Ahead of its earnings date, investors should have high expectations for PayPal Holdings Inc PYPL as the stock is trading up nearly 50 percent over the last seven months.

“At this juncture, we believe investors in PYPL shares will be looking not only for an earnings beat and perhaps an increase in annual guidance, but also updates on its anticipated move to an asset-lite model and on its effort to monetize its fast-growing P2P app, Venmo,” BTIG analyst Mark Palmer wrote.

Palmer maintains his Buy rating and $63 price target (see his track record here).

PayPal Continues To Find New Growth Initiatives

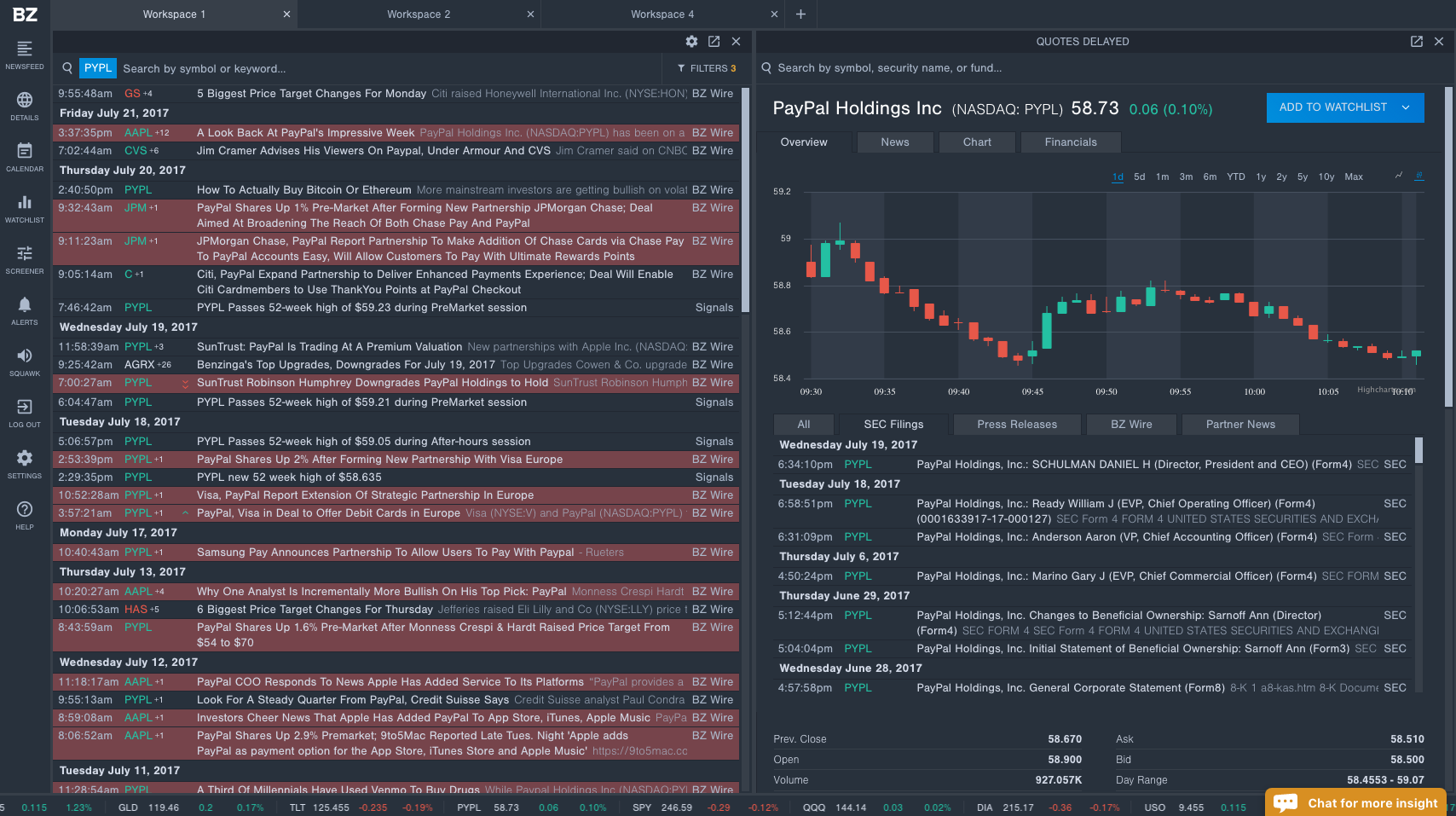

PayPal is coming off of a huge week after signing new deals with Apple Inc. AAPL, Samsung Electronic SSNLF, Visa Inc V Europe and JPMorgan Chase & Co. JPM. Palmer noted how all of these deals “has helped to underline its dominance in the payments space.”

Additionally, Palmer highlighted that several of PayPal’s growth initiatives are just starting to play out. Specifically, he highlighted OneTouch, which has already attracted 53 million users, which is only a small portion of the company’s 203 million active account users.

Venmo Still A ‘Noteworthy Untapped Source Of Positive Optionality’

Venmo processed over $6.8 billion in volume during the first quarter of 2017, and PayPal has still been elusive when it comes to monetizing the application.

However, “that may change soon as management during the company’s 1Q17 conference call announced the launch of a beta test for ‘Pay with Venmo’ in which select U.S. merchants will accept the social P2P app as a payment option,” Palmer said. “We continue to believe that Venmo will benefit from its first-mover advantage in building an expansive network and becoming a brand name synonymous with P2P such that new competitors such as Zelle may struggle to slow its rapid growth.”

Could PayPal Acquire Square?

As PayPal continues to grow through acquisitions and the company still has an ample amount of cash for acquisitions, Morgan looked into the speculation regarding whether PayPal could acquire Square Inc SQ.

“We have doubts about the efficacy of such a deal from PayPal’s standpoint and whether it would represent the best use of its cash. Square has sought to expand its focus from its original targeting of micromerchants to larger small- and middle-sized businesses, but that still somewhat narrow focus stands in contrast to PayPal ongoing quest for ubiquity. We think PYPL is likely to seek to add to its functionality on an incremental basis rather than taking on a deal with significant integration risk,” Morgan said.

Overall, PayPal should certainly be a name on investors watch list’ going forward as the company continues to make major deals and find new ways to grow. PayPal reports earnings on July 26.

To read the latest news financial news and PayPal rumors, visit the Benzinga Pro news wire.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.