Goldman Sachs’ prediction that the S&P 500 will deliver 3% annualized nominal total returns over the next 10 years has gotten a lot of attention. (Read TKer’s view here and here.)

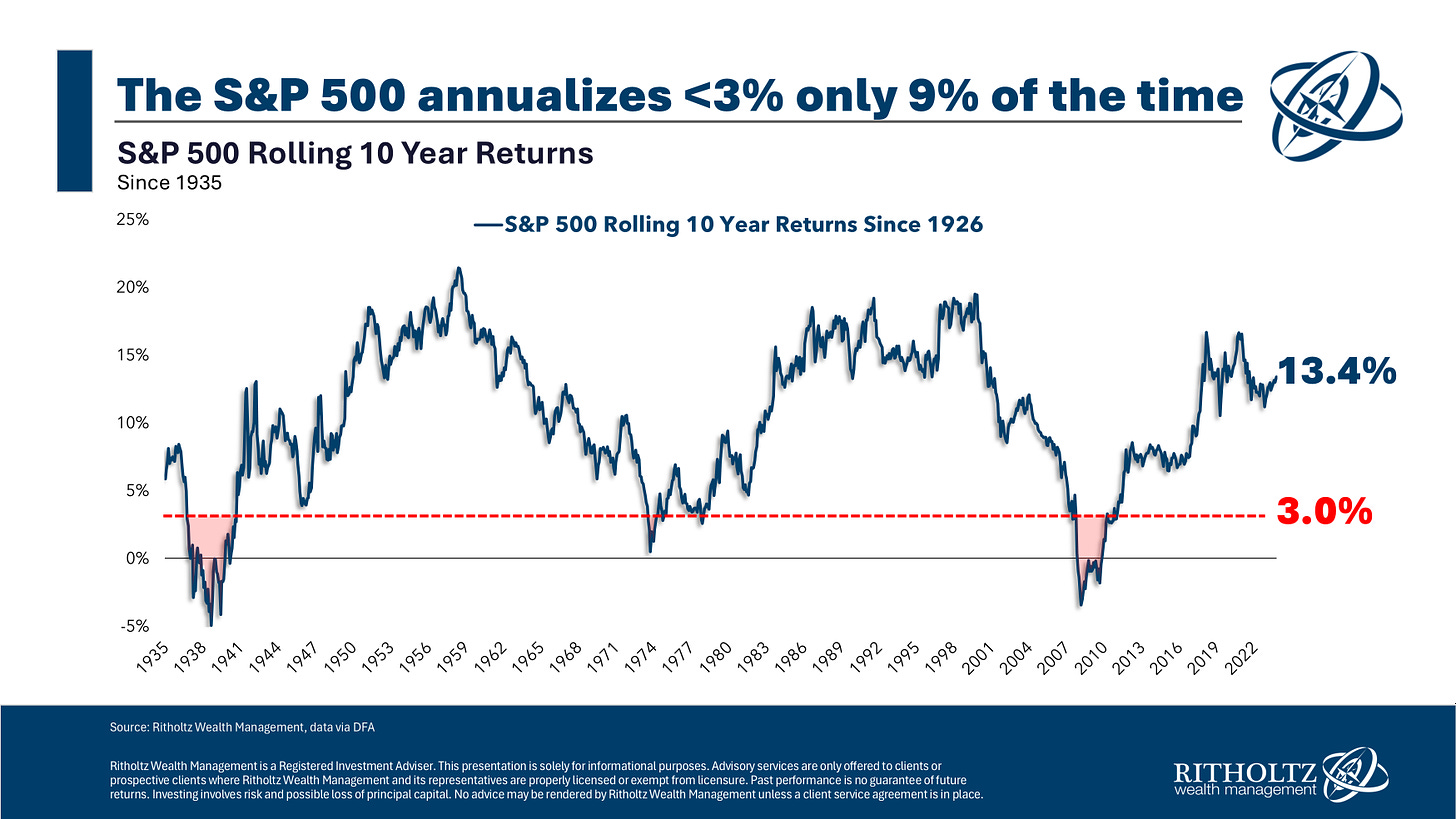

I think Ben Carlson of Ritholtz Wealth Management said it best: “It’s rare to see such low returns over a 10 year stretch but it can happen. Roughly 9% of all rolling 10 year annual returns have been 3% or less… So it’s improbable but possible.”

