Climate change represents one of the greatest challenges the world faces. Rising temperatures, increased frequency of extreme weather events, water scarcity, and other adverse consequences have brought environmental concerns to the forefront, sparking over seventy countries to commit to net-zero emission targets.1 One of the key levers countries will likely utilize to meet these emissions goals is the transition from vehicles using traditional internal combustion engines (ICEs) to electric vehicles (EVs). This shift could meaningfully reduce the global carbon footprint, since the transportation sector currently constitutes 22% of global emissions2. In this report, we analyze the EV transition, the outsized role emerging markets (EMs) play in the electric vehicle supply chain, and how this represents a potential longer-term idiosyncratic tailwind for the EM asset class.

Key Takeaways

- As countries around the globe work to achieve net-zero emissions, the transition from traditional internal combustion engines to electric vehicles will likely be essential in reaching these goals.

- Given their outsized role in commodities production, emerging markets stand to be key beneficiaries of the shift to electric vehicles.

- Electric vehicle adoption in emerging markets is likely to be slow, but we do expect to see some progress beyond China.

Putting the Electric Vehicle Opportunity Into Perspective

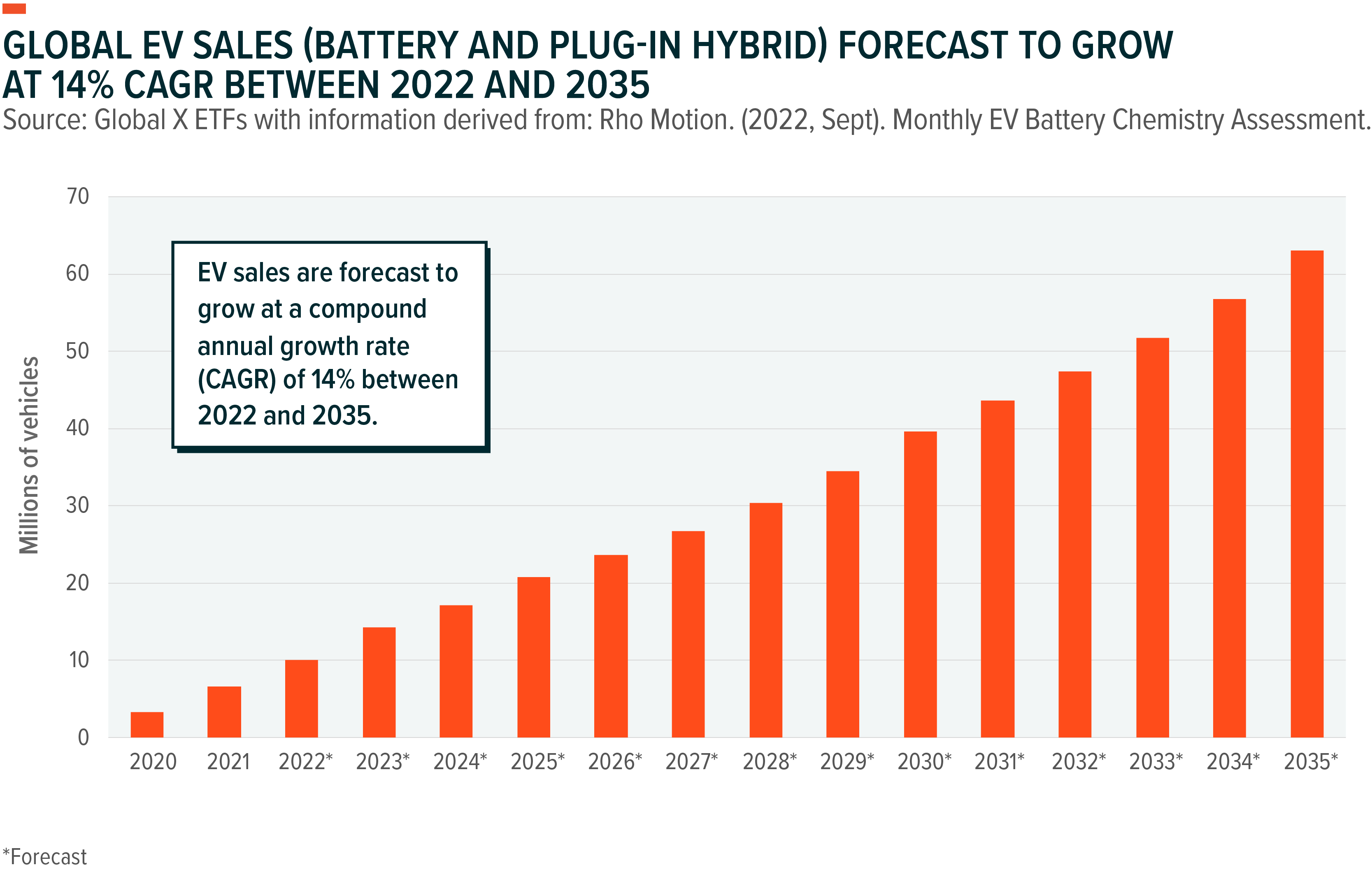

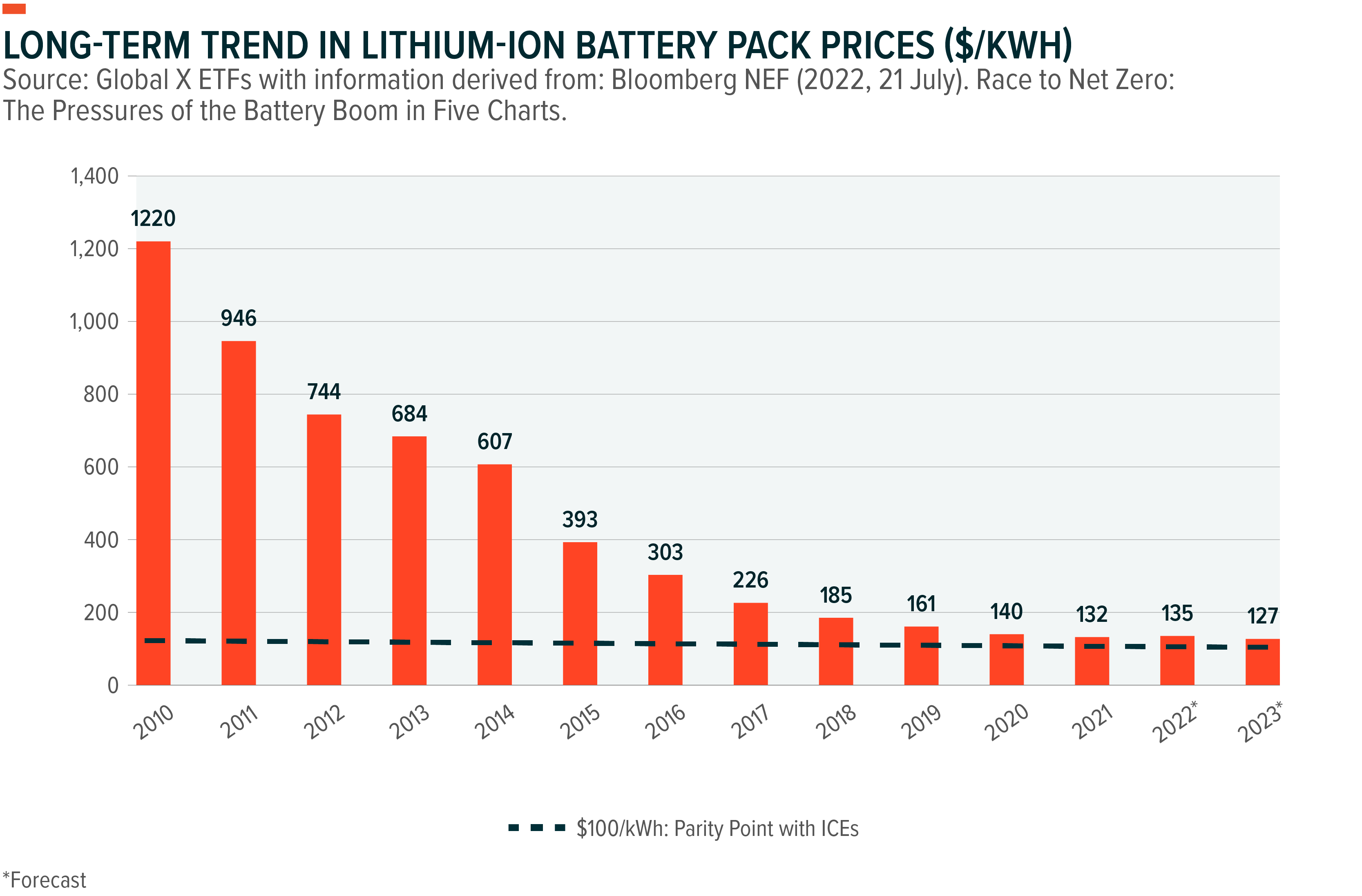

Electric vehicle penetration accelerated over the past decade, due to technological improvements, which increased battery storage capacity while also greatly reducing the cost of batteries. Beyond continued technological innovation, government subsidies and charging-infrastructure buildouts will likely help further accelerate EV adoption. EV penetration stood at 9% in 2021, and analysts estimate that if we remain committed to our net-zero goals, EVs as a percentage of new light vehicle sales would have to rise to over 60% by the middle of the next decade.3 The cumulative vehicle investment to achieve net-zero emissions by 2050 will probably come in around $81.8 trillion, while charging infrastructure investments could total an additional $2.8 trillion.4 This opportunity is clearly immense, but how do emerging markets factor into this equation?

Emerging Markets Provide Key Materials for Electric Vehicles

Lithium is one of the major inputs for electric vehicle batteries, with each battery containing roughly nine kilograms of the element.5 EV penetration will likely drive exponential need for lithium, with demand expected to increase forty-fold by 2040.6 Over the past year or so, the supply of lithium has been unable to meet this EV-led demand boom, causing a spike in battery-grade lithium prices in 2022 which, despite continued technological improvements, led to the first increase in EV battery prices since 2010. Although lithium prices have pulled back since peaking in November 2022, they remain well above pre-pandemic levels.7

