The nation's largest supermarket chain, Kroger Co. KR stock has been decelerating ever since peaking at $58.34 on April 1, 2024. While the latest consumer price index (CPI) reported a 3.3% rate of inflation, consumer spending is still showing restraint even among the affluent. Consumers are trading down from brand-name products to private-label and generic offerings. Kroger is a benefactor as its private label sales continue to climb even as inflation continues to decelerate.

Kroger competes in the retail/wholesale sector with retail stores offering groceries, including Walmart Inc. WMT, Target Co. TGT and Weis Markets Inc. WMK. Kroger is still pursuing its merger with competitor Albertsons Co. ACI but faces hurdles from the Federal Trade Commission (FTC) lawsuit to block it.

Kroger’s Family of Retail Banners

Kroger owns and operates over 2,800 supermarkets, warehouse stores, marketplaces, and multi-department stores. Its standard format is a supermarket with a pharmacy that draws customers from a 2 to 2.5-mile radius. Its multi-department store Fred Meyer stores average over 165,000 square feet, and marketplace stores range from 100,000 to 130,000 square feet.

Kroger operates under many retail store banners, including its namesake Kroger, Ralphs, Dillons, Smith's, Fry's, QFC, City Market, Owen's, Jay C, Pay Less, Baker's, Gerbes, Harris Teeter, Pick 'n Save, Metro Market, Mariano's and Fred Meyer.

Kroger's Private-Label Brands and Products Continue to Expand

Private-label brands are not a new concept. Wildly successful grocery store chains like Trader Joe's and Aldi are known for selling only private-label products, which carry huge margins. Kroger has been expanding its private-label business continually.

Kroger’s private label business is comprised of the Kroger Brand, Simple Truth, Smart Way, and Private Selection. Its fresh brands include Home Chef, Murray's Cheese, Bloom Haus, Baker Fresh, and Heritage Farm. It recently launched a new brand, Field & Vine, which sells high-quality regionally grown berries. Its private-label pet brands include About, Luvsome, and Pet Pride. Its baby brand is Comforts. Its private-label home and office products include Dip, Office Works, HD Designs and Everyday Living. Kroger launched 346 new Our Brand items in Q1 2024.

