Stocks ticked higher last week, with the S&P 500 rising 0.4% to close at 4,327.78. The index is now up 12.7% year to date, up 21% from its October 12, 2022 closing low of 3,577.03, and down 9.8% from its January 3, 2022 record closing high of 4,796.56.

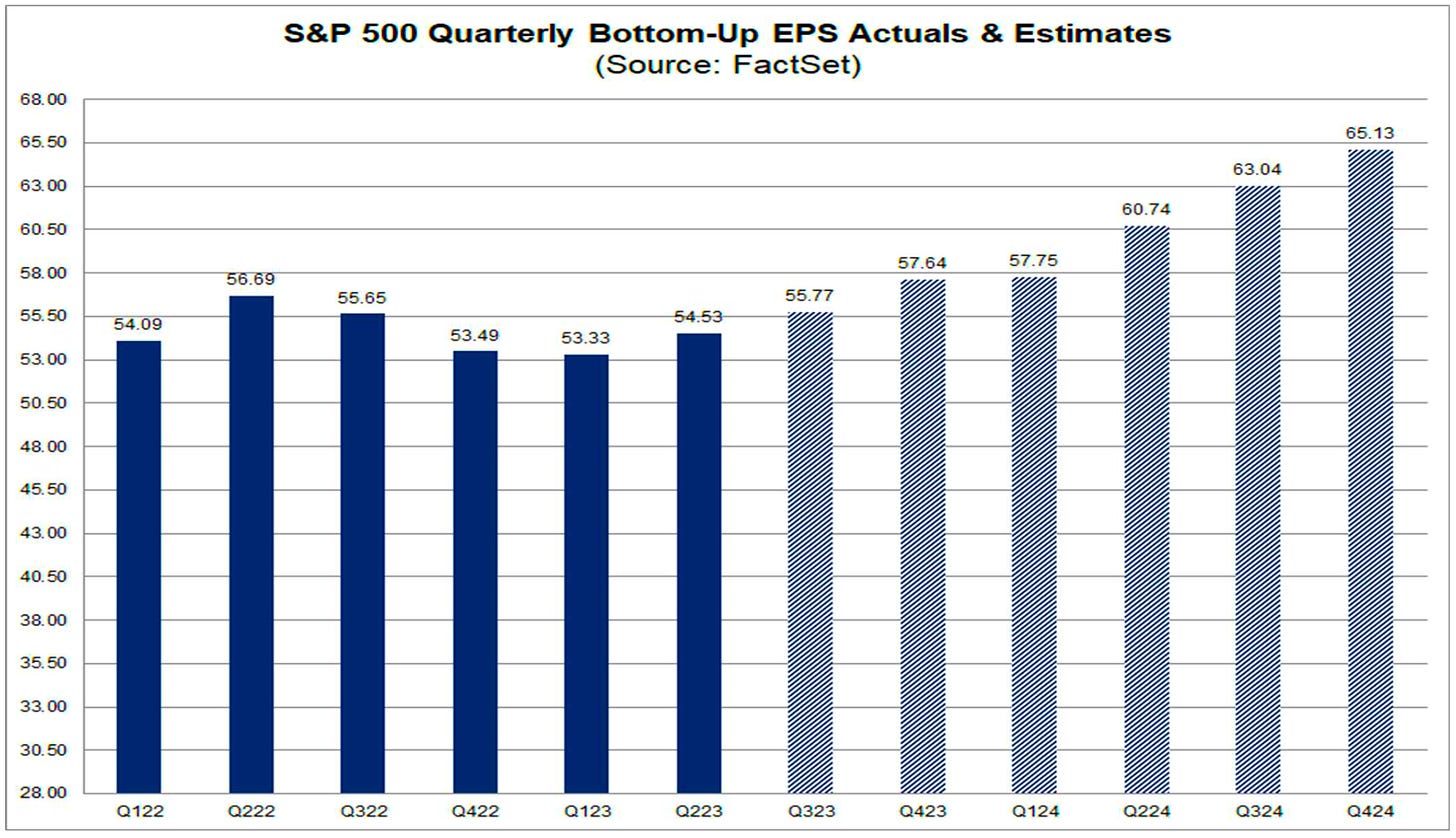

Quarterly earnings are on the rise (Source: FactSet)

Q3 earnings season kicked off this past week on a bullish note, with big banks like JPMorgan and Citigroup announcing better-than-expected financial results.

According to FactSet, analysts expect S&P 500 companies to report a second consecutive quarter of earnings growth following a brief earnings recession.

