On March 23rd, 2020, the pandemic caused the S&P 500 to tumble 34% in just a single month. And after one month, the market shot up to a record high, with the S&P closing above 4,700 for the first time ever. And if you had the foresight to catch the previous dip, then it could’ve been an opportunity to buy low and sell high.

Now, the new Omicron fear could potentially be a similar big investment opportunity, but with a catch...

Unlike familiar strains like the Delta variant, the Omicron strain is still relatively unknown. Yet, it has already been detected growing at a faster rate than other strains. In fact, The World Health Organization says it poses a “very high” global risk due to its possible immune escape potential and transmissibility advantages.

That means this new strain could potentially create an even bigger dip than the one in 2020. Just recently on November 26th, the Dow tumbled 900 points due to the new fear (the worst day of the year so far for the Dow). So if the market crashes again, there could be an even greater opportunity to buy at the new market bottom and cash in on the recovery.

This is important because during the last pandemic, the BBC reported: “more than 5 million people became millionaires across the world in 2020.”

While many benefited from the economic recovery thanks to the low-interest rates, the unbelievable relief bills passed by Congress, and the huge housing market, the biggest gains were made in the market by simply buying low and selling at the high.

Is The Market About To Dip Again?

With the market at an all-time high, many people are worried the bull isn’t going to run forever. And with inflation at a record high (more than double the rate of every single year in the past decade), “The Great Resignation”, and now the new Omicron strain, people are bracing for what could be a huge historical, once-in-a-lifetime crash.

One expert, 48-year market veteran David Hunter, warns that the stock market could crash by more than 80%, due to soaring inflation and the Fed’s new control policies. All to say, the potential new market dip could offer a unique opportunity for savvy investors to buy low.

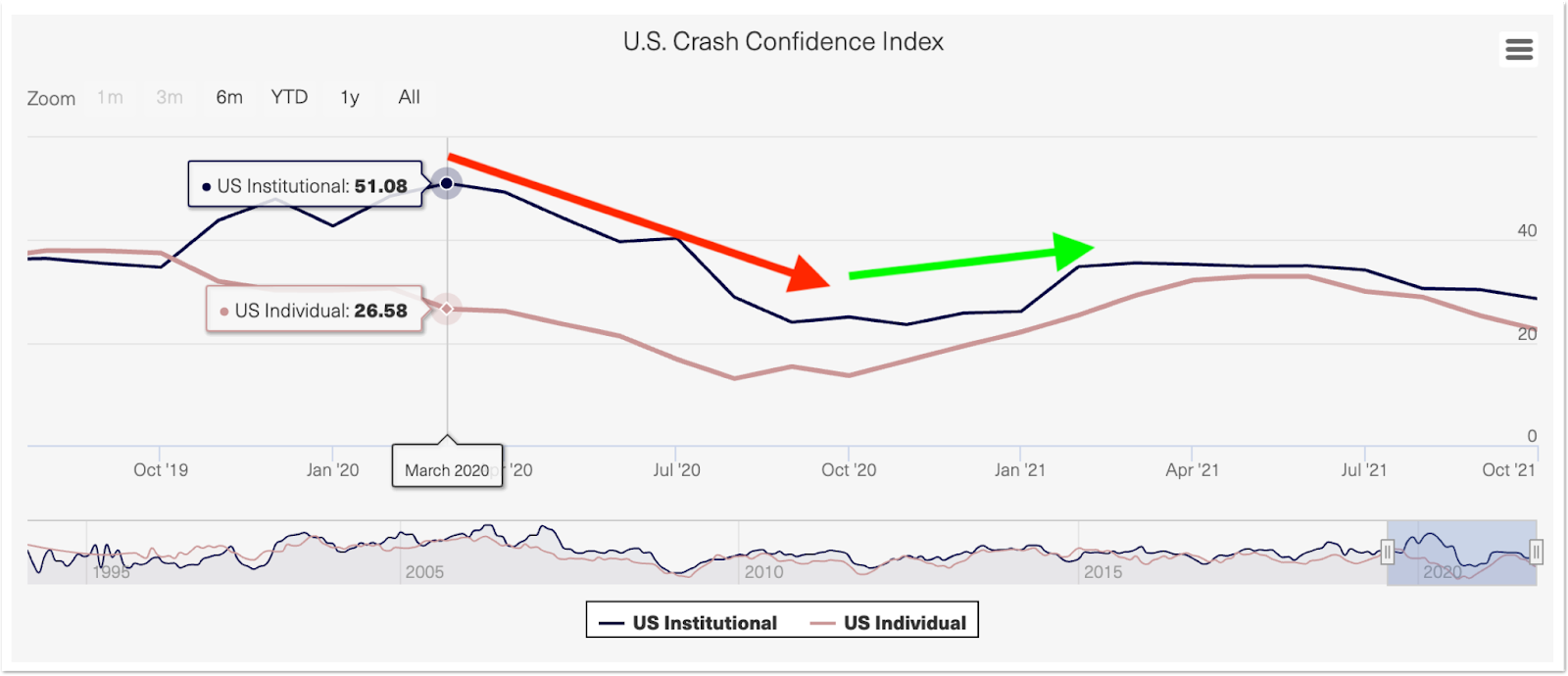

Source: U.S. Crash Confidence Index by Robert Shiller (Yale economist).

Take a look at the stock market confidence indices, developed by famous Yale economic professor Robert Shiller. You can see how people’s confidence in the market hit an all-time low in August of 2020. And while there is a recovery, this new strain could cause this dip in market confidence again. This time, it could be a lot worse due to the potentially more deadly and uncertain transmittable effects of this new strain.

Keep in mind, this index is just one way of many to tell that an opportunity for a dip could be coming soon. And remember this: when people are fearful, they tend to sell their investments, causing a dip in the market. And when the market dips, it has historically always rebounded.

An Alternative Investment?

The problem is that if the economy does falter, we have no idea when the market will recover. We can’t read the future after all. And we certainly don’t know if the market will recover as fast as the last time (which took just a month.)

That means investing in the stock market could be very risky right now, especially with how uncertain the effects the new strain could bear on the market.

Here’s some unconventional investment advice:

If you want to invest in alternative assets, then consider this “unpopular” asset: fine art.

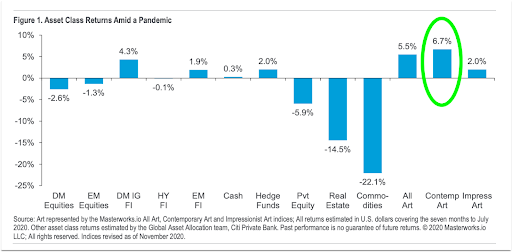

Source: Asset class returns amid a pandemic (Citi).

According to Citi Private Bank, in the first seven months of 2020, the art market outperformed ten major asset classes with Contemporary art achieving the strongest gains.

What’s more, Art Basel and UBS. reported that the art market has a total estimated global value of $1.7 trillion, roughly equal to the entire capitalization of every cryptocurrency combined.

And with artworks selling for 15-times their asking price, The Wall Street Journal recently declared “art is among the hottest markets on Earth.”

Some of the wealthy have invested in art. And while the art market used to be reserved for the super-rich who could afford a Banksy, Picasso or Andy Warhol painting, that’s changed.

Because with this new investing platform, you can invest in high-priced artworks too, but without needing to have millions of dollars in net worth. Bill Gates and Warren Buffett invest in art, now you can too.

Photo by Nicholas Cappello on Unsplash

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.