Stocks climbed last week with the S&P 500 rising 1.0% to close at 4,582.23. The index is now up 19.3% year to date, up 28.1% from its October 12 closing low of 3,577.03, and down 4.5% from its January 3, 2022 record closing high of 4,796.56.

The market rallied as we were reminded not to underestimate the American consumer.

On Friday, the BEA reported that personal consumption expenditures growth accelerated in June, rising to a record annualized rate of $18.4 trillion.

This matters because consumer spending is the dominant driver of the U.S. economy, with personal consumption expenditures accounting for 68% of GDP.

However, consumer behavior can be complex and nuanced.

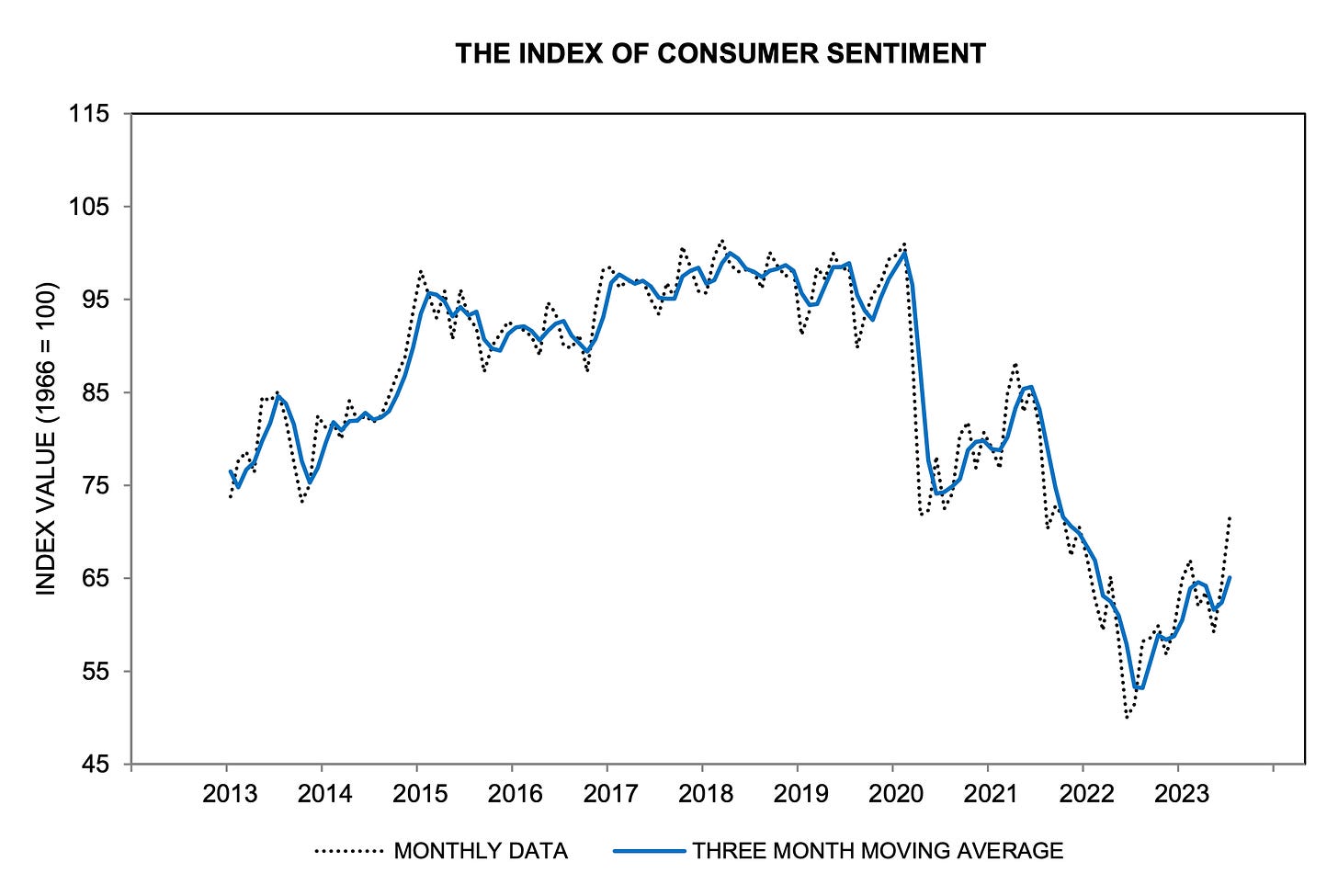

For most of the past two years, measures of consumer sentiment have been in the dumps — largely due to inflation manifesting clearly in the rising prices of goods and services.

