The Federal Reserve’s July FOMC meeting potentially tilted the market’s focus from interest rate sensitivity to economic growth sensitivity. Therefore, the prospect of slower interest rate rises has significant implications for market positioning. We maintain our view that inflation protection should be balanced with quality and defensive equity positioning, although the balance between cyclical value exposures and growth areas is starting to shift. Defensive growth-focused areas could hold up better as the market looks for companies and segments that can grow despite economic weakness.

Positioning Overview

While navigating these transitions, we believe it is helpful to understand the historical relationship between sectors and economic factors including yields, the dollar, and crude oil prices. The tables below provide a broad template of portfolio positioning for an environment with rising economic risks and falling interest rate risks.

The analysis we conducted can be separated into two key areas: growth sensitivity and defensive positioning. The next two sections will provide more detail into these key areas followed by a section that combines these two ideas.

Sector Economic Growth Sensitivity

Economic growth sensitivity is likely to become increasingly important as recession risks rise. For instance, U.S. GDP contracted for a second-straight quarter this year, which meets the unofficial definition of a recession.

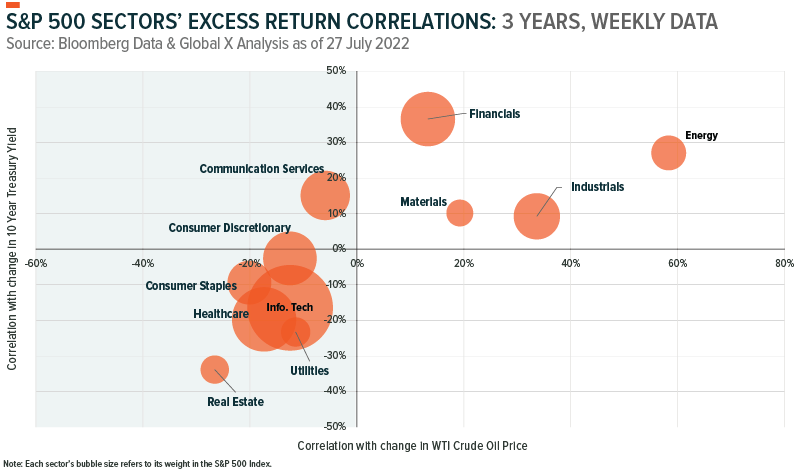

In our analysis, we examined the correlation between excess returns across sectors relative to changes in the WTI crude oil price to determine how sectors respond to shifting economic growth expectations. Crude and other growth sensitive commodities are typically highly sensitive to economic growth expectations. Additionally, the shape of the yield curve also reflects economic growth expectations. The yield curve is currently inverted, with the 2-year Treasury yield more than 20 basis points (bps) above the 10-year Treasury yield.1

Financials, Materials, Industrials and Energy are the key cyclical value sectors that are positively correlated with crude prices and the 10-year Treasury yield. Here are some additional relationships to consider.

- The shape of the yield curve has a direct impact on bank net interest margins. A weaker economy could weigh on loan growth and credit quality, which are headwinds for Financials.

- The Energy sector is highly sensitive to both crude prices and the 10-year Treasury yield.

- Slowing economic growth expectations weigh on Materials and Industrials. For example, over the past month, several regional manufacturing indices have plummeted, which points to a contraction in overall business activity.

- Real Estate has a negative correlation with Treasury yields, although, like Financials, economic growth is an important driver of the sector’s excess return. Periods of sustained growth are typically conducive to higher property values and rental income if interest rates remain low. When yields rise, Real Estate companies are at risk of declining property values and higher borrowing costs.2 That could make the relatively higher dividend yields generated by real estate investment trusts (REITs) less attractive compared with Treasury bonds.

Defensive Positioning

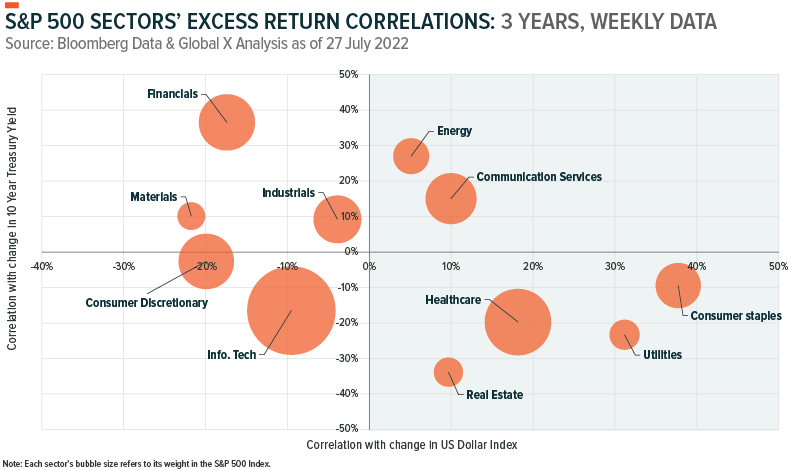

Monetary policy divergence combined with economic growth concerns have strengthened the U.S. dollar relative to a basket of currencies. A flight to safety over the past few months favored defensive positioning.

- Consumer Staples, Utilities and Health Care have the highest correlation with the dollar. These defensive sectors provide exposure to segments of the economy where consumers have less ability to scale back as real disposable income declines.

