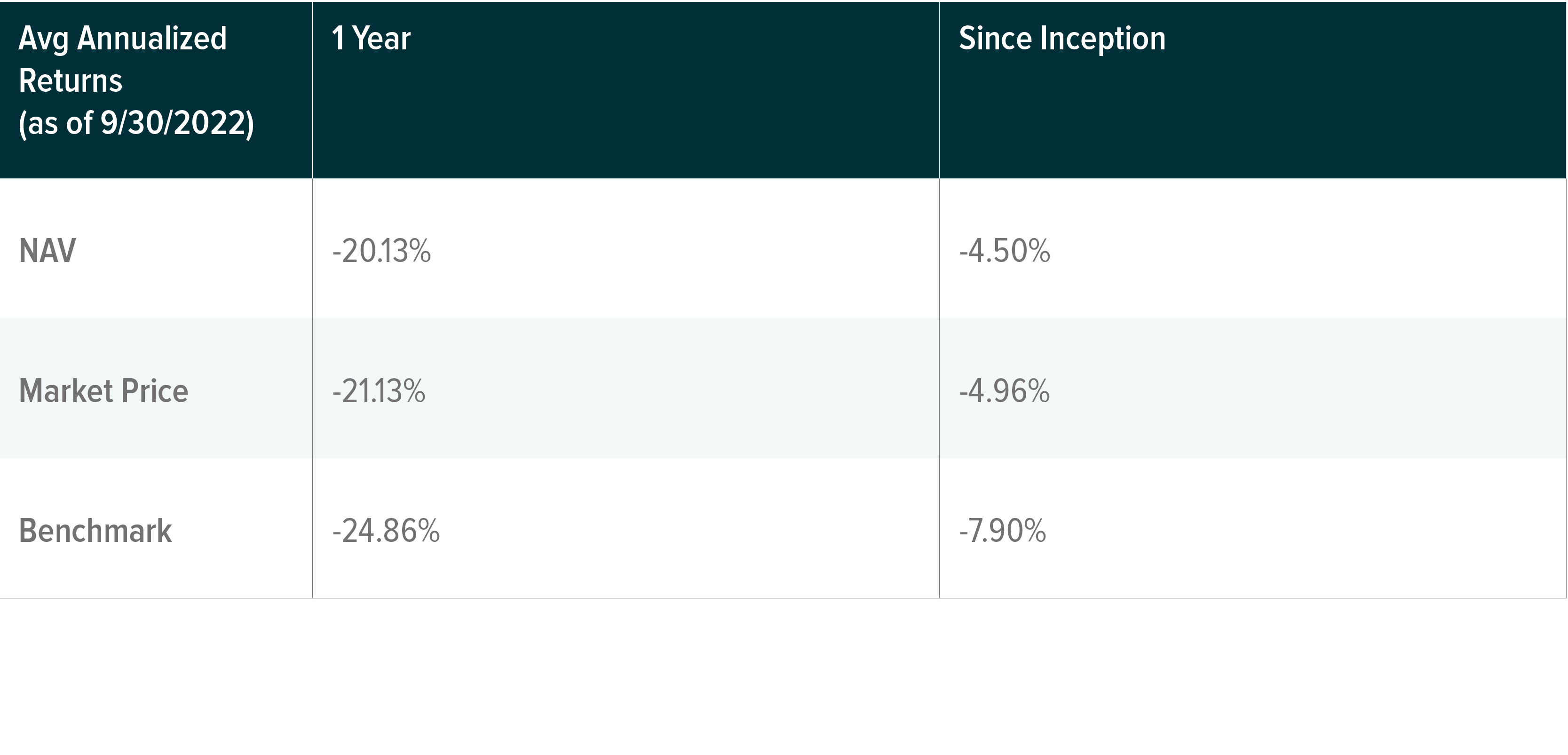

For the period July 1, 2022, to September 30, 2022 (the “Period”), the Global X Emerging Markets Bond ETF (the “Fund”) sub-advised by Mirae Asset Global Investments (USA) LLC posted a loss of 4.11% (including distributions paid to unitholders). This performance compares to a loss of 4.90% for the Fund’s benchmark, the JP Morgan EMBI Global Core Index (the “Index”) during the same period.