Yet consumer spending growth has persisted.

The explanation: Consumer finances have been in remarkably good shape thanks to a combination of excess savings and relatively low debt levels. Meanwhile, more consumers have been getting jobs, which means more consumers have been making money. If people have money, they’ll spend it.

But no economic or market narrative goes unchanged forever. The consumer tailwinds mentioned above have been showing signs of fading.

The Consumer Narrative Is Shifting In A Fascinating Way

In recent months, we’ve been watching excess savings shrink, consumer debt levels begin to normalize (i.e, rise from unusually low levels), and job growth cool.

These are developments that might not lead you to assume that consumer sentiment would be improving.

But believe it or not, consumer sentiment is improving.

On Friday, we learned the University of Michigan’s Index of Consumer Sentiment in July rose to its highest levels since October 2021.

Sentiment is at its highest level since October 2021. (Source: University of Michigan)

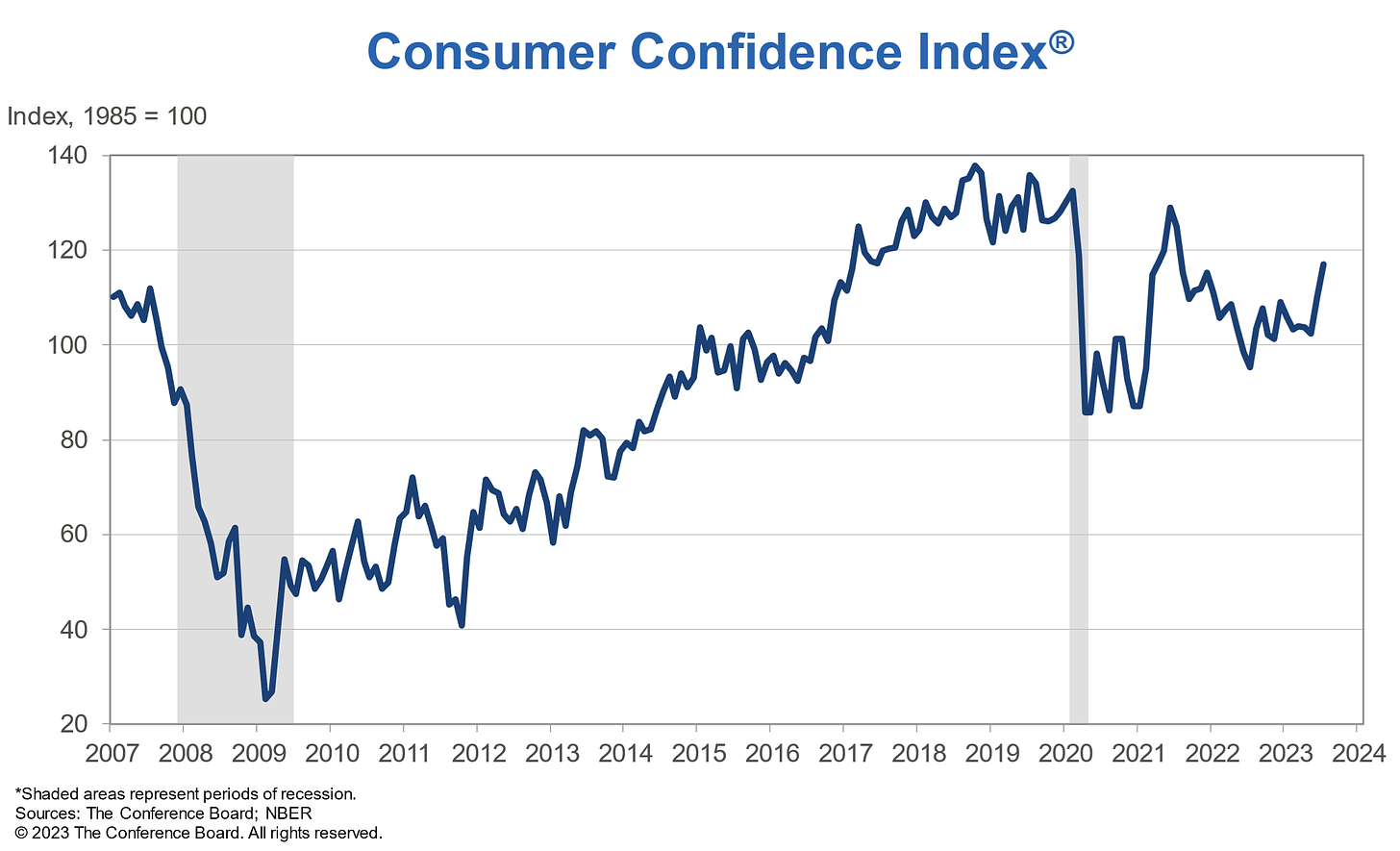

On Tuesday, we learned the Conference Board’s Consumer Confidence Index in July jumped to its highest level since July 2021.

Confidence is at its highest level since July 2021. (Source: The Conference Board)

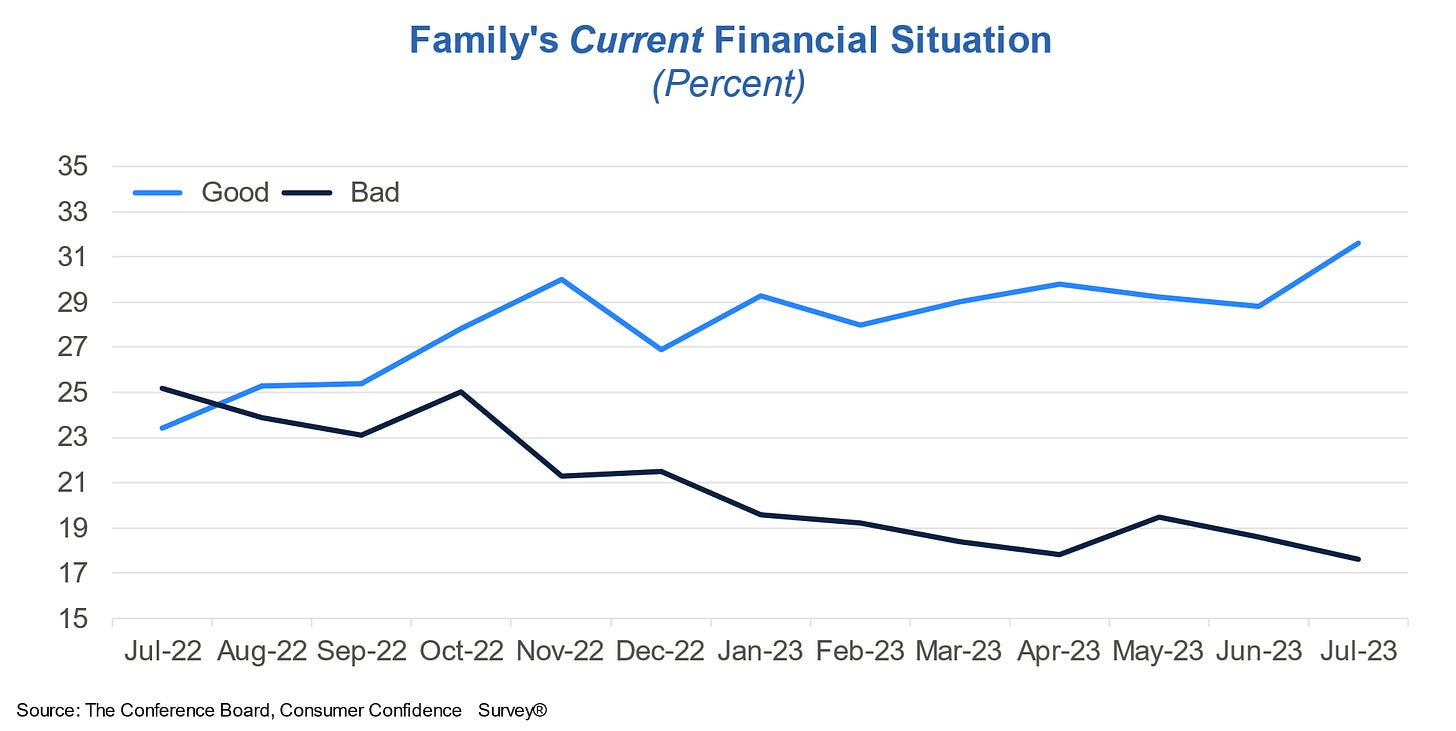

Notably, the Conference Board’s survey also found more consumers are saying their financial situation is good and fewer are saying it’s bad.

