Strategy Shares Gold ETF (Ticker GOLY)

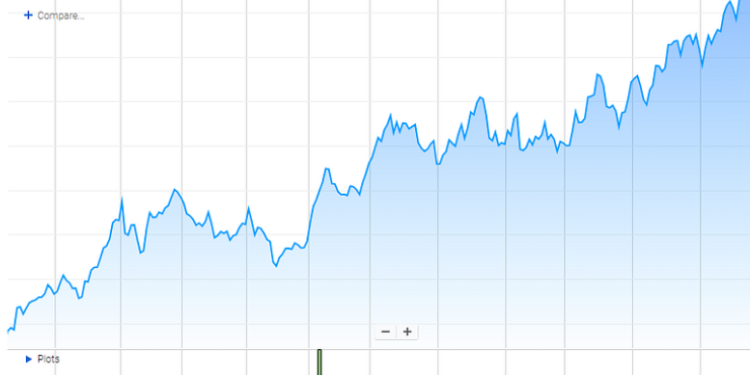

The Strategy Shares Gold ETF (Ticker GOLY) has been surfing record highs, with Monday's gold futures price hitting $2,676.3 per ounce, sending the value of a 400 troy ounce solid gold bar to $1,070,050. The GOLY ETF is up 50.87% over the last 12 months as of Oct 1, 2024 outpacing the price of Gold which has generated a 43.25% return over the same window. This ETF has outperformed gold bullion and other gold ETFs like GLD by stacking a yield from investment grade corporate bonds on top of the returns of gold.

The yellow metal has forged meteoric gains over the past twelve months, emerging as the world's second-best-performing asset next to crypto. Its 28.48% year-to-date gain edges out the megacap-loaded Nasdaq Composite (^IXIC) — itself up a healthy 18%. (A proxy for the crypto market writ large, the Bitwise 10 Crypto Index Fund (BITW), is up 28.9% this year.)

According to BofA Global Research, gold funds just absorbed the largest inflows in four weeks, attracting $1.1 billion. Yet, the broader trend has actually seen $2.5 billion in outflows year to date, suggesting that underlying strength is coming from outside traditional fund flows.

Why the Surge in Gold Prices is Likely to Continue

Central banks — especially those of developing countries — have been buying the barbarous relic at a record clip. According to the World Gold Council, central banks have purchased 290 tonnes in the first quarter alone, beating out the prior Q1 record from 2023 and setting CBs on a path to record gold purchases in 2024 that are estimated to easily eclipse 1,000 tonnes.

"Not only is the long-standing trend in central bank gold buying firmly intact, it also continues to be dominated by banks from emerging markets," wrote the Gold Council.

In that regard, Turkey tops the buy list this year with 30 tonnes purchased in the first quarter — lifting its gold reserves to 570 tonnes. China bought 27 tonnes in Q1, making it the 17th consecutive quarter of purchases and also bringing its holdings to 2,262 tonnes. Other notable purchasers include India, Kazakhstan, the Czech Republic, Oman, and Singapore.

The central bank buying spree has solidified gold's status as a reserve asset. According to BofA, gold has now surpassed the euro to become the world's largest reserve asset second only to the US dollar, representing 16% of the reserve pool.

The precious metal's performance can be attributed to its unique position as a real asset with one of the lowest correlations to stocks across asset classes, making it a safe haven from market swings and inflation.

According to Tom Bruni, head of market research at StockTwits, in a recent episode of Stocks in Translation, "We're seeing gold being used as an uncertainty hedge."

Bruni also emphasized gold's appeal to traders due to its price action. "With gold breaking out above its 2011 highs, it's drawing significant attention from trend followers and technical analysts alike."

Investors looking for deep, liquid gold markets have a robust choice of futures markets, ETFs, and gold miner stocks and ETFs, which tend to be even more volatile than the underlying metal.

"The volatility in gold prices has made it a prime trading vehicle, whether through gold ETFs or mining stocks," said Bruni.

BofA separately highlighted how this latest gold rally isn't like the other advances this century, offering a tantalizing glimpse of future bullish potential.

The bank noted this is the third major gold advance in two decades, yet "households have missed this rally." The first two rallies — from 2004 to 2011, and from 2015 to 2020 — attracted big fund flows into gold ETFs. But over the last year, gold bullion and gold miner ETFs have shed $6.4 billion in assets, according to Bloomberg data and Yahoo Finance calculations.

But if last week's large gold inflows were to gain momentum, that trend could signal a perfect storm of retail, institutional, and central bank gold buying is brewing.

The GOLY ETF is a unique way to capitalize on central banks buying gold that not only tracks the price of gold but also pays a 3.5% annualized distribution that other Gold ETFs lack.

The post Why this Gold ETF is Outperforming Nearly Everything So Far This Year appeared first on New York Tech Media.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.