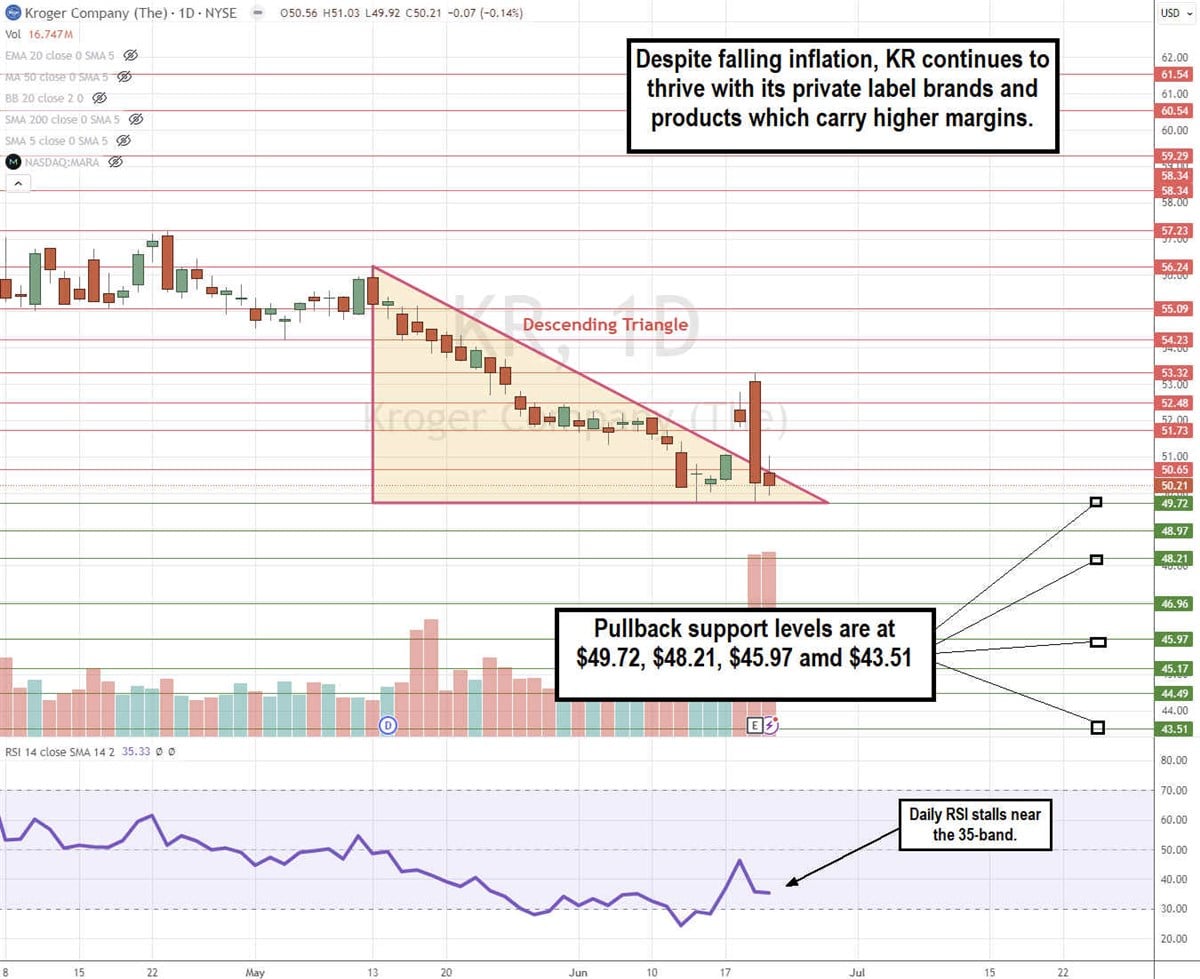

KR Stock is in a Descending Triangle Pattern

The daily candlestick chart for KR illustrates a bearish descending triangle pattern. This is comprised of a descending trendline of lower highs and a flat-bottom lower trendline. They meet at the apex. KR will break out or break down as it moves closer to the apex. KR initially appeared to be forming a breakout on its earnings release as shares gapped to $52.32 but sold off back under the $50.65 descending trendline. The daily relative strength index (RSI) fell to the 35-band. Pullback support levels are at $49.72, $48.21, $45.97, and $43.51.

Kroger Starts Strong in 2024

Kroger reported Q1 2024 EPS of $1.43, beating consensus estimates by 8 cents. Operating profit was $1.294 billion. Gross margin was 22.4% of sales, falling seven bps due to lower pharmacy margins and increased price investments offset by a favorable product mix reflecting Our Brands' margin performance. Revenues rose 0.2% YoY to $45.27, beating $44.87 billion consensus analyst estimates. The company reported that in Q1 2024, identical sales rose by 0.5%, excluding fuel.

Flower Sales, Delivery and Pickup Rates Are Thriving

Kroger achieved a new record for quarterly floral sales driven by robust Valentine's Day and Mother's Day sales. Digital sales rose 9% YoY. The company increased delivery sales by more than 17% YoY by customer fulfillment centers and increased digitally engaged households by 9% YoY. Pickup rates are high, which is a new quarterly record.

Kroger Reaffirmed Full Year 2024 Guidance

The company reaffirmed 2024 guidance with EPS of $4.30 to $4.50 versus $4.44 consensus estimates. Identical Sales without fuel are expected to grow by 0.25 to 1.75%. The company has temporarily paused its buyback program to prioritize de-leveraging following its proposed merger with Albertsons.

CEO Projects a Second-Half Recovery in Health & Wellness

Kroger CEO Rodney McMullen noted that better-than-expected performance from its grocery business helped offset softness in its fuel and health and wellness segments. The company experienced growth in households and increased customer visits. Kroger expects Health and wellness to experience softness in Q2 2024 but expects strong performance in the second half of 2024.

Mainstream and Premium Customers are Robust, While Budget Household Start Recovery

McMullen pointed out that customers continue to seek out value and are shopping differently based on their financial situation. Premium and mainstream customer spending continues to be robust. McMullen noted that mainstream households were the driver behind overall household growth as the company improved wallet share with premium customers who are spending more on its Private Selection and fresh departments. Budget-conscious households are starting to see positive momentum.

CEO McMullen summed it up, “Our ongoing work to differentiate and elevate our brands is driving higher profitability. We are identifying new supply sources using more effective promotions and improving product mix, which is contributing to further margin improvements.”

Kroger analyst ratings and price targets are at MarketBeat.

The article "Kroger Stock is Ready to be Checked Out by Value Investors " first appeared on MarketBeat.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.