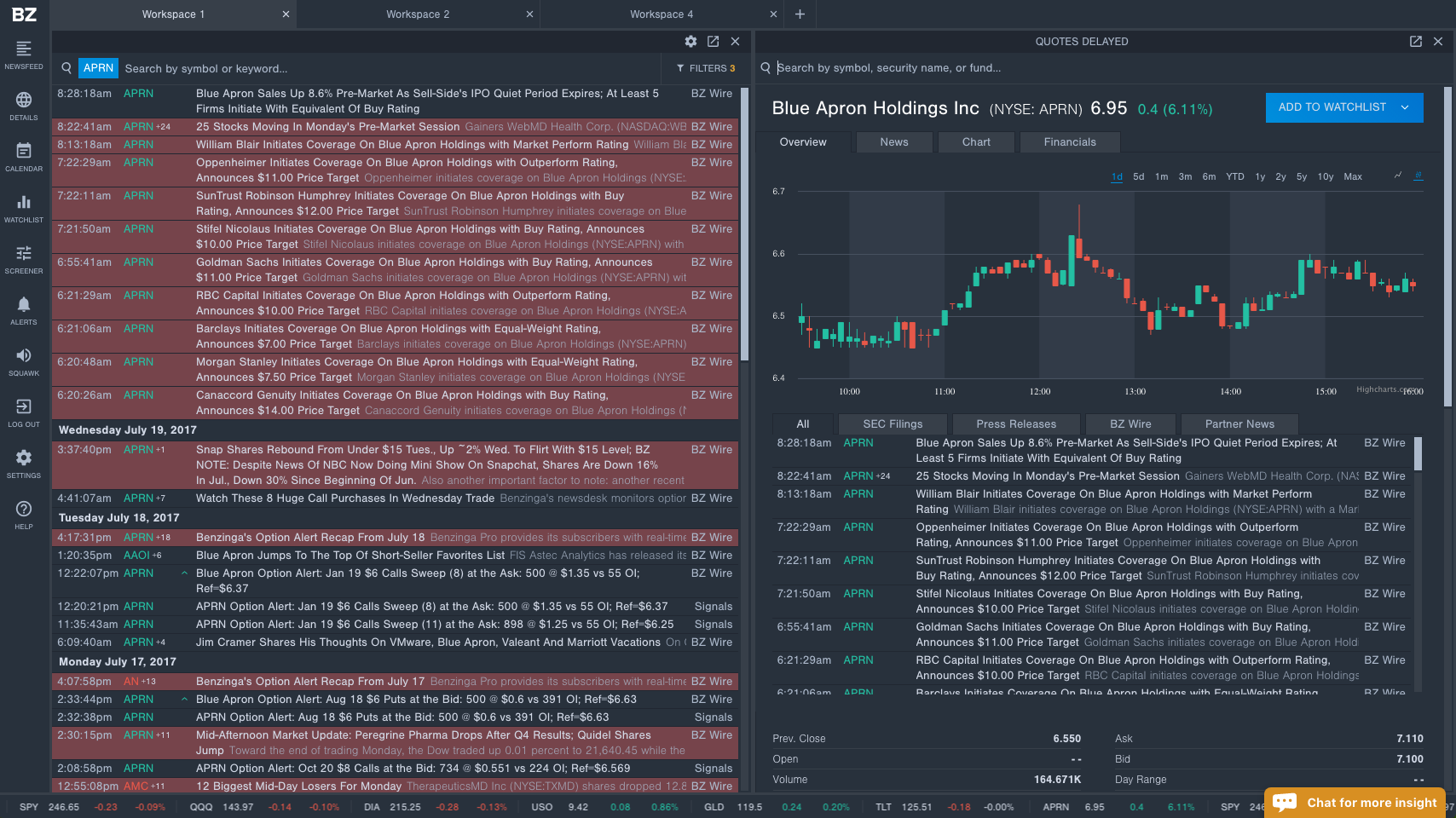

Helfstein Not The Only Positive Voice This Morning

- Stifel Nicolaus initiated coverage with A Buy rating, $10 price target.

- Goldman Sachs initiated coverage with a Buy rating, $11 price target.

- RBC Capital initiated coverage with an Outperform rating, $10 price target.

- Canaccord Genuity initiated coverage with a Buy rating, $14 price target.

- SunTrust Robinson Humphrey initiated coverage with a Buy rating, $12 price target.

Youssef Squali, SunTrust's analyst, stated in his initiation note, "There are a number of instances where the worst fears from the threat of Amazon's potential entry into a vertical have failed to materialize," as quoted by Business Insider. "As an example, Amazon's entry into photo books (through a tie-up with District Photo) last year failed to have a noticeable impact on Shutterfly, a category leader in personalized print."

Overall, analysts clearly believe it is hard to see shares of Blue Apron trading any lower, as the competition appears to be already well-priced in. This wave of good news caused Blue Apron shares to move up over 8 percent during Monday’s pre-market session.

To read the latest news financial news, check out the Benzinga Pro news wire.

_________ Image Credit: By Louise.ward (Own work) [CC BY-SA 4.0 (http://creativecommons.org/licenses/by-sa/4.0)], via Wikimedia Commons

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.