People are feeling better about their finances. (Source: The Conference Board)

Fortunately, what we’re witnessing isn’t total madness among consumers.

While some key metrics of financial health have deteriorated in recent months, others have been improving.

Incomes Are Outpacing Inflation

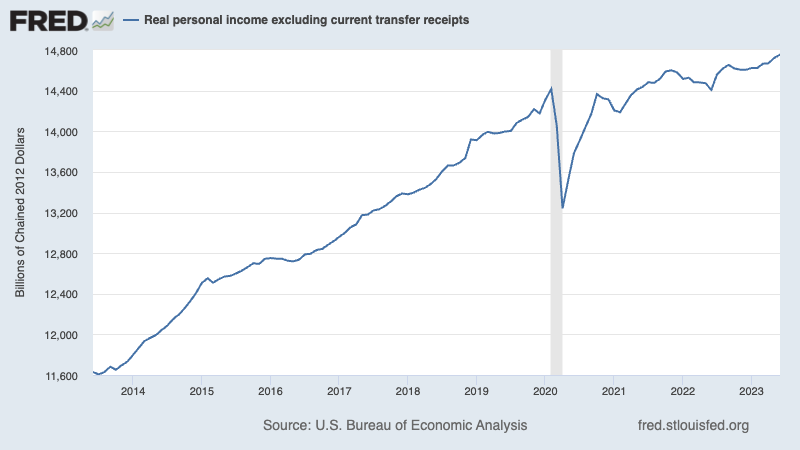

As Renaissance Macro’s Neil Dutta has been highlighting for months, real income growth has been positive (i.e., consumers’ wage growth is outpacing inflation).

According to BEA data released Friday, real personal income excluding transfer receipts (e.g. Social Security benefits, unemployment insurance benefits, and welfare payments) rose to a record high in June and has been trending higher since December.

Real incomes are up. FRED

This has as much to do with wages rising as it does with inflation cooling.

Earlier this month, we learned the consumer price index in July was up just 3% from a year ago, the lowest print since March 2021.