Sub 3% returns are unusual but not unprecedented. (Source: Ben Carlson)

Investors would probably love to hear a more decisive view. But predicting long-term returns is hard, and these kinds of imprecise assessments are the best we can do as we manage our expectations.

That said, last week came with a lot of Wall Streeters pushing back on Goldman’s forecast.

JPMorgan Asset Management (JPMAM) expects large-cap U.S. stocks to “return an annualized 6.7% over the next 10-15 years,” Bloomberg reports.

“I feel more confident in our numbers than theirs over the next decade,” JPMAM’s David Kelly said. “But overall, we think that American corporations are extreme — they’ve got sharp elbows and they are very good at growing margins.“

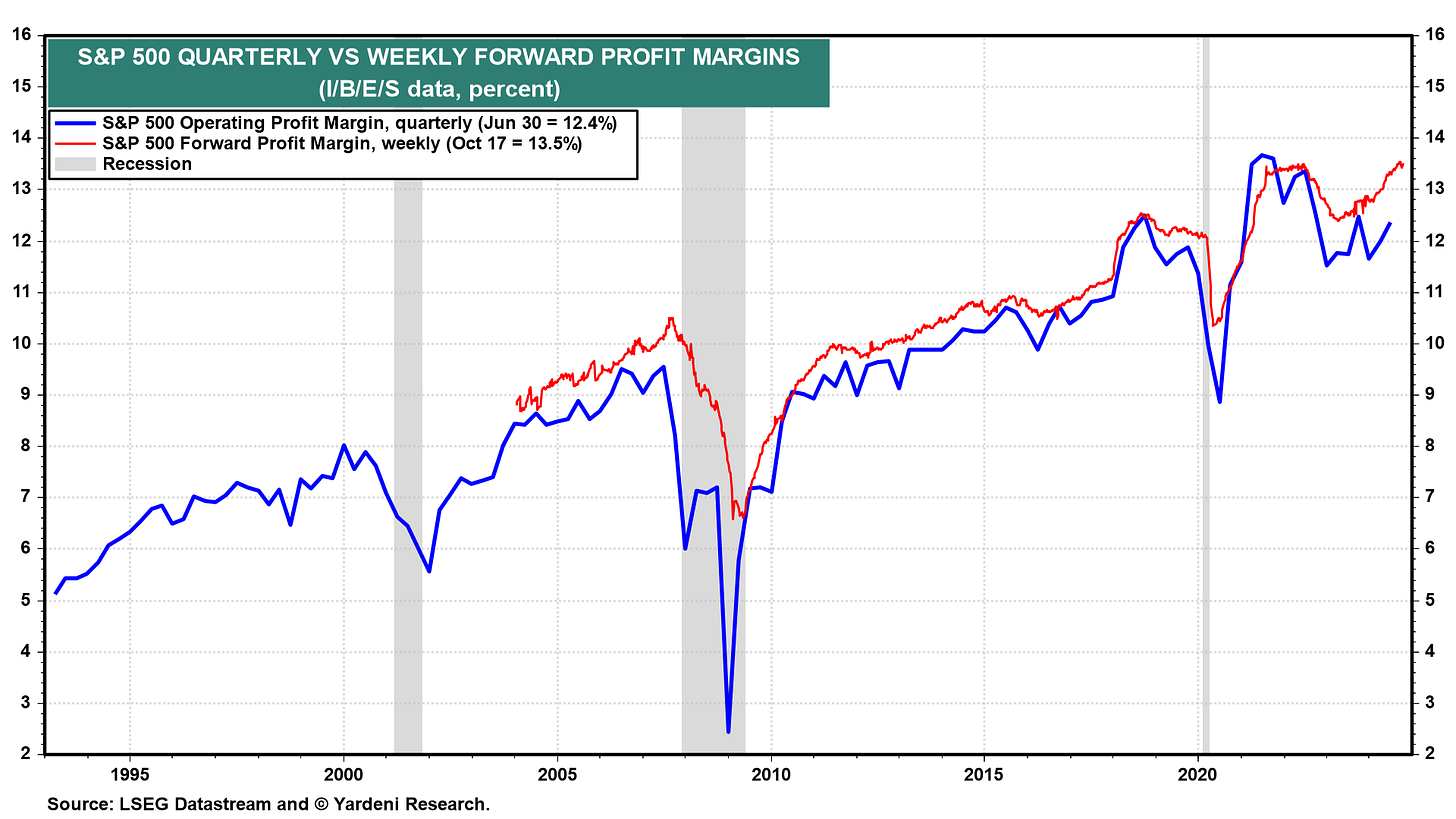

Expectations for improving productivity, strong profit margins, and healthy earnings growth have been hot topics lately. They’re trends that Ed Yardeni of Yardeni Research also expects to drive stock prices higher for years to come.

“In our opinion, even Goldman's optimistic scenario might not be optimistic enough,” Yardeni wrote. “If the productivity growth boom continues through the end of the decade and into the 2030s, as we expect, the S&P 500's average annual return should at least match the 6%-7% achieved since the early 1990s. It should be more like 11% including reinvested dividends.”

Profit margins are high, and they’re expected to stay high. (Source: Yardeni Research)

“In our view, a looming lost decade for U.S. stocks is unlikely if earnings and dividends continue to grow at solid paces boosted by higher profit margins thanks to better technology-led productivity growth,” Yardeni said.

Datatrek Research co-founder Nicholas Colas is encouraged by where the stock market stands today and where it could be headed.

“The S&P 500 starts its next decade stacked with world class, profitable companies and there are more in the pipeline,” Colas wrote on Monday. “Valuations reflect that, but they cannot know what the future will bring.“

He believes “the next decade will see S&P returns at least as strong as the long run average of 10.6%, and possibly better.“

Could Something ‘Very, Very Bad’ Occur?

Colas noted that historical cases of <3% returns “always have very specific catalysts which explain those subpar returns.“ The Great Depression, the oil shock of the 1970s and its after effects, and the Global Financial Crisis were all associated with these low 10-year returns.