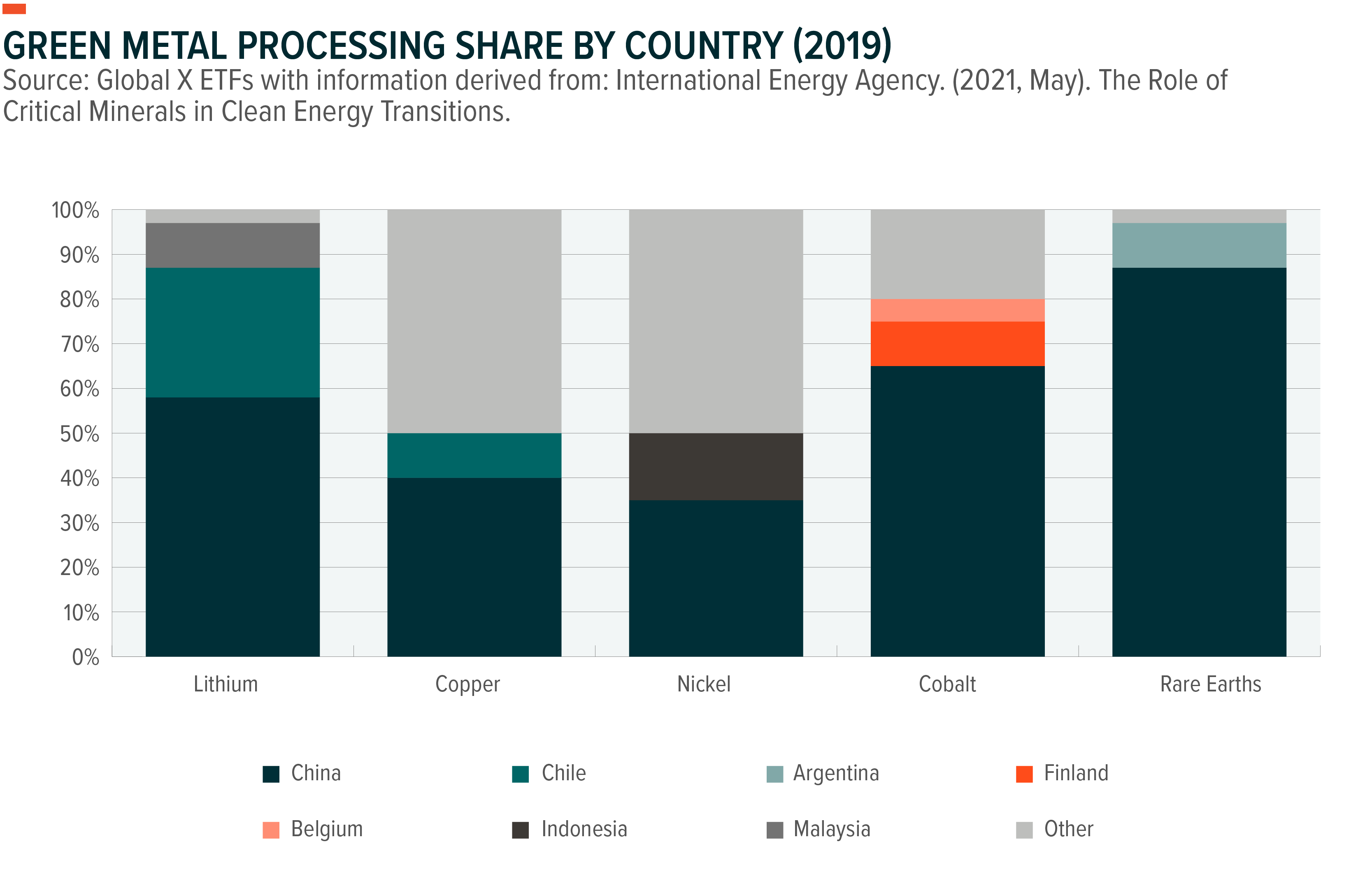

Supply has underwhelmed due to the lack of investment, political uncertainty, and the long ramp-up time for new projects. This is particularly evident in Latin America, where roughly 55% of the world’s reserves lie in the “Lithium Triangle” alone.8 This 400,000 square kilometer area that spans across Chile, Argentina, and Bolivia only contributes 35% of global supply.9 Moreover, this percentage is expected to decrease over time, as new projects are unlikely to be approved in Chile and Bolivia’s production capabilities remain inadequate. China is the other large EM producer of lithium, with the country’s current output amounting to 15% of the global supply and growing.10 Despite new projects in other markets, with Australia leading the charge, global climate goals demand further investment.

Copper is another major input for the green energy transition, with the typical EV utilizing more than double the amount of copper than the average ICE vehicle.11 Copper is also a major input in EV charging stations, wind and solar power, and other green technologies. As a result of its utility across the energy transition, green demand will likely grow from 3% of global copper demand in 2020 to approximately 15% by 2030.12 Emerging markets are currently large producers of copper, constituting over 70% of global supply, while Chile and Peru account for roughly 25% and 10%, respectively.13 The current supply outlook is limited, and supplies could remain pressured through 2030, according to some estimates.14 As a result, the supply/demand dynamics could translate into higher prices, representing a significant tailwind for certain emerging markets.

Other metals, such as cobalt and nickel, are also integral to EV batteries, especially the higher-end versions that currently dominate global markets. Consequently, continued subsidies for EVs and tighter regulations surrounding ICE vehicle sales should drive demand for these types of batteries. For cobalt, supply is very concentrated, with the Democratic Republic of the Congo responsible for over two-thirds of global output.15 This concentration adds a lot of risk to the EV supply chain, and we expect to see increased investment in alternative jurisdictions that report high levels of cobalt reserves, such as Australia. Looking at nickel, output concentration is less of an issue, but current supply remains constrained, and continued investment appears needed to meet the expected growth in future demand from electric vehicles.