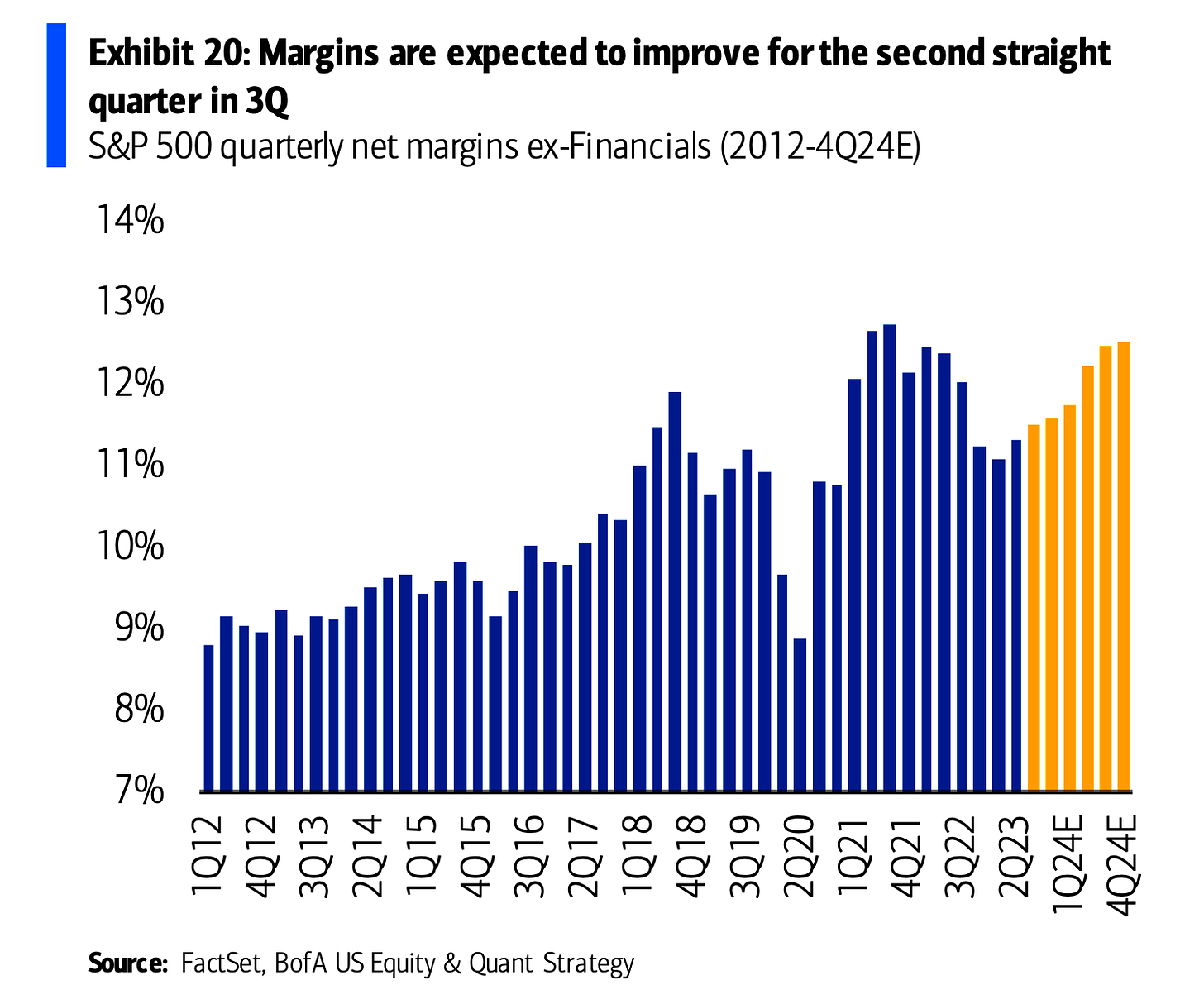

Perhaps the most controversial assumption embedded in these earnings forecasts is the expectation that profit margins will expand again.

Analysts expect profit margins to expand. (Source: BofA)

Historically high profit margins have been a controversial issue in recent years.

As inflation rates surged in 2021, analysts were convinced rising costs would crush profit margins. But the opposite happened: Profit margins actually rose to record levels. During this period, many companies were able to pass higher costs to their customers through higher prices. Combined with improved operating efficiencies, this dynamic led to record profits. It was a reminder that it’s “dangerous to underestimate Corporate America.”

Surprising to some, high profit margins have persisted. And after a modest dip in recent quarters, profit margin expansion resumed in Q2.

How were margins in Q3, and what’s management’s outlook for margins in the quarters and years to come?

Almost every major macroeconomic narrative in one way or another is reflected in margins.

-

Demand: If customer demand is weak, companies may cut prices to move volume, which is bad for margins. If volumes fall, margins may also fall if companies can’t quickly adjust costs.

-

Inflation: If the unit cost of goods falls, then companies may benefit from a margin tailwind. However, companies would offset this tailwind if they also cut prices.

-

Labor: If workers have leverage, they may demand higher wages, which could pressure margins if companies aren’t able to pass those higher costs on to their customers.

-

Capex, AI: If companies have been upgrading their equipment and workflows, the improved productivity should manifest as higher profit margins.

-

Interest rates: Interest rates have been on the rise. If companies rely on short-term debt or they’ve had to recently refinance long-term debt, then their interest expenses may be up, which should pressure net margins. But it’s also worth remembering that many companies sit on a healthy amount of cash, which is likely generating an increasing amount of interest income.

While a lot of attention is paid on earnings “beats” and “misses,” the role of profit margins in the bottom line results may be far more telling.

A version of this post was originally published on Tker.co.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.