The performance data quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. For performance data current to the most recent month or quarter-end, please click here. Total expense ratio: 0.39%.

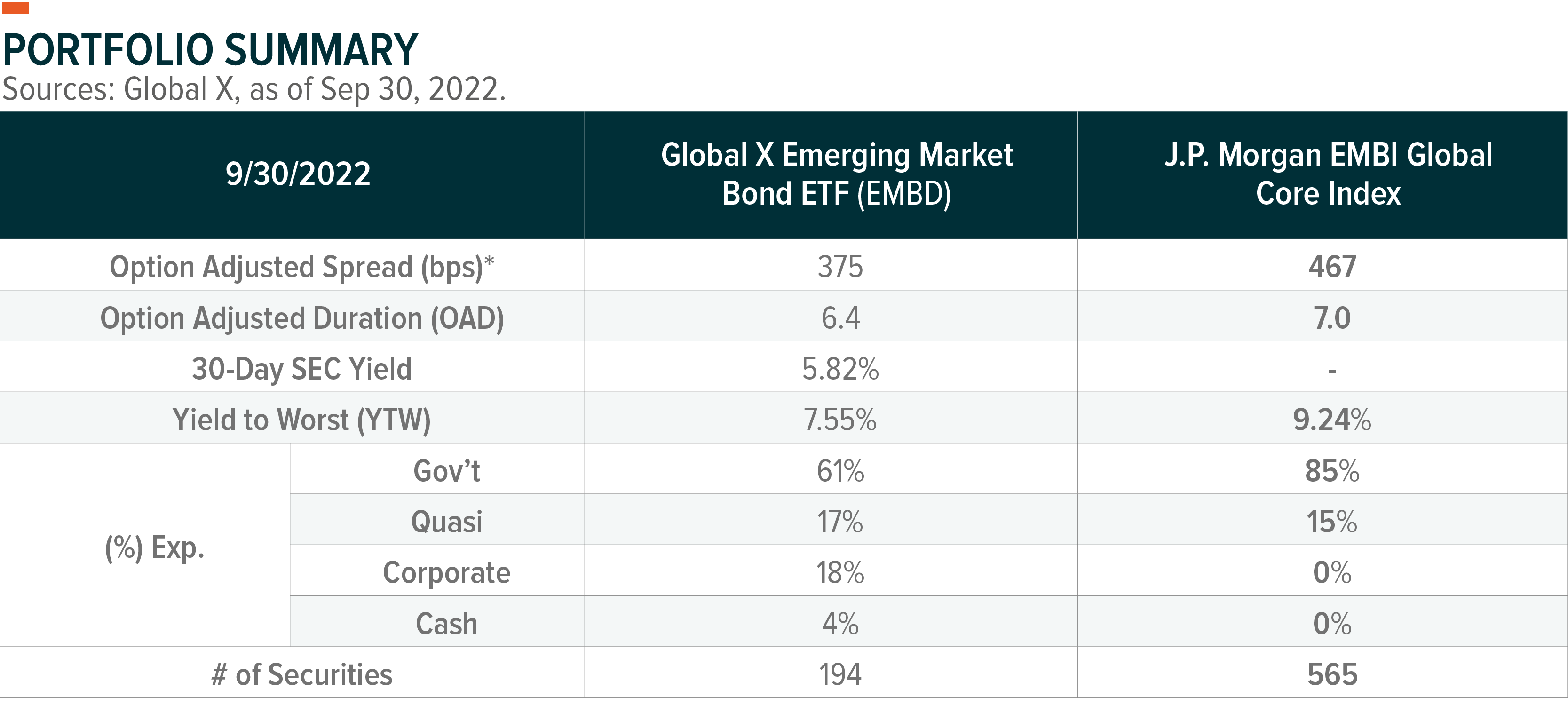

The Index tracks liquid, US dollar emerging market (EM) fixed and floating-rate debt instruments issued by sovereign and quasi-sovereign entities.

