Stocks pulled back last week with the S&P 500 shedding 1.3% to close at 4,457.49. The index is now up 16.1% year to date, up 24.6% from its October 12 closing low of 3,577.03, and down 7.1% from its January 3, 2022 record closing high of 4,796.56.

Recent market gains can be attributed to the outlook for earnings growth. And some of that expected earnings growth can be attributed to what’s arguably the most unexpected development in the corporate world over the past two years: The resilience of profit margins.

As inflation rates surged in 2021, analysts were convinced rising costs would crush profit margins.

But the opposite happened as profit margins actually rose to record levels. During this period, many companies were able to pass higher costs to their customers through higher prices. Combined with improved operating efficiencies, this dynamic led to record profits. It was a reminder that it’s “dangerous to underestimate Corporate America.”

Upgrade to paid

Surprising to some, high profit margins persisted. And after a modest dip in recent quarters, profit margin expansion resumed in Q2.

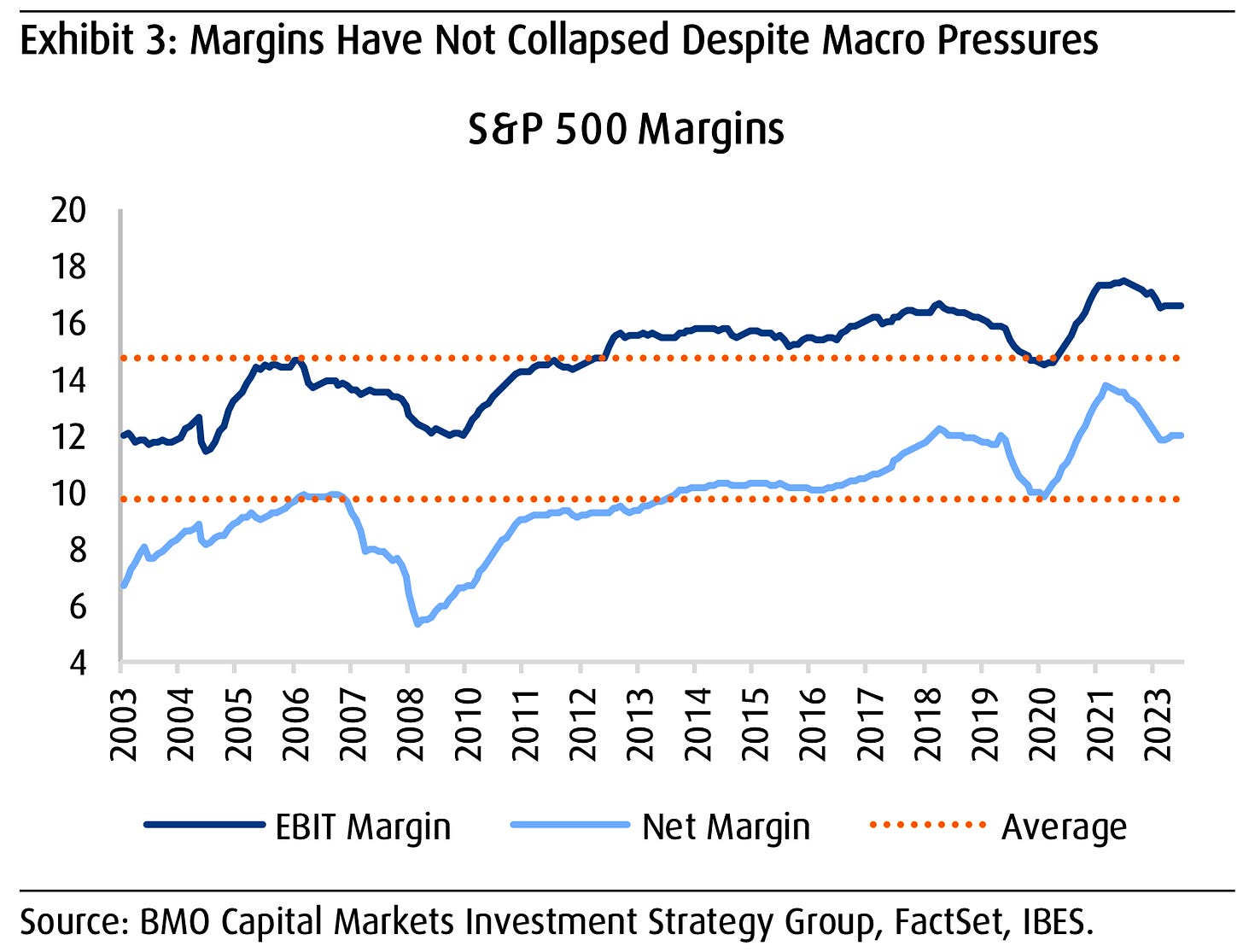

“For much of the year, many believed that the combination of high inflation and rising interest rates would lead to a significant deterioration of earnings growth due to the pressure that both were perceived to have on profit margins,“ BMO Capital’s Brian Belski wrote on Tuesday. “[W]hile EBIT and net margins are certainly lower, they remain well above-average.“

Profit margins continue to trend near record high levels. BMO

In addition to benefiting from strong pricing, corporations haven’t seen interest costs spike despite higher interest rates. This is because many companies refinanced their debt in recent years, locking in low interest rates for years to come.

