Zinger Key Points

- The SPDR S&P 500 ETF regained the $400 mark as investor skepticism over U.S. banking system eases.

- Technically, this is a multi-resistance region, where SPY could find some hurdles to the upside.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

The S&P 500 index, which is tracked by the SPDR S&P 500 ETF Trust SPY, reclaimed the crucial psychological threshold of 4,000 on Tuesday, as U.S. policymakers give assurances on the stability of the financial system.

The ETF posted a 1.31% daily gain and is up 3.5% from its March 13 lows. The price increase has been accompanied by a similar rise in inflow volume, thus validating the strength of the rebound.

The S&P 500 ended Tuesday's session at 4,002.87, while the corresponding ETF closed at $398.91.

Investors Return To Stocks As Banking Crisis Eases, Fed Overtightening Looks Unlikely

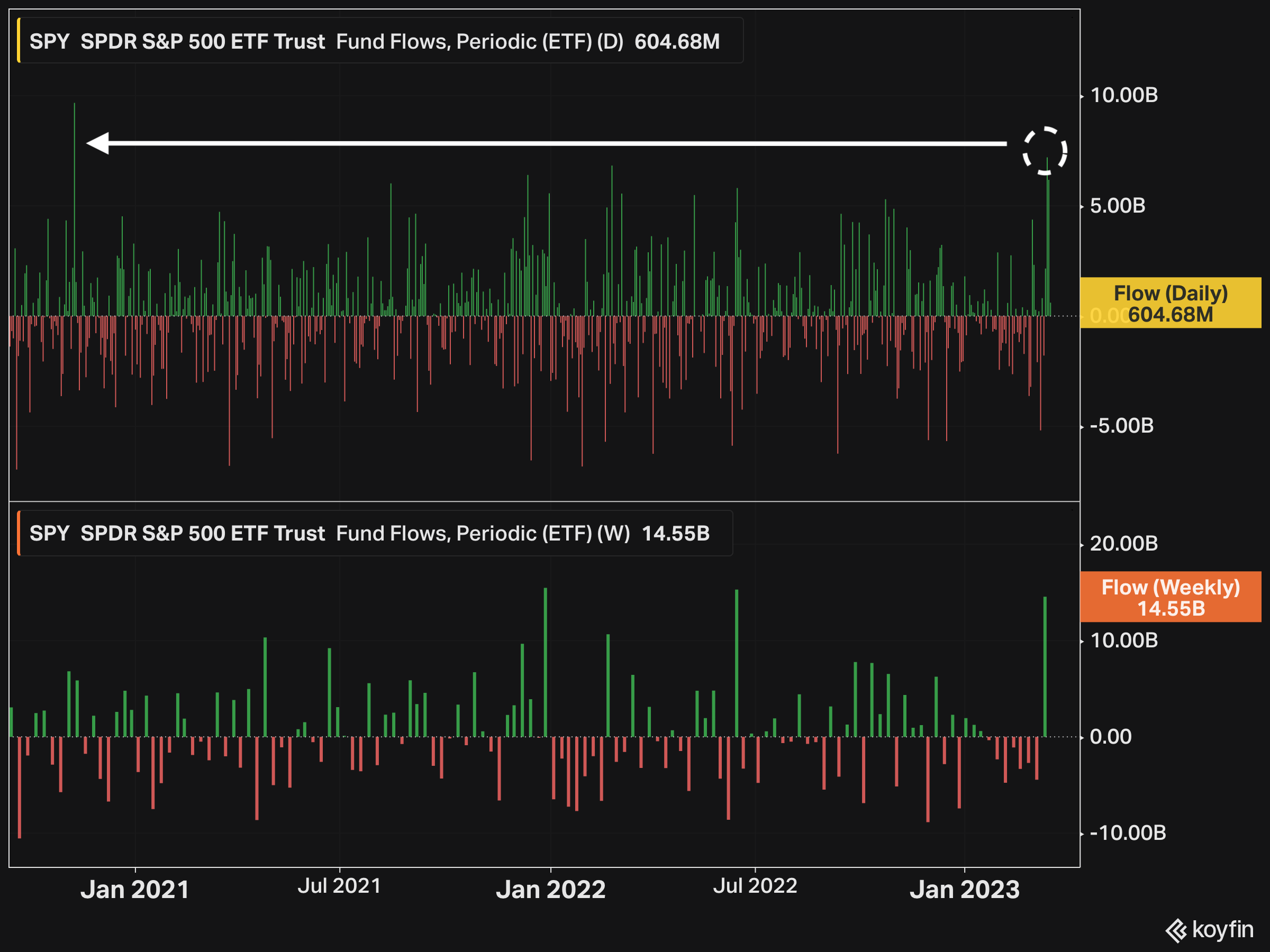

The SPY saw four consecutive days of inflows totaling approximately $15 billion for the week ending March 20 and marking the best week since June 2022.

On March 15, $7.2 billion was pumped into SPY, the largest daily inflows since Nov. 9, 2020, when the COVID-19 vaccine was revealed.

As a Fed overtightening becomes less likely given the banking situation, stock investors are speculating that this might mark the end of the bear market.

SPY ETF Fund Flows as of March 20, 2023 – Chart: Koyfin

SPY Technical Analysis: Testing Key Resistance Ahead Of FOMC

SPY is now testing a multi-resistance region, which includes the $400 psychological level, the 200-day moving average and the 50% Fibonacci level of the February-March bearish range.

These are key technical hurdles that SPY needs to overcome first in order to rise above March highs at $407 and then trying to assault the 78.6% Fibonacci retracement of the February bearish trend. The daily momentum indicator (14-day RSI) rose above the 50 mark for the first time since March 6.

SPY ETF price chart – TradingView

SPY ETF price chart – TradingView

How Could SPY React To March FOMC Call?

The FOMC meeting on Wednesday will be a critical event in dictating the SPY's upcoming path.

Markets have nearly completely discounted a 25bps hike, but what the Fed plans to do beyond March will be crucial to monitor.

If the Fed pushes back against market pricing, which anticipates a terminal rate of 4.9% in May and two rate cuts before the end of the year, and reiterates its commitment to battle inflation, stocks may see a return of volatility, with SPY attempting to find support around $392 (50dma).

If the Fed reinforces the need for liquidity in the financial system and temporarily halts efforts to fight inflation, this would likely feed investor confidence in stocks, and SPY may attempt to hit March highs of $407.

Read next: Best S&P 500 ETFs

Photo via Shutterstock.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.