General Market Review

Heading into the third quarter, financial markets were positioned for a gloomy macro outlook due to three primary drivers. Firstly, markets were concerned about how aggressively central banks would continue tightening monetary policy on the back of unabating inflationary dynamics. Secondly, investor concerns over recession risks rose as growth momentum started to show signs of weakness. Lastly, fear of Russia completely cutting off gas supplies to Europe intensified as the Russia-Ukraine war became dragged out. All of the above risk factors turned for the worse during the period, but risk asset price movements were interestingly much more benign than expected. In fact, risk-assets staged a mini-rally on the back of a possible US Federal Reserve (Fed) pivot in policy. At the time, the Fed reasserted its hawkish policy stance and even strengthened its hawkish forward guidance at both August’s Jackson Hole summit and September’s FOMC meeting, guiding the market towards a “higher for longer” policy path with a third consecutive 75 bps hike during September’s FOMC.1 Consequently, the US 10-year Treasury yield rose more than 81 bps to 3.83%.2

Across financial markets, the bond market was the worst performing asset class as global central banks embarked on an even faster tightening cycle. In addition to central banks’ tightening policy pressures, bond markets were jolted by the announcement of UK’s energy price measures and pro-growth expansionary fiscal plans, which were expected to be financed through additional government borrowings. A notable shift in fiscal measures in the US was also observed as state governments (18) distributed some form of “inflation stimulus” checks before the midterm elections to help residents cope with high living costs.

Credit markets were relative outperformers for the period as the global high-yield spread narrowed by 14 bps with markets assessing a higher probability of a soft-landing scenario with fewer bankruptcies than typical recessions.3 A more benign recession risk scenario was predicated on the assumption that the Fed would quickly pivot its monetary policy when economic conditions deteriorate. However, the September FOMC and dot-plots indicated that the Fed was aiming to regain control of inflationary dynamics at the expense of slowing economic growth.

Emerging market (EM) assets were pressured mainly as a result of slower global growth momentum and hawkish Fed policy. A stronger US dollar tightened financing conditions for emerging markets. From a growth perspective, the Chinese economy, which appeared to rebound from April lows on the back of government pledges to ease regulations and implement more policy support, had a muted recovery as Chinese homebuyers joined a nationwide mortgage boycott intensifying the real-estate downturn. Furthermore, China’s Zero-COVID policy resulted in more lockdowns in major cities, dampening the prospects for a quicker recovery. On the other hand, a moderation of oil prices relieved energy importers from external pressures. Some EM central banks, who began the hiking policy path sooner than Developed Market counterparts, indicated peak rates were near with slowing domestic demand dynamics.

Pakistan was among the top underperformers. Pakistan’s prospects worsened after a devastating flood submerged one third of the country, pressing the government to seek debt relief from its international creditors as the flooding caused an estimated total of $30bn in damage costs.4 Even before the disaster, Pakistan was struggling to repay its outstanding external debts of about $100bn due to a balance-of-payments crisis and depleted foreign exchange (FX) reserves, which stood at $8bn (enough to cover less than 2 months of imports) at the end of Q3 2022.5 Though Pakistan received some debt relief in the form of a $1.1bn bailout from the IMF in late August along with an agreement to not only extend the country’s Extended Fund Facility by a year until end-June 2023 but also increase the total funding by $940mn to about $7bn, market concerns surged with fear of another default as the flooding further amplified Pakistan’s challenges.6

Meanwhile, Ukraine started the third quarter by officially asking international creditors to freeze its debt payments on $3bn of outstanding Eurobonds for 2 years and to make changes to its GDP warrants in a consent solicitation as the government sought to preserve cash for its prolonged war against Russia. In August, Ukraine’s Finance Ministry announced that holders of approximately 75% of Ukraine’s outstanding debt agreed to the solicitation, passing the needed approval from holders of at least 2/3 of the total and more than 50% of each issue.7 Though the deferral in payments provided room for improvement in the foreign currency cash flow for Ukraine, markets saw the freeze by itself to be insufficient to stabilize FX reserves, which fell to $22.4bn at the end of July from $28.2bn in March.8 Concerns further increased in September as Russian President Vladimir Putin began a partial mobilization and warned that Russia would “use all available means” to counter threats against the nation’s territorial integrity.