- Consumer Discretionary and Materials have the lowest correlation with the dollar. These cyclical sectors benefit from greater spending among businesses and consumers, which occurs during the economic recovery and expansion phases.

Combining Growth Sensitivity and Defensive Exposure

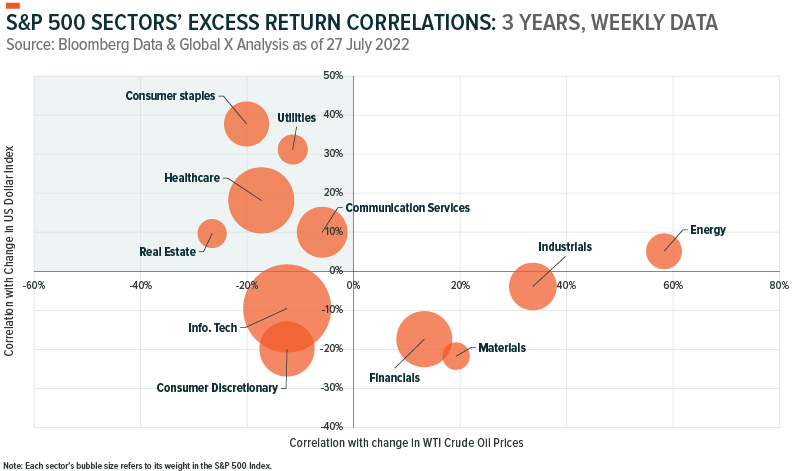

Removing the interest rate environment from consideration focuses attention on a single quadrant. While defensive sectors take the lead, growthier sections such as Communication Services and, to a lesser extent, Information Technology are just behind. Conversely, cyclical value sectors such as Financials and Materials stand out, challenged by a defensive environment with greater economic risks.

The Energy sector has been positively impacted by exogenous factors that remain in play. Typically, we would expect a negative relationship between Energy and the U.S. Dollar as a stronger dollar typically weighs on commodity pricing.

However, regime shifts from expansion to contraction can be volatile, which means deviating away from economically sensitive factors could help mitigate downside risk in equity portfolios. On the other hand, when the rise in yields and inflation slows, growth sectors such as Technology could be more receptive to a market rebound.

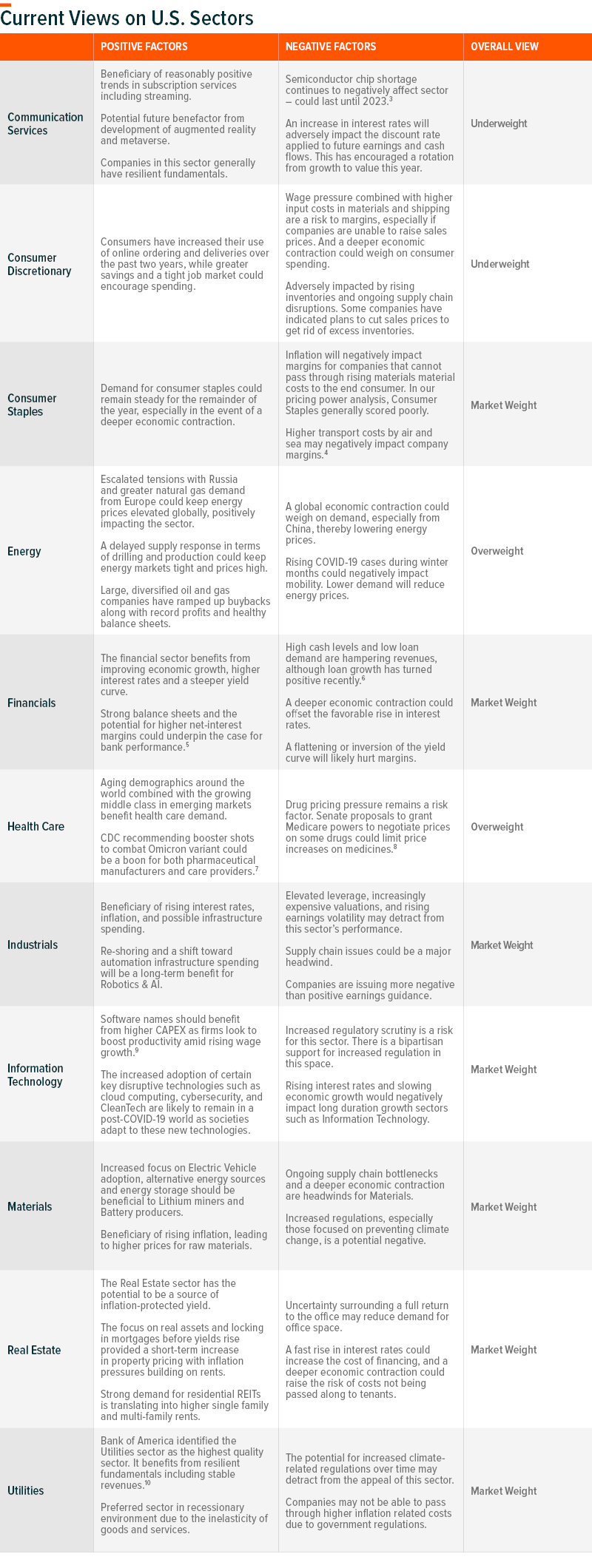

Our sector views table provides more detail on sector positioning and the current tailwinds and headwinds for each sector.

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.