Zinger Key Points

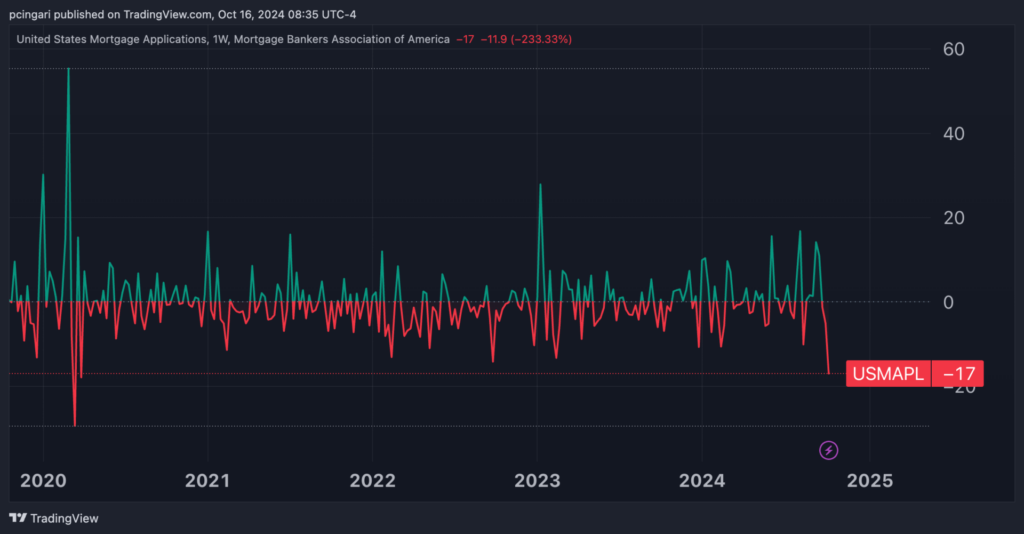

- U.S. mortgage applications dropped 17% last week, marking the steepest decline since April 2020, driven by a sharp rise in interest rates.

- Refinancing activity plummeted 26%, as higher mortgage rates made refinancing less attractive for homeowners, the worst decline since March

- Get 5 New Stock Recommendations Every Week

U.S. mortgage demand saw its steepest weekly drop in over four years, as a sharp rise in interest rates caught homebuyers off guard.

After weeks of steady declines, the new surge in interest rates has driven away potential buyers, with many sidelined due to affordability concerns.

The Mortgage Bankers Association (MBA) reported Wednesday that mortgage applications fell by 17% in the week ending Oct. 11, marking the largest weekly drop since the onset of the COVID-19 pandemic in April 2020.

Applications Sink As Mortgage Rates Climb To Highest Levels Since August

The 17% plunge in mortgage applications follows a 5.1% decline the previous week, extending the downtrend into its third consecutive week.

For perspective, the last time mortgage demand dropped by such a significant margin was in early April 2020, when the initial COVID-19 lockdowns caused applications to tumble by 17.9%.

Refinancing activity, which is highly sensitive to interest rate fluctuations, suffered a staggering 26% decline last week, the biggest drop since March 2020, as higher rates made refinancing options less attractive to existing homeowners.

Mortgage Rates Rise, Led by Treasury Yield Surge

The average interest rate for a 30-year fixed-rate mortgage with conforming loan balances (up to $766,550) increased to 6.52%, the highest since August 2024, up by 16 basis points from the previous week.

For jumbo loans, which apply to homes priced above $766,550, the average rate climbed to 6.76%, up by 12 basis points.

This rise in mortgage rates has been primarily driven by a jump in U.S. Treasury yields. The 30-year Treasury bond yield, a key benchmark for long-term mortgage costs, surged to 4.40% by the end of last week, its highest level since late July 2024.

Rising Treasury yields have been spurred by stronger-than-expected economic data and a surprisingly higher inflation reading in September.

Last week's data showed that the headline consumer price index (CPI) slightly decelerated to 2.4% year-over-year in September, down from 2.5% in August, but came in above forecasts of 2.3%. Core inflation, which excludes volatile food and energy prices, increased to 3.3% year-over-year in September, surpassing market expectations of 3.2%.

Read Next:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.