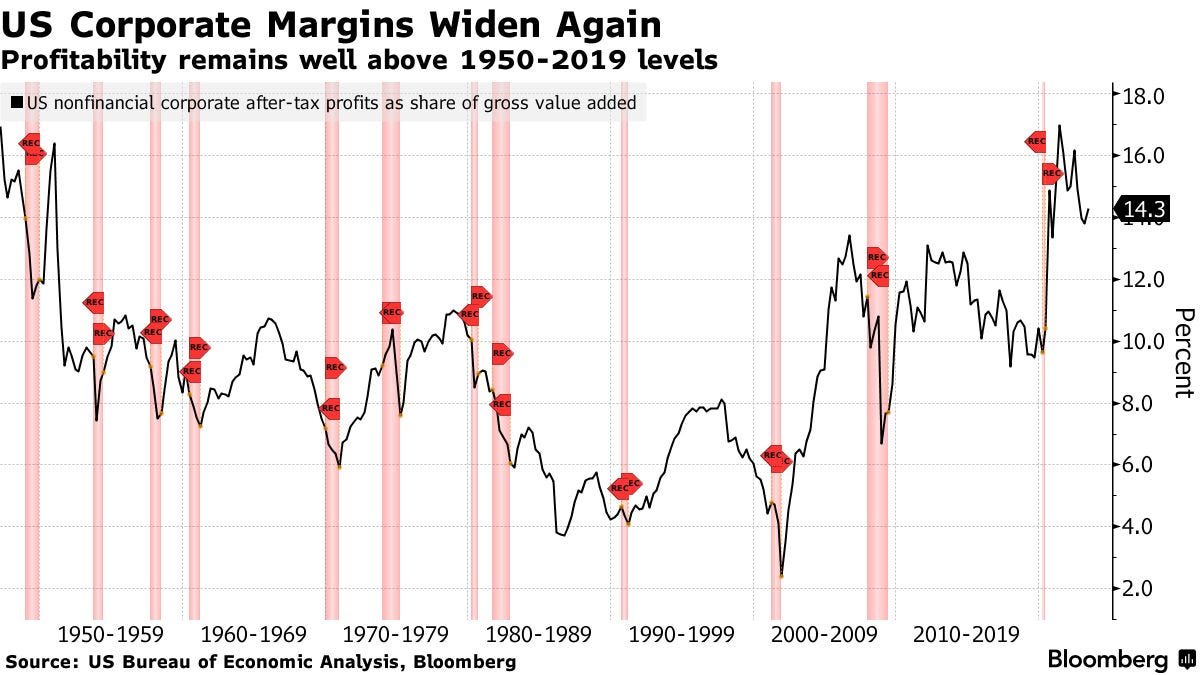

By the way, this isn’t just an S&P 500 phenomenon. As Bloomberg’s Matthew Boesler recently reported: “After-tax profits for nonfinancial firms rose 4.5% in the second quarter, a Bureau of Economic Analysis report on gross domestic product showed. Measured as a share of gross value added — a proxy for aggregate profit margins — they rose to 14.3% from 13.8%.“

Aggregate profit margins across the economy are elevated. (Source: Bloomberg)

So, what’s next for margins?

As is often the case, there isn’t a clear consensus on the outlook for margins.

“Margins have proved surprisingly resilient this year, benefiting from the decision by many corporates to prioritize price increases over volume growth,” BNP’s Viktor Hjort wrote in a note circulated on Thursday. “This ability can be frustrated as inflation begins to trend lower, unless it can be compensated for by faster real growth.“

This prioritization of “price increases over volume growth” has become a key controversial issue in the inflation discourse as it implies consumers could be getting their goods and services for cheaper. In some cases, analysts have used terms like “excuseflation” and “greedflation” to characterize how corporations maintained high pricing for the sake of keeping margins high.

As such, there’s a thinking out there that if high inflation helped expand profit margins, then low inflation should eventually lead to contracting margins.

Upgrade to paid

But not everyone is convinced margins are sure to contract — even with inflation cooling. In fact, the Wall Street consensus is for margins to continue to expand in the coming quarters.

Among other things, analysts expect companies to benefit from productivity gains yielded from operational changes made in recent years.