“History shows that 3% returns or worse only come when something very, very bad has occurred,” Colas said. “While we are relying on press accounts of Goldman’s research, we have read nothing that outlines what crisis their researchers are envisioning. Without one, it is very difficult to square their conclusion with almost a century of historical data.“

Because of the way Wall Street research is distributed and controlled, not everyone is able to access every report, including experts who may be asked to respond to them.*

Goldman shared the report with TKer. Regarding the issue Colas flagged, Goldman does discuss those catalysts but actually highlights them as periods when their forecasting model failed.

That said, very bad things have happened in the past, and they could happen again in the future. And those events could cause stock market returns to be poor.

“Forecasting one form of economic disaster or another over the next 10 years is not much of a reach; you will be hard-pressed to think of any decade where some economic calamity or another didn’t befall the global economy,” Barry Ritholtz of Ritholtz Wealth Management wrote. “But that’s a very different discussion than 3% annually for 10 years.”

This leads me to my conclusion: It is very difficult to predict with any accuracy what will happen in the next 10 years. Goldman makes a point of this in their report. There are good cases to be made for weak returns as well as strong returns as argued by Yardeni and Colas.

Who will be right? We’ll only know in hindsight.

Generally speaking, I’m of the mind that the stock market usually goes up because we have a capitalist system that’s great at generating earnings growth, and earnings are the most important long-term driver of stock prices. And history shows there’s never been a challenge the economy and stock market couldn’t overcome. After all, the long game is undefeated.

“I have no idea what the next decade will bring in terms of S&P 500 returns, but neither does anyone else,” Ritholtz said. “I do believe that the economic gains we are going to see in technology justify higher market prices. I just don’t know how much higher; my sneaking suspicion is one percent real returns over the next 10 years is way too conservative.”

A version of this post was originally published on Tker.co.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.