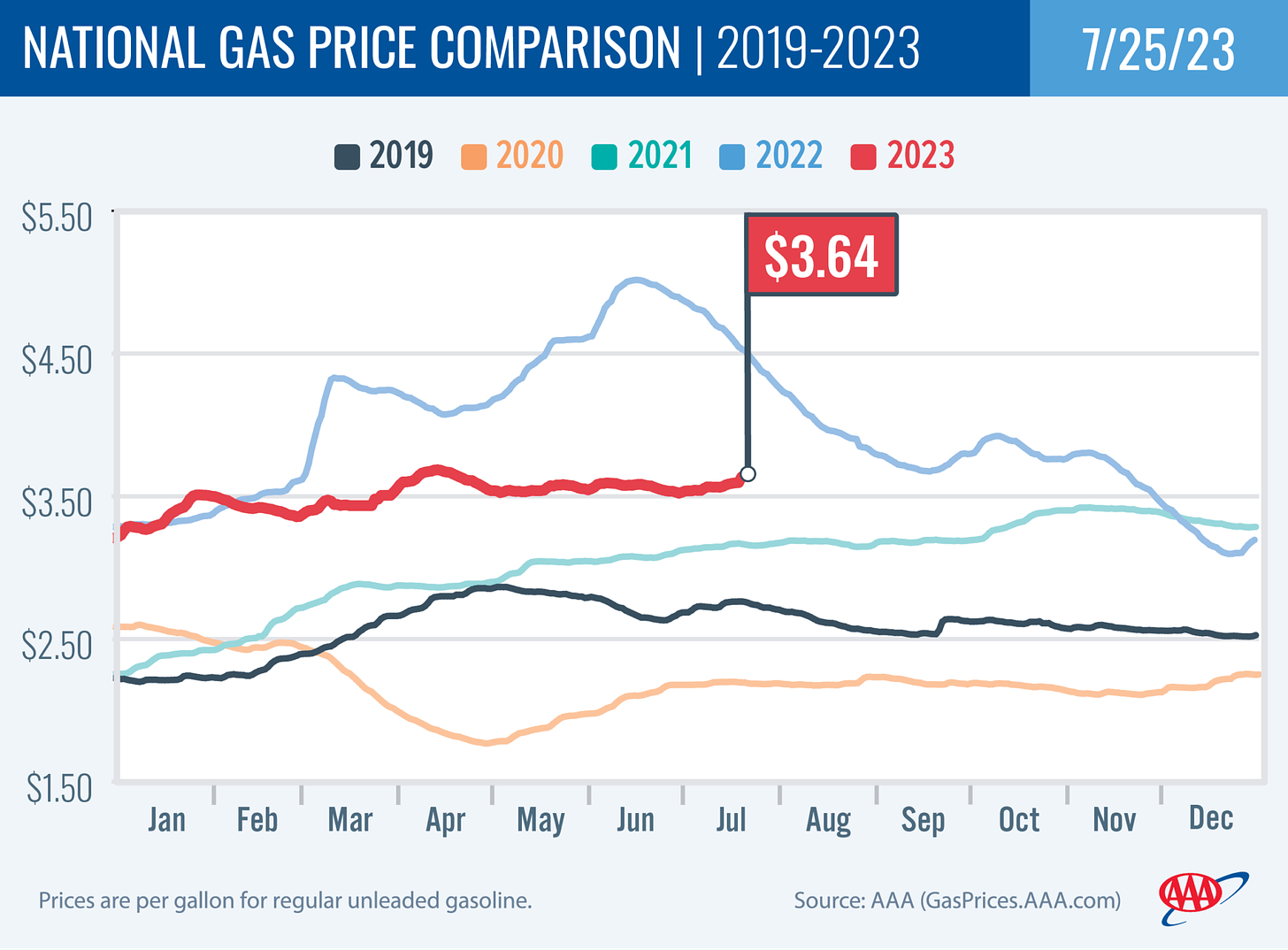

Among the biggest forces bringing down inflation were energy prices, which were down 16.7% from year-ago levels. Gasoline prices are way down after a brutal 2022.

Gasoline prices are down. AAA

While policymakers tend to focus on “core” measures of inflation (which exclude volatile components like food and energy prices), headline measures of inflation can have a huge impact on sentiment as they include the prices of goods consumers confront very regularly.

"It is a good thing headline inflation has gone down a bit," Federal Reserve Chair Jerome Powell said on Wednesday (h/t Myles Udland). "I would say that having headline inflation move down that much... will strengthen the broad sense that the public has that inflation is coming down, which will, in turn, we hope, help inflation continue to move down."

And even though job growth has been cooling, there continue to be a lot of signs that the demand for labor remains robust.

This was recently confirmed in The Conference Board’s July survey, which showed that “46.9% of consumers said jobs were ‘plentiful,’ up from 45.4%. 9.7% of consumers said jobs were ‘hard to get,’ much lower than 12.6% last month.“

“Overall, the sharp rise in sentiment was largely attributable to the continued slowdown in inflation along with stability in labor markets,” University of Michigan’s Joanne Hsu said.

The Conference Board noted: “Despite rising interest rates, consumers are more upbeat, likely reflecting lower inflation and a tight labor market.”