In Kenya, William Ruto was sworn in as the country’s fifth president after winning a tight electoral race with 50.5% of the votes against 48.9% for opposition leader and former Prime Minister Raila Odinga. As Kenya’s Independent Electoral and Boundaries Commission (IEBC) declared the winner in August, many feared the tightness of the race would open the results for dispute as seen in past elections. While the 2007 election caused violence leaving some 1,200 people dead and more fleeing homes amid claims of a stolen election, the 2017 elections caused the Supreme Court to annul the results and order a re-run of the presidential poll due to logistical errors. However, as Odinga accepted the Supreme Court ruling upholding the result, fears of political violence were gradually alleviated.

Portfolio Review

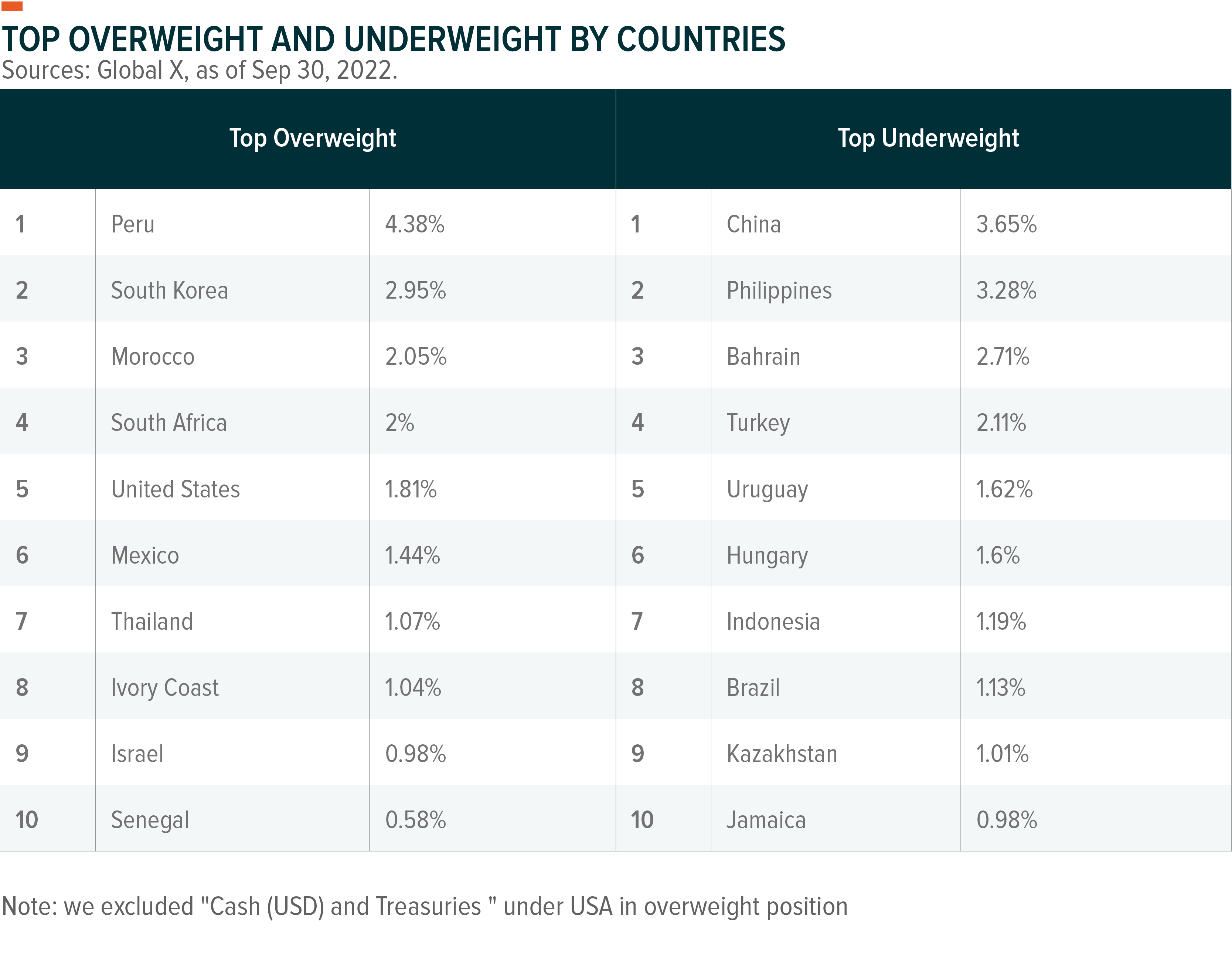

During the period, the Fund outperformed the Index by 79 basis points. The Fund’s duration, which measures sensitivity to interest rate changes, was low relative to the Index. That and the Fund’s country selections positively contributed to the Fund’s performance by 50 bps and 51 bps, respectively. However, the Fund’s security selections detracted 22 bps from performance.

