Your Exclusive Benzinga Insider Report

(DO NOT FORWARD)

By analyst Gianni Di Poce

Volume 3.45

Market Overview (Member Only)

- Stocks retraced last week. The Nasdaq leading the way lower, finishing down 1.50%, while the Dow Jones Industrial Average DOW and S&P 500 Ticker: SPY) fell 0.15% and 1.37%, respectively.

- The market's internals improved dramatically, with risk-on sectors outperforming again.

- Inflation came in at estimates last week, but jobs were a big miss. The Fed is only going to cut 25 basis points this Thursday.

- The presidential election is Tuesday. I think if we know the results that night, it will be well received by markets.

Stocks I Like

TG Therapeutics TGTX – 26% Return Potential

What's Happening

- TG Therapeutics (TGTX) is a commercial stage biopharmaceutical company.

- The company made $233.66 million in revenue along with $12.67 million in earnings.

- TGTX has a fair valuation, especially for a biotech company. The P/E is at 35.81, its Price-to-Sales is at 10.59, while the EV to EBITDA is at 33.76.

- From a technical standpoint, TGTX is starting to break above resistance of a saucer formation that could lead to another leg higher in prices.

Why It's Happening

- G Therapeutics recently received FDA approval for its BRIUMVI drug for the treatment of relapsing forms of multiple sclerosis (RMS). This approval marks a significant milestone for the company, as it enters the lucrative multiple sclerosis market. With an estimated 1 million people in the U.S. living with MS, BRIUMVI has the potential to capture a substantial market share and drive significant revenue growth for TG Therapeutics in the coming years.

- The company’s management team has expressed confidence in BRIUMVI’s potential, citing positive feedback from healthcare providers and patients. CEO Michael S. Weiss stated that the drug’s efficacy, safety profile, and convenient dosing schedule position it as a competitive option in the MS market. This optimism from leadership suggests strong growth prospects for the company.

- The company’s focus on developing innovative therapies for B-cell diseases positions it well in a growing market. With BRIUMVI’s success in MS, TG Therapeutics has demonstrated its ability to bring novel treatments to market, potentially paving the way for future pipeline developments and additional revenue streams.

- The global multiple sclerosis therapeutics market is projected to reach $33 billion by 2029, growing at a CAGR of 3.5%. As a new entrant with a differentiated product, TG Therapeutics is well-positioned to capture a meaningful share of this expanding market, potentially driving substantial revenue growth and stock appreciation.

- The company reported strong Q2 2023 financial results, with total revenue of $17.5 million, a substantial increase from $0.6 million in the same period last year.

- TGTX has a short interest of around 23%, which makes it a solid candidate for a short squeeze.

Analyst Ratings:

- TD Cowen: Buy

- HC Wainwright: Buy

- B. Riley Securities: Buy

My Action Plan (26% Return Potential)

- I am bullish on TGTX above $21.00-$22.00. My upside target is $34.00-$35.00.

Coinbase COIN – 100% Return Potential

What's Happening

- Coinbase (COIN) is a cryptocurrency brokerage company.

- The company made $2.93 billion in revenue in 2023, along with $94.87 million in earnings.

- COIN has an elevated valuation with its P/E at 38.45, its Price-to-Sales at 12.53, and its EV to EBITDA at 26.12.

- From a technical perspective, COIN is trying to break out from a saucer pattern. The result may be another acceleration to the upside.

Why It's Happening

- Coinbase’s recent partnership with BlackRock has opened up new avenues for institutional crypto adoption. This collaboration allows BlackRock’s Aladdin clients to access crypto trading and custody services through Coinbase Prime, potentially bringing a significant influx of institutional capital to the platform and boosting transaction volumes.

- The company’s diversification efforts are paying off, with subscription and services revenue growing 34% year-over-year in Q2 2023. This shift towards more stable revenue streams reduces Coinbase’s reliance on volatile trading fees and provides a more predictable income base, which investors typically value highly.

- Coinbase’s strong regulatory compliance and proactive engagement with authorities position it favorably in the evolving crypto regulatory landscape. As one of the few publicly traded crypto exchanges, Coinbase stands to benefit from increased regulatory clarity, potentially capturing market share from less compliant competitors.

- Coinbase’s commitment to innovation is evident in its continuous product launches, such as its new Ethereum layer-2 network and enhanced staking offerings. These initiatives not only diversify revenue streams but also strengthen Coinbase’s competitive position in the rapidly evolving crypto market.

- The potential for a crypto market recovery, possibly driven by the upcoming Bitcoin halving in 2024, could significantly boost Coinbase’s trading volumes and revenue. As one of the largest and most trusted crypto exchanges, Coinbase is well-positioned to capture a substantial portion of any renewed market enthusiasm.

- COIN has a free quarterly cash flow of $484.19 million.

