Zinger Key Points

- Markets expect headline PCE to edge up to 4.3% year on year in April, up from 4.2% in March.

- Both the dollar and short-term Treasury yields have risen lately due to debt ceiling talks.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

The personal consumption expenditure (PCE) price index, the Federal Reserve's favored gauge of inflation, will be announced on Friday, May 26.

The April PCE inflation report comes at a time when investors are increasingly wondering if the Fed will hike interest rates again in July, after briefly pausing in June.

What To Know Ahead of the PCE Inflation Release

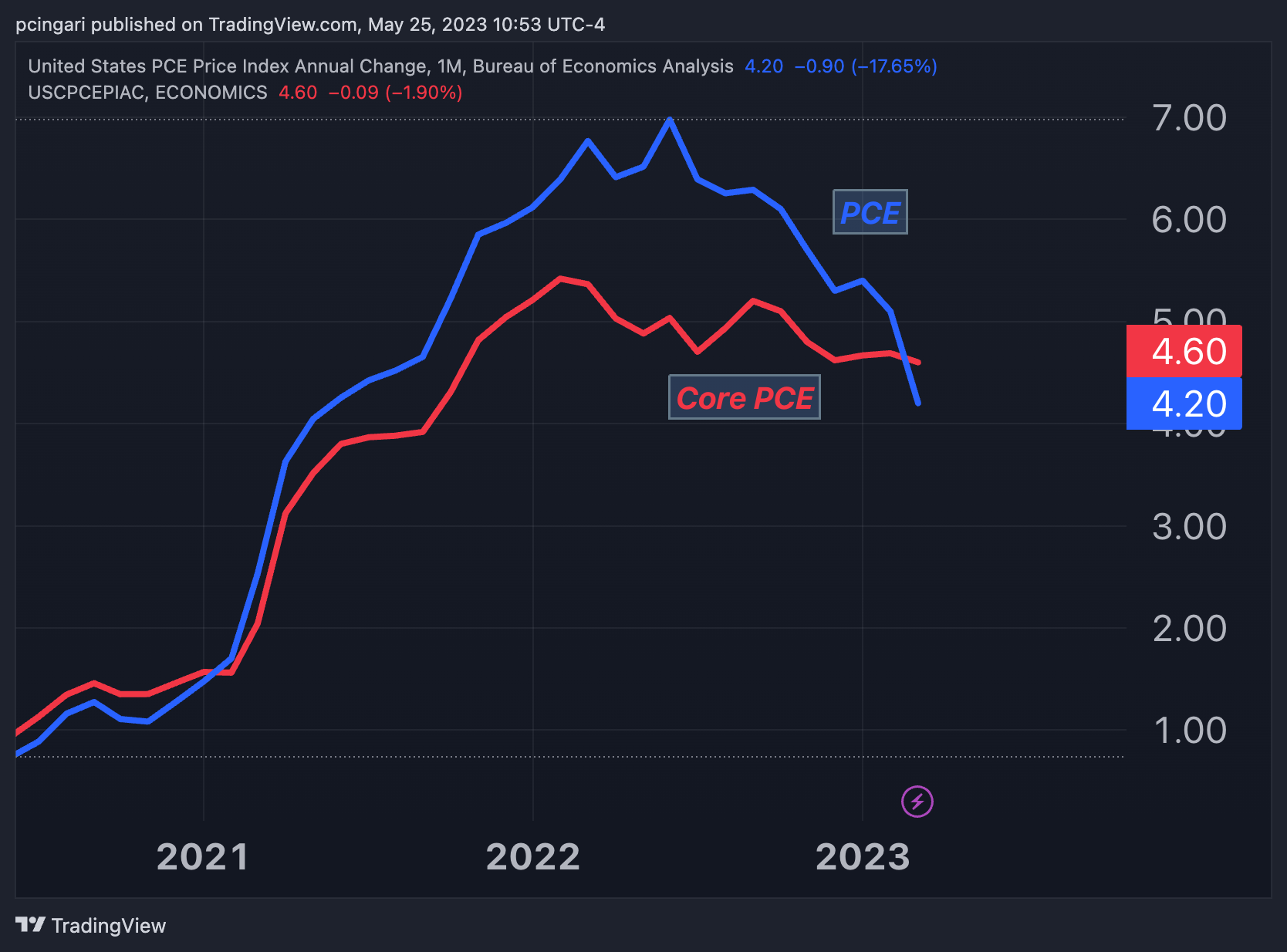

- Economists estimate that the headline PCE will edge up to 4.3% year-on-year in April, up from 4.2% in March.

- Headline PCE inflation is predicted to grow 0.3% month on month, accelerating from 0.1% in March.

- Core PCE inflation, which excludes energy and food and provides a more accurate picture of the underlying causes of inflation, is predicted to stay stable at 4.6% yearly and 0.3% monthly.

- The latest Federal Open Market Committee (FOMC) minutes highlighted that "recent data for core PCE goods prices came in above expectations, and the staff judged that supply–demand imbalances in goods markets were easing a bit more slowly than anticipated."

- Last month, the consumer price index (CPI) inflation rate ticked down from 5% to 4.9% year-on-year. The core CPI inflation also slightly eased from 5.6% to 5.5%.

- While shelter is the largest component of the CPI index, accounting for one-third of the basket, medical care (20-21%) and housing with energy (17-18%) are the key components of the PCE price index.

- The dollar is trading at its highest level in over 10 weeks, while the yield on the two-year Treasury note has increased for ten consecutive sessions, returning to mid-March levels.

- The Invesco DB USD Index Bullish Fund ETF UUP, a gauge of the dollar index (DXY), is on track to notch its third consecutive week of gains.

- Investors' expectations for Fed rate rises have risen lately. The market expects a rate rise at the June meeting with a likelihood of little less than 40%, which increases to 66% for the July meeting.

Chart: PCE vs Core PCE inflation

Image: Shutterstock

UUPInvesco DB USD Index Bullish Fund ETF

$27.64-0.22%

Edge Rankings

Momentum

62.11

Price Trend

Short

Medium

Long

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in