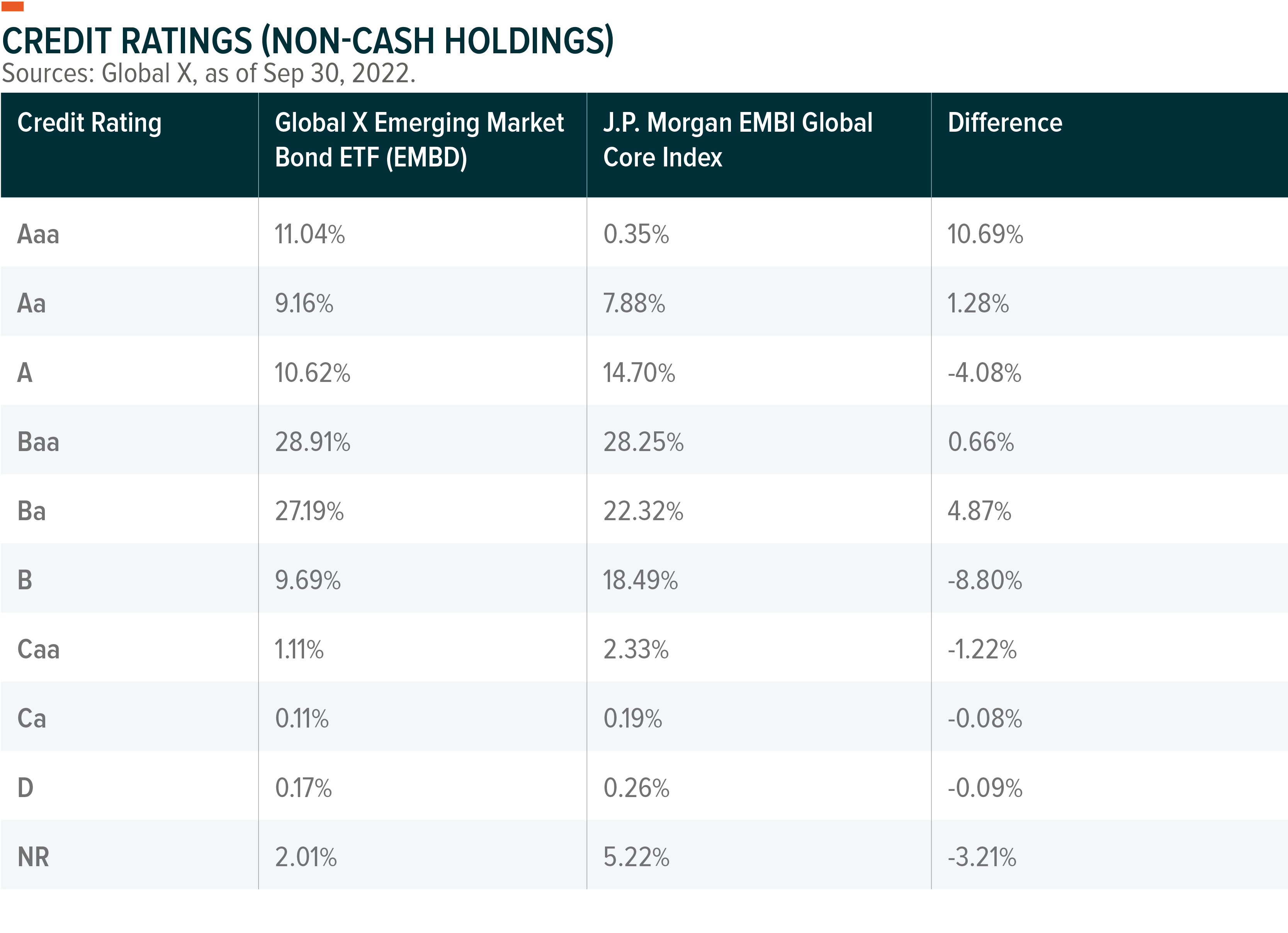

We maintained a conservative stance for the period as we expected the risk-reward mix to continue tilting towards downside risks rather than the upside potential. We continued to move up the credit quality spectrum by adding high-quality issuers while reducing our lower quality and high-beta exposures. Beta measures the extent a stock moves when the market moves, with a high-beta implying higher volatility than the market.

The largest positive contributions came from underweight positions in Hungary (13 bps), the Philippines (13 bps), Ghana (11 bps) and Oman (6 bps). Ghanaian authorities and the IMF continued negotiations on a program aimed to ensure debt and macroeconomic stability through key structural reforms and social protection. The government had previously indicated it would not seek financial help from the IMF. However, that policy decision was later reconsidered with an announcement from Finance Minister Ken Ofori-Atta stating the government’s plans to borrow $3bn over the course of 3 years.9

Separately, the Fund’s country selection of Sri Lanka further added to performance. The country reached a staff-level agreement with the IMF for a $2.9bn, 48-month arrangement under the Extended Fund Facility (EFF) provision in early September.10 The agreement came as inflation reached a record 60.8% YoY in July and after the IMF resumed talks with a new government under President Ranil Wickremesinghe, who the IMF claimed showed commitment to comprehensive and significant reforms as Sri Lanka faces the need to restructure nearly $30bn of debt.11

On the contrary, Mexico (-10 bps), Brazil (-9 bps), Turkey (-8 bps), Colombia (-7 bps), and South Africa (-6 bps) were the main detractors from performance. Colombia witnessed the inauguration of the country’s first leftist president, Gustavo Petro, who promised to transition to an economy without coal or oil and to make fiscal reforms to improve the country’s long-standing income inequality. Within Petro’s first month in office, the administration sent a 25tn COP ($5.6bn) tax reform bill to Congress alongside a record budget of 405.6tn COP ($93.3bn) for the year of 2023.12,13 The latter was unanimously approved by the Congressional economic committees but has yet to be ratified by Congress to become law.

