Zinger Key Points

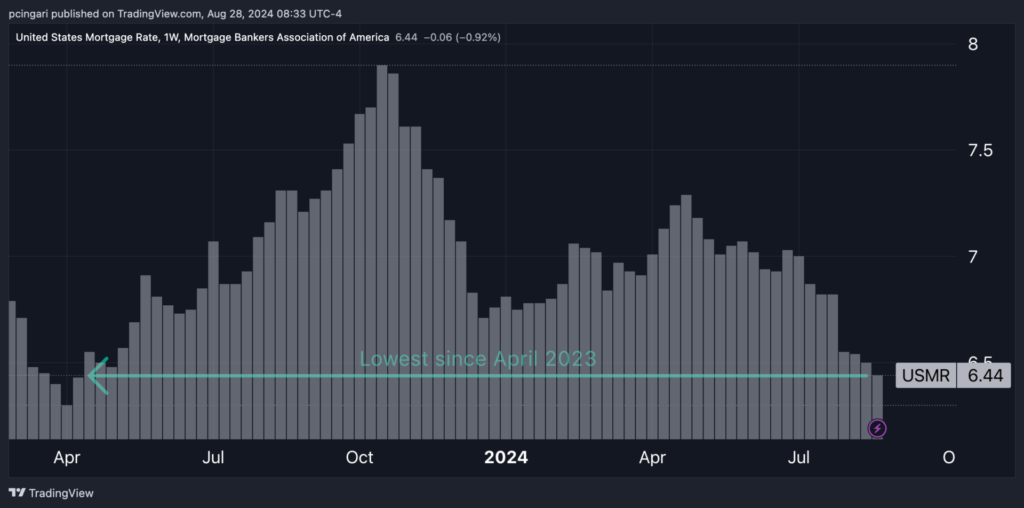

- Average 30-year mortgage rates fell to 6.44%, the lowest since April 2023, marking four weeks of consecutive declines.

- Despite lower rates, mortgage applications rose just 0.5%, reflecting cautious homebuyer sentiment.

- The ‘Trade of the Day’ is now live. Get a high-probability setup with clear entry and exit points right here.

Good news is on the horizon for U.S. homebuyers as mortgage rates continue their downward trend.

In the week ending Aug. 23, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances (up to $766,550) dipped from 6.50% to 6.44%. This marks the lowest level since April 2023 and the fourth consecutive week of rate declines.

Yields on a 30-year Treasury bond – a key benchmark for mortgage costs – fell by 5 basis points to 4.09% in the week ending Aug. 23.

Chart: 30-Year Mortgage Rates Drop To Levels Unseen Since April 2023

Despite the easing rates, homebuyers are still taking a wait-and-see approach. Mortgage applications saw a modest increase of 0.5% from the previous week, according to the Mortgage Bankers Association's (MBA) Weekly Applications Survey.

Refinancing activity, which is more sensitive to changes in interest rates, showed a slight decline. The Refinance Index fell by 0.1% from the prior week, though it remains 85% higher than the same week last year, reflecting a robust annual surge in homeowners looking to take advantage of the lower rates.

Adjustable-rate mortgages (ARMs) also saw a decrease in interest rates. The average contract interest rate for 5/1 ARMs fell to 5.98% from 6.25%, indicating some relief for borrowers seeking more flexible loan terms.

“As observed in recent weeks, despite lower rates, purchase applications have not moved much. Prospective homebuyers are staying patient now that rates are moving lower and for-sale inventory has started to increase,” said Joel Kan, MBA's vice president and deputy chief economist.

Mortgage-Linked Stocks Jump To 2-Year Highs

The decline in mortgage rates is also having a notable impact on mortgage-linked stocks. The iShares Residential and Multisector Real Estate ETF REZ closed 0.6% higher on Tuesday, reaching its highest levels since late August 2022.

The ETF is currently on a 14-week winning streak, fueled by rising expectations of potential Federal Reserve interest rate cuts.

Investor sentiment toward the sector is strong, with $135 million in net inflows into the REZ ETF in August 2024 alone, marking the largest monthly influx since January 2022. This surge underscores investor optimism about the real estate market's future as borrowing costs continue to ease.

Chart: REZ ETF Surges To 2-Year Highs With 14-Week Winning Streak

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.