Zinger Key Points

- Mixed economic data: Q3 GDP revised downward, jobless claims stable.

- Philly Fed Manufacturing Index hits lowest point since September.

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

Thursday morning brought mixed economic prints, providing insights into the current state of the U.S. economy. The data releases covered third-quarter economic growth, jobless claims and manufacturing health in the Philadelphia Federal Reserve district.

Economic Highlights:

- The economic growth in the third quarter has been downwardly revised from 5.2% to 4.9% quarter-on-quarter annualized growth, according to the final reading by the U.S. Bureau of Economic Analysis. The main revision to the second estimate was a reduction in consumer spending.

- The U.S. nominal GDP was $27.61 trillion in the third quarter, a downward revision of $34.3 billion from the previous estimate.

- Simultaneously, the U.S. Department of Labor reported that initial jobless claims inched marginally higher last week, reaching 205,000, up from 202,000. Despite the increase, the result was lower than the expected surge to 215,000. Continuing claims stood at 1.865 million, broadly unchanged from 1.866 million the previous week.

- The Federal Reserve Bank of Philadelphia said the Philly Fed Manufacturing Index, which covers the manufacturing sector’s health in eastern Pennsylvania, southern New Jersey and Delaware, declined from negative 5.9 points to negative 10.5 points, coming in well below the expected negative 3 reading. This marks the lowest print since September.

US Futures Premarket Action

U.S. equity futures reacted positively to economic data during premarket trading on Thursday, aiming for a positive start to the day following Wednesday’s negative session.

Contracts on the S&P 500 Index gained 0.8% at 8:35 a.m. in New York, while those on the Nasdaq 100 rose 1%.

Futures on the Dow Jones added over 220 points, or 0.6%.

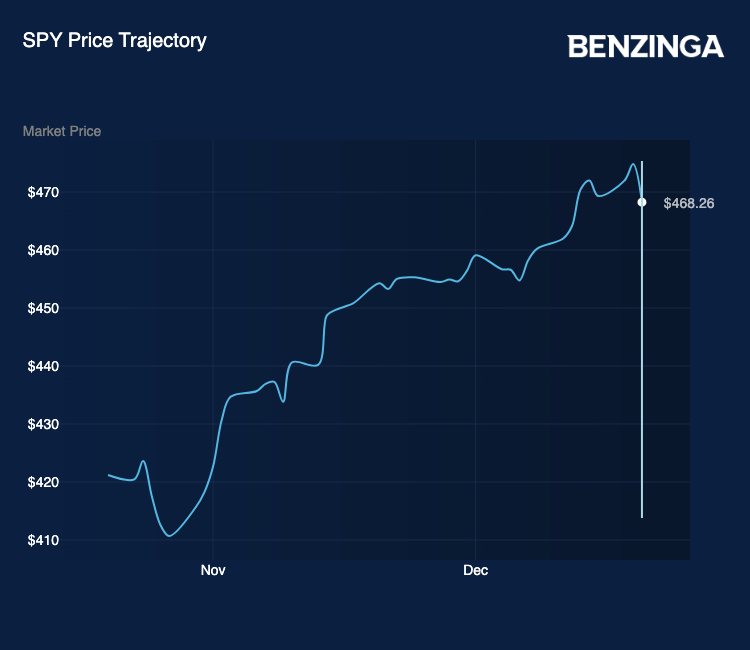

The broader stock market, as tracked by the SPDR S&P 500 ETF Trust SPY, fell 1.4% on Wednesday, marking its worst daily performance since late October.

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.