Meanwhile, the Central Bank of Turkey (CBRT) surprised markets by ending its 7-month pause in the easing cycle in August with a 100 bps rate cut from 14% to 13% despite inflation reaching 79.6%.14 The decision to resume President Recep Tayyip Erdogan’s unorthodox belief of high interest rates causing inflation soon continued with another cut of the same size one month later amid inflation running at a 24-year high above 80%.15 As the Monetary Policy Committee (MPC) reiterated expectations of the disinflation process starting on the back of its policy measures and justified the recent rate cuts with “a loss of momentum in economic activity” since the beginning of July, markets expected the CBRT to continue cutting the interest rate further, especially in the lead up to next year’s general elections.

Outlook & Strategy

As we head into Q4 2022, the outlook for external macroeconomic conditions in the EM sovereign credit market is challenging. We believe the Fed’s current monetary policy stance is too restrictive on the back of rapidly deteriorating macroeconomic conditions and could pose higher financial stability risks. Our assessment is that the Fed’s new hawkish “higher for longer” guidance was sufficient to avoid inflationary pressures from becoming entrenched, especially when the full effects of quantitative tightening were not considered. Meanwhile, the Fed’s push for higher terminal rates towards 4.5-4.75% at September’s FOMC was imprudent given the market was still assessing the impact of the “higher for longer” policy. We highly expect to see a similar situation to late June, when the Fed was challenged by the market to backtrack on its hawkish stance with funding market stress and recession fears.

