Zinger Key Points

- A Benzinga poll shows whether readers believe new all-time highs for the stock market can be reached again in 2024.

- Earnings from four Magnificent 7 stocks during the trading week are also sized up in the poll.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

The last week of July and first part of August marked a busy one for the markets with several notable earnings reports, including four of the Magnificent 7 stocks reporting quarterly financial results.

A poll conducted by Benzinga reveals that many investors see the market trading higher in the last four months of the year.

What Happened: The month of July saw major U.S. stock indexes hit all-time highs, with technology stocks including the Magnificent 7 stocks helping power the year-to-date gains.

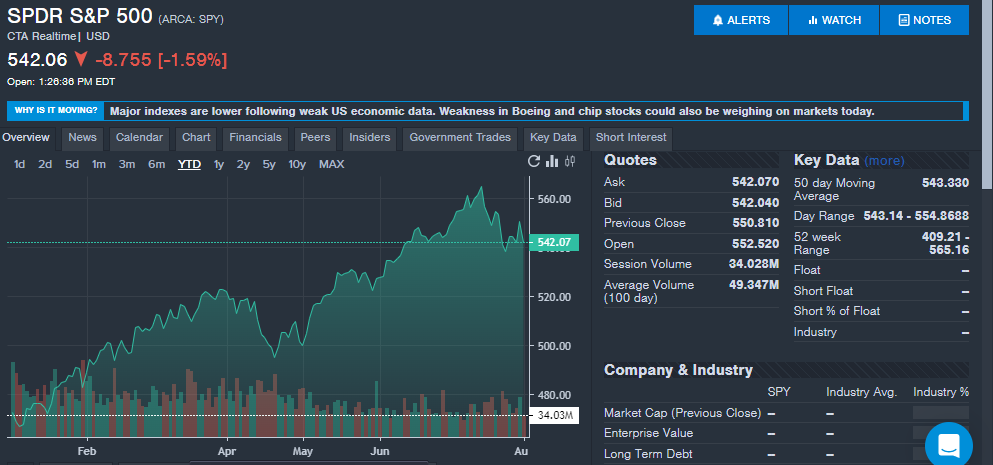

The SPDR S&P 500 ETF Trust SPY, which tracks the index, is currently up 18.4% year-to-date, as shown in the Benzinga Pro chart below.

Benzinga recently asked readers if they thought new highs would be reached in the last four months of the year.

"Do you believe the markets have already peaked in 2024?" Benzinga asked.

The results were:

- Yes: 27.9%

- No: 72.1%

The results show that the majority of readers believe the market will rise by the end of 2024 and hit new highs.

Benzinga also asked about the impact of earnings reports from Apple Inc AAPL, Amazon.com Inc AMZN, Meta Platforms META and Microsoft Corporation MSFT.

"Apple, Microsoft, Meta, and Amazon report earnings this week. Will the markets finish the week higher or lower?"

The results were:

- Higher: 66%

- Lower: 34%

The SPDR S&P 500 ETF began the week trading at $546.02 and currently trades at $543.01, down on the week.

Meta Platforms, Apple and Microsoft reported quarterly financial results, beating revenue and earnings per share estimates from analysts.

Amazon missed the Street consensus estimate on net sales, but reported second-quarter earnings per share of $1.26, which beat a Street consensus estimate of $1.03.

Why It's Important: After hitting highs in July, the S&P 500 could be in for a rough couple of months according to past market trends.

The months of August and September represent the worst performing two-month stretch historically over the last 20 years.

In the past 20 years, the S&P 500 is down an average of 0.4% during August and September. The S&P 500 was up 10 years and down 10 years for the two-month stretch. The S&P 500 is down three straight years during the August, September two-month stretch.

The earnings reports from Amazon and Apple to kick off August could serve as keys to the two-month stretch, starting on a high note.

For the rest of 2024, the November 2024 presidential election could also prove worthwhile for investors, with the S&P 500 often up in presidential election years overall and during the two-month stretch of August and September.

A rotation from large caps to small caps, which comes with a higher likelihood of a rate cut by the Federal Reserve, could also factor into whether the S&P 500 hits new highs in 2024.

SPY Price Action: The SPDR S&P 500 ETF Trust closed at $543.01 on Thursday, versus a 52-week trading range of $408.91 to $565.16.

Read Next:

The study was conducted by Benzinga in July 30-31, 2024 and included the responses of a diverse population of adults 18 or older. Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from 105 adults.

Image created using artificial intelligence via Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.