Zinger Key Points

- Bitcoin ETFs soar 100% in 2024, quadrupling SPY's 24.4% gains and outperforming MAGS' 64.89%.

- SPY and MAGS show bearish short-term trends, while Bitcoin ETFs maintain long-term bullish momentum.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Bitcoin BTC/USD ETFs delivered over 100% gains in 2024. That’s four times the returns of the S&P 500 index. The Roundhill Magnificent Seven ETF MAGS, meanwhile, lagged at 65%, proving the tech elite can't always keep up with crypto.

The SPDR S&P 500 ETF Trust SPY, a reliable proxy for the S&P 500, posted a respectable 24.4% gain over the past year.

It has faltered recently, dropping 2.51% over the last month.

Chart created using Benzinga Pro

With the stock price below its eight-, 20- and 50-day simple moving averages, SPY's technical outlook remains strongly bearish.

That said, a glimmer of hope lies in its 200-day SMA (simple moving average), which signals a bullish undertone at $555.48 compared to SPY's current $589.49 price. Short-term pain may precede long-term gains, as buying pressure hints at future bullish movement.

Read Also: Is SPY Losing Its Spark? The S&P 500’s Risk Conundrum

Bitcoin ETFs Shine Despite Headwinds

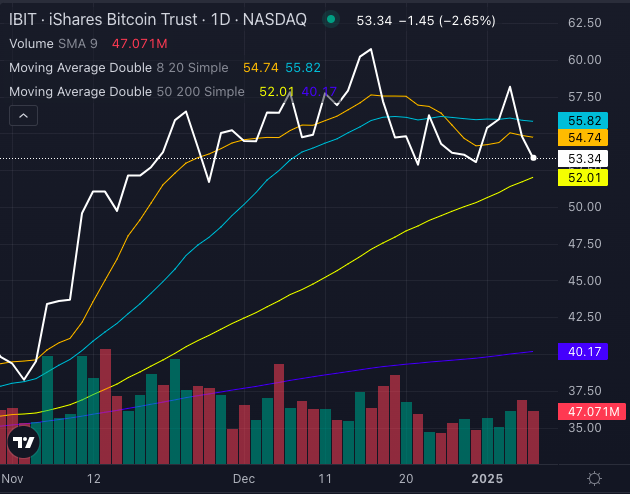

The iShares Bitcoin Trust ETF IBIT, a proxy of Bitcoin performance, crushed benchmarks with a 100.3% return in 2024.

Chart created using Benzinga Pro

Despite a slight 2.54% dip last month, IBIT's long-term technicals remain robust, trading well above its 200-day SMA at $40.17. However, recent selling pressure and a price of $53.34 below its eight and 20-day SMAs indicate a short-term bearish trend.

With Bitcoin ETFs delivering unmatched growth, even slight headwinds haven't dampened their shine.

MAGS: Tech Titans In Neutral

The Roundhill Magnificent Seven ETF MAGS, a barometer for the magnificent seven tech giants, climbed 64.89% last year, a commendable performance but still lagging Bitcoin ETFs.

The MAGS ETF offers equal-weight exposure to the Magnificent Seven stocks:

- Alphabet Inc GOOGL GOOG

- Amazon.com Inc AMZN

- Apple Inc AAPL

- Meta Platforms Inc META

- Microsoft Corp MSFT

- Nvidia Corp NVDA

- Tesla Inc TSLA.

Chart created using Benzinga Pro

MAGS has mostly stalled in recent months, with a 0.24% gain over the past month and signs of short-term selling pressure.

Its price of $55.04 sits below its eight and 20-day SMAs but above the 50 and 200-day SMAs, reflecting a mix of caution and resilience. As tech struggles to regain momentum, investors may seek opportunities elsewhere.

Crypto steals the spotlight as SPY and MAGS navigate choppy waters. Can Bitcoin ETFs keep their lead in 2025?

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.