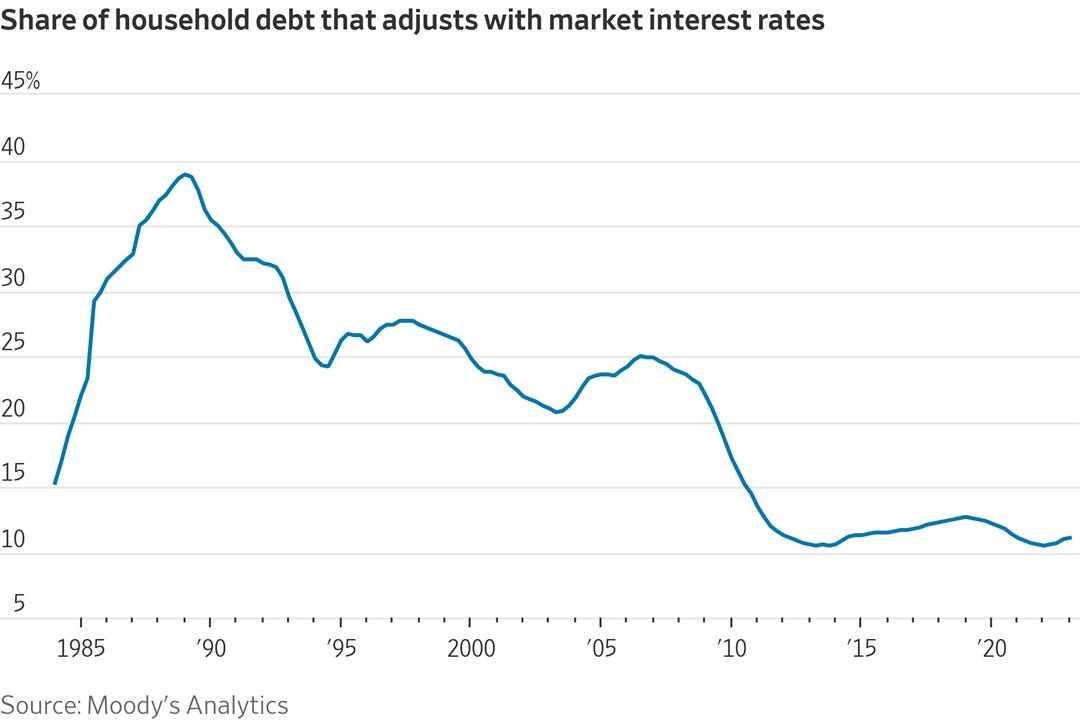

On the matter of rising interest rates, it’s worth remembering that the share of household debt with an adjustable interest rate is low by historical standards.

The vast majority of household debt has a fixed interest rate. WSJ

What To Watch

Metrics like excess savings, consumer debt, and debt delinquencies have moved unfavorably in recent months. But none of these developments are signaling that a recession is around the corner. The metrics have only eased from their hottest levels.

But will spending hold up? This will be the key dynamic to watch in the coming months.

It’s great that consumer sentiment is on the mend. And it’s even better that real incomes are on the rise.

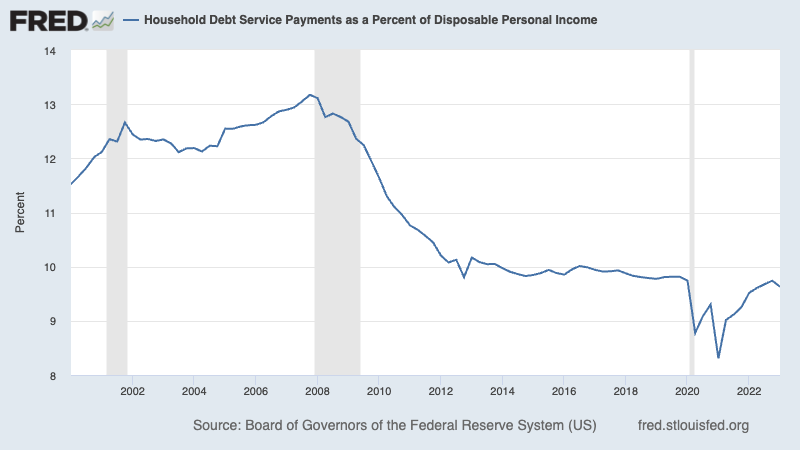

And generally speaking, consumer finances remain very healthy. As Federal Reserve data shows, household debt service payments remain historically low relative to disposable income.

Consumer finances have been in great shape. FRED

In addition to resilient measures of consumer spending at the aggregate level, anecdotes suggest discretionary spending remains very strong: Royal Caribbean says cruise bookings are surging, Bank of America says Barbie and Oppenheimer have people out and about, and even the Federal Reserve says Taylor Swift concerts are fueling local tourism.

And like consumer behavior, the dynamics of the economy are complex and nuanced. Just because some key metrics are deteriorating doesn’t mean the economy is going down. There may be other metrics offsetting these headwinds. You just have to be vigilant and open to the possibility that big narratives can change.

A version of this post was originally published on Tker.co

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.