Analyst Ratings:

- Monness, Crespi, Hardt: Buy

- B. Riley Securities: Neutral

- JMP Securities: Market Outperform

My Action Plan (100% Return Potential)

- I am bullish on COINabove $180.00-$185.00. My upside target is $370.00-$375.00.

Nu Holdings NU – 60% Return Potential

What's Happening

- Nu Holdings (NU) is a digital banking platform in various countries around the world.

- The company generated $3.71 billion in revenue in 2023, as well as $1.03 billion in earnings.

- NU has a high valuation with its P/E at 49.32, its Price-to-Sales at 10.42, and its Book Value at 1.45.

- From a charting perspective, NU is trying to break out from a broadening wedge pattern. These typically lead to an acceleration in upside price momentum.

Why It's Happening

- The recent launch of checking accounts in Mexico and Colombia has already attracted deposits of $3.3 billion and $220 million, respectively. This successful expansion into new markets opens up additional growth avenues for Nu, potentially driving future stock gains.

- The company’s unique ability to consistently expand its active customer base while accelerating revenue growth and profitability sets it apart from competitors. This combination of growth and profitability makes Nu an attractive investment opportunity in the fintech sector, with the potential for significant stock price upside.

- The company’s activity rate increased to a record high of 83%, marking the eleventh consecutive increase in this metric. This growing engagement demonstrates Nu’s ability to retain and monetize its user base, a crucial factor for sustained growth and potential stock price appreciation.

- Nu’s monthly average revenue per active customer (ARPAC) reached $11.2 in Q2 2024, with more mature cohorts achieving $25. This trend indicates Nu’s success in cross-selling and upselling services, which should drive future revenue growth and stock performance.

- Net income more than doubled year-over-year, reaching $487 million in Q2 2024.

- Gross profit surged 88% year-over-year to $1.4 billion, with gross profit margin improving from 42% to 48%.

Analyst Ratings:

- JP Morgan: Underweight

- HC Wainwright: Buy

My Action Plan (60% Return Potential)

- I am bullish on NUabove $13.50-$14.00. My upside target is $23.00-$24.00.

Market-Moving Catalysts for the Week Ahead

I'm Bullish Regardless of the Election Outcome

Well, the time has finally arrived. It's election time and I think markets would appreciate having the results on Tuesday night. It's a good time to remember that politics has no place in your portfolio, so I'm going to list a few reasons why the markets could be bullish regardless of the election outcome.

If Trump wins, we could see tax cuts and deregulations, which will easily pad corporate profits. This will translate into higher earnings, and ultimately help bring down P/E levels for those that are concerned about market valuations.

If Harris wins, we could see a surge of infrastructure spending, and I would expect the tech sector's outperformance to accelerate. Automation and fintech will probably do well, but taxes could rise. As the saying goes, "Necessity is the mother of invention." Innovation is good for markets.

Don't Forget About the Fed

The election is capturing the headlines right now, but don't ignore the fact that another rate cut is coming next week. Right now, the market's expectation is for a 25-basis point rate cut, and then once more by the end of the year.

The Fed is probably patting themselves on the back right now for a job that was seemingly well done. Many said that a soft landing was impossible, but we're actually starting to see GDP accelerate a bit.

This isn't that surprising if you consider that we had a recession in 2022, which is something I've been adamant about. This means that we should continue to see the economy expand into next year, but I remain concerned about it overheating.

Assessing Inflation and Labor

Last week's inflation and employment reports confirmed that the economy is chugging along, but the Fed's attention may shift more towards the labor market. Although inflation remains a concern, consumer prices are not accelerating to the upside like they were before.

The bigger concern was the huge jobs miss. The economy created just 12,000 jobs in the month of October. Policymakers blamed the Boeing strike and the recent hurricanes in the southeast as the main cause. Even so, the unemployment rate stayed the same at 4.1%.

Wage growth is occurring, but only nominally. It has not kept pace with inflation, and at the end of the day, purchasing power is all that matters. Fed easing might help boost corporate profits, but unless that translates to wage growth, it will continue to leave the majority behind.

The U.S. Is Still the Best House

Despite all its problems, it's important to stay respectful of the secular market trends. For almost two decades now, U.S. stocks have outperformed their foreign counterparts by a wide margin. Some may attribute this to monetary factors, but there's also the innovative factor too.

Put simply, U.S. firms innovate at a much greater pace than the rest of the world. The artificial intelligence boom's center is undoubtedly in the U.S., and the federal government is starting to make policy moves to ensure that stays the case.

I think money will continue to flow into the U.S. next year with lower rates. Global capital is going to gobble up these temporarily higher rates while they can. Think about this… buying the one-year Treasury right now is basically a layup trade for bond traders around the world. Why own any other global bond?

Sector & Industry Strength (Member Only)

The sector performance rankings continue to tell a profound story when it comes to this market. The strongest sector year-to-date is still communications XLC, and its lead is comfortable over utilities XLU and financials XLF.