One of the most challenging issues for financial markets is the growing calls for global governments to respond to the cost-of-living crisis with fiscal support to prevent social unrest. For example, given the energy price crisis is not a one-off transitory shock from the geopolitical realignment of energy supplies, governments’ responses to higher energy prices with price controls and subsidies will not be able to bring balance to the supply and demand. More importantly, such expansionary fiscal policy measures will counter monetary authorities’ attempt to tame inflationary pressures and force central banks to maintain a restrictive monetary policy much longer than desired. Thus, the outcome of the US mid-term elections will be important as strong results for the Democrats could lead to further expansionary fiscal policy with increased budget deficits.

We expect the global growth momentum to continue trending lower in Q4 2022 with Europe leading the slowdown with an energy supply crisis, high inflation and a rapid reversal of the European Central Bank (ECB) policy. China’s economic activity will add to the slowdown as it has failed to recover more quickly due to Beijing’s commitment to the Zero-COVID policy and as we do not expect such policy to dramatically change even after the 20th Party Congress. Furthermore, the Biden administration’s aggressive trade and technology restrictions will likely not only worsen China’s economic activities but also have negative global trade implications.

EM sovereign credit fundamentals could continue to face headwinds as the Fed’s tightening monetary policy will cause capital outflows from the emerging markets, forcing EM governments to pay high external borrowing costs. As noted above, the slowing global growth momentum and the US-China trade war will further pressure EM’s macroeconomic outlook. With the IMF pressing EM issuers and investment community to adopt the G20 Common Framework, we could see more highly distressed EM issuers seeking debt moratorium in the coming months. That being said, investors in EM credit markets have priced in most of these risks as the EM high-yield spread nears 1000 bps with large underweight positioning across the EM debt investor community.

Given that the risk-reward mix is tilted towards more down-side risks than upside potential, we plan to maintain a conservative portfolio stance. However, we plan to use the weaknesses in the credit markets triggered by the market’s overly aggressive assumption of the Fed’s policy stance to tactically add duration risks. We feel that the current market pricing of the Fed’s fund rates is too aggressive, and that the Fed would have to balance the financial stability risks with the goal of containing the inflation outlook. From a credit risk perspective, we plan to continue moving up the credit quality spectrum by adding high-quality issuers while reducing lower quality and high-beta exposures. We find the investment grade corporate sector attractive from a risk-reward perspective as they provide a hedge against downside risks given that their credit fundamentals remain solid. Our regional allocation mix favors the Middle East over Latin America and Asia due to heightened commodity price volatility and political risks. From a country allocation perspective, we believe credit differentiation driven by sovereigns with healthy external balance sheets will be the key theme for EM assets as the Fed withdraws liquidity support from the system.

Credit Ratings noted are by Fitch, Moody’s, and Standard & Poor’s. Ratings are measured on a scale that generally ranges from Aaa (highest) to D (lowest). If more than one of these rating agencies rated the security, then an average of the ratings was taken to decide to security’s rating.

Holdings are subject to change.

Related ETFs

| EMBD: The Global X Emerging Markets Bond ETF is an actively managed fund sub-advised by Mirae Asset Global Investments (USA) LLC that seeks a high level of total return, consisting of both income and capital appreciation, by investing in emerging market debt. EMBD primarily invests in emerging market debt securities denominated in U.S. dollars, however, the Fund may also invest in those denominated in applicable local foreign currencies. Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries.

EMBD’s portfolio managers incorporate both top-down macro views consistent with the firm’s Investment Committee and bottom-up fundamental research to evaluate the investment attractiveness of select countries and companies that are believed to offer superior risk-adjusted returns. The portfolio managers determine country allocation primarily based on economic indicators, industry structure, terms of trade, political environment and geopolitical issues. In addition, the portfolio managers conduct relative valuation analysis on sovereign and corporate issues to tactically identify potential opportunities to enhance the Fund’s risk-adjusted returns. The portfolio managers may dynamically adjust the top-down and bottom-up strategies of the Fund to better reflect market developments. Please click the fund name above for current fund holdings and important performance information. Holdings are subject to change. |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.