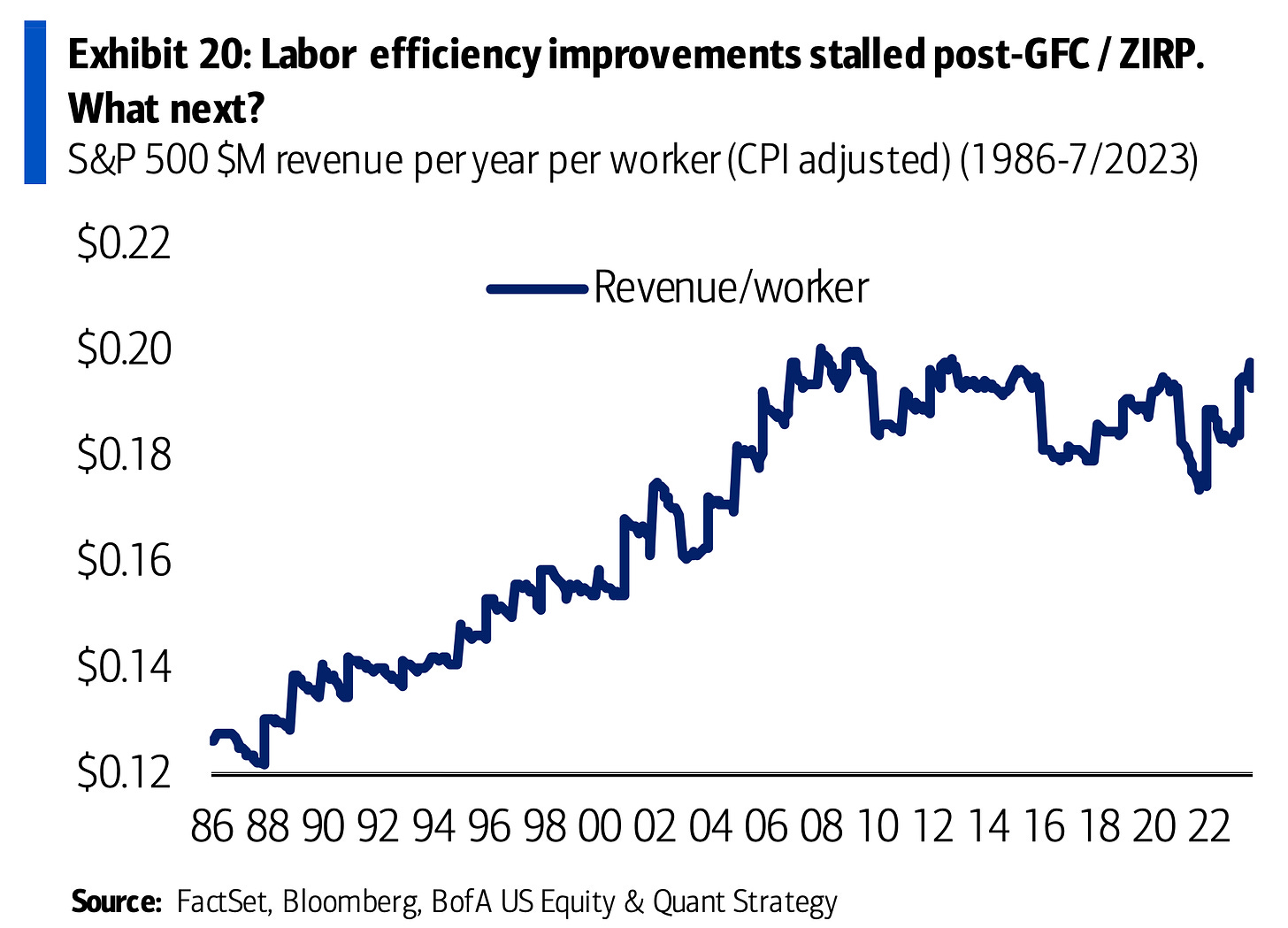

“From here, efficiency gains — which have been non-existent for the last 10 years — via new tools like AI and robotics could create an even more labor light benchmark, a key positive for S&P 500 margins,“ BofA’s Savita Subramanian argued on Thursday.

She shared this eye-catching showing how revenue per worker has been improving.

Companies have become increasingly labor light. (Source: BofA)

To be clear, it’ll be some time before we can clearly confirm any tangible benefits from the deployment of AI. For now, we can at least say companies are acting aggressively to integrate AI technology as reflected by the booming businesses of AI providers like Nvidia.

We’ll have to wait to see whether or not corporations are able to maintain or improve their already high margins.

That said, it’s hard to rule out the possibility that businesses will succeed on this front, especially considering the degree to which they’ve surprised to the upside in recent years.

A version of this post was originally published on Tker.co

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.