We saw technology XLK slip a bit last week, which is a concern. But now that we're through the biggest of tech earnings, we could see a bit more stability in that sector. I still like how consumer discretionary XLY is outperforming consumer staples XLP.

After last week's inflation report, we had further confirmation that inflationary pressures are contained. As long as energy XLE continues to be the worst performing sector in the market, I expect this to continue.

| 1 week | 3 Weeks | 13 Weeks | 26 Weeks |

| Communications | Communications | Consumer Discretionary | Real Estate |

Editor's Note: Communications leading across 1-week and 3-week intervals is a risk-on sign. So is consumer discretionary leading at the 13-week interval.

The Crypto Conundrum (Sector ETF: ETH/BTC)

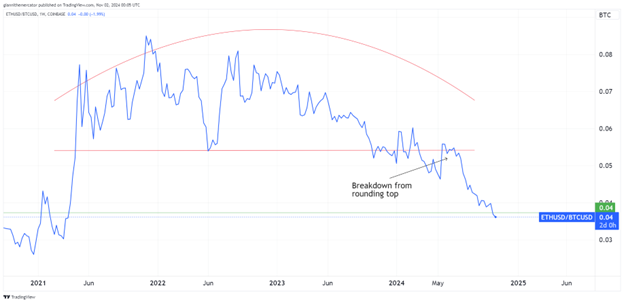

With Bitcoin flirting with all-time highs, it may be a good time to check in on how its performing relative to its decentralized counterpart, Ethereum. This chart looks at the ratio between Ethereum ETH and Bitcoin BTC.

Since November 2021, Bitcoin has outperformed Ethereum by a wide margin. This ratio is in a clear-cut downtrend, as seen by the series of lower-lows and lower-highs. As long as this is the case, don't expect big things from Ethereum.

The ratio even broke down from a rounding top pattern at the beginning of the year. Right now, sentiment in Ethereum is bleak, which is interesting given that it's sitting on an important support zone. Perhaps Ethereum bulls have an opportunity to make something happen in the coming weeks here.

Seeking Alpha in Metal Miners (Sector ETF: SIL/GDX)

Here in Benzinga's Insider Report, we were big precious metals bulls coming into 2024. Now that gold is hitting new all-time highs every other day, and silver is surging to levels not seen in over twelve years, the public is finally paying attention.

But when precious metals are in legit bull runs, like we are now, it's imperative to see precious metal mining stocks outperform the spot price of metals. This is a hush-hush secret the gold bugs don't want you to know: You can make more money owning shares of mining stock than physical metals.

Just like how I need to see silver outperform gold, I like to see silver miners SIL outperform gold miners GDX. We may be on the precipice of such a moment, especially if the following ratio breaks out from the broadening wedge formation.

Will Another Rate Hike Juice Credit Spreads? (Sector ETF: LQD/IEI)

Even though next week's presidential election is captivating the market's headlines, let's not forget that we have a very important monetary policy update too, as the Federal Reserve is expected to cut interest rates another 25 basis points.

This makes it an excellent time to revisit credit spreads. I like to use the ratio between investment grade corporate debt LQD and 3-7 Year Treasuries IEI. Remember that when LQD outperforms IEI, it's a good sign for liquidity, but when IEI outperforms LQD, it's bad for liquidity.

I'm keeping a close watch on the rounding bottom formation in this ratio. If it breaks out above resistance, it will confirm that liquidity conditions are improving. I think with more rate cuts coming, the probability of this is very high.

Editor's Take:

The tension in the market is elevated, between earnings season as the presidential election. I think the Fed is keen on keeping things as stable as possible in this environment, at least until things settle down a bit.

With the latest inflation report coming in at estimates, I think the Fed will be emboldened to lower rates and boost the market's liquidity. There are some problems on the longer end of the curve right now, which are worth monitoring.

I still think long-term rates can come down into next year, but that the Fed is playing with an inflationary fire. At some point, inflation will rear its ugly head again, and policymakers will have quite the mess to clean up.

Cryptocurrency

Back to looking at Solana this week, and the technical setup here is looking increasingly compelling. The price action has formed a textbook ascending support trendline since September, with each consecutive higher low reinforcing the bullish momentum.

SOL is also pressing against the major resistance zone around $180-$190, which makes up part of a saucer formation. This has acted as a significant barrier since March. With rising momentum, this resistance could finally break the trendline after multiple attempts already.

If prices can close above the $190 resistance zone, we could see an explosive rally targeting the previous swing highs around $220, and then, prices could even rally as high as $275-$280. The risk-reward in Solana continues to favor bulls and its notable strength is very noticeable.

Legal Disclosures:

This communication is provided for information purposes only.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but Benzinga does not warrant its completeness or accuracy except with respect to any disclosures relative to Benzinga and/or its affiliates and an analyst’s involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Benzinga does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, Benzinga may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a Benzinga subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of Benzinga. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of Benzinga. Copyright 2022 Benzinga. All rights reserved.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.