China Dominates the Remainder of the Battery Supply Chain

In addition to producing an increasing amount of rare earth metals needed for green technologies, China will probably benefit from the transition to EVs, as it plays a dominant role further down the supply chain. China processes and refines about 60% of global lithium and 80% of cobalt.16,17 It is also a major player when it comes to copper and nickel. Furthermore, China is by far the market leader in battery construction, representing 70% of global cathode and 85% of anode production.18 This dominant market position has raised red flags and pushed the United States, through the Inflation Reduction Act, to increase domestic battery making capacity. Although China’s market share may fall, it still stands to benefit, as it will likely remain the key player in the rapidly growing EV market moving forward. The push to reduce the global EV supply chain’s reliance on China represents an interesting nearshoring opportunity for other emerging markets, such as Mexico. In fact, Tesla recently announced its intention to build one of its gigafactories in Mexico, an investment that could be worth some $5 billion and create up to 6,000 jobs.19

Emerging Markets Likely to Be Adoption Laggards, but We Anticipate Progress

Although emerging markets are vital for the global transition to electric vehicles, adoption in most EMs will probably be delayed due to myriad factors. Most notably, high sticker prices and elevated financing costs price out many EM consumers, while EM governments generally lack the ability to invest in infrastructure or subsidies. China is the major exception, with the country currently leading the adoption curve, due to government investment, population density, and a strong push from domestic EV producers, such as BYD. This energy transition is likely key for China to reach its goal of net-zero emissions by 2060, especially as it is currently the largest producer of emissions globally.20,21 We expect China to remain ahead of the curve, with its wide assortment of EVs unlocking consumption from a larger segment of the population.

Electric vehicle adoption in many emerging markets will likely lag those of developed market peers and China. However, we believe there is ample opportunity for environmental improvements within certain markets, which will be instrumental in achieving global emission goals, since EMs outside of China constitute over one-third of global CO2 emissions.22

Shining a Spotlight on Brazil

Brazil is an interesting example of an EM country that could see long-term EV adoption, as 84% of its energy generation stems from hydro-power and other renewables, while nearly all of the country’s light vehicles currently run on ethanol fueled engines.23 Although the EV transition is less feasible in the short term, the private sector is already driving environmental efficiency improvements in the transportation sector, and these corporations appear well positioned to expedite the eventual EV transition in Brazil. For instance, Vamos rents and leases new heavy vehicles, such as trucks and machinery, to both businesses and individuals in Brazil. The Brazilian truck fleet is aged when compared to peer markets, with the average commercial vehicle being 20.7 years old.24 As a result, the inefficiency of the fleet drives up both fuel costs and CO2 emissions. Vamos’s offerings can assist in solving this issue, by helping replace older trucks with newer versions, which can produce up to 95% less CO2, while also offering its customers a roughly 30% cost savings.25

Rumo is the largest rail operator in Brazil, with the majority of its business exposed to the quickly growing agricultural sector in the interior of the country. Currently, Brazil’s transportation sector is much more reliant on trucks than rail, resulting in inefficiencies, higher costs, and elevated CO2 emissions. Consequently, Rumo drives innovation as it takes market share away from trucks, increases its capacity through investments in new projects, replaces older locomotives with more fuel-efficient engines, and implements technology to further optimize its operations.

Finally, Localiza is the largest car and fleet rental company in Brazil, with the company now building out its long-term individual rental business. Localiza’s business model allows it to be a major force behind the renewal of Brazil’s light vehicle fleet. Once EV demand accelerates in the country, we expect to see Localiza as being a key driver of the EV transition in Brazil.

Conclusion: Electric Vehicles Expected to Drive Growth for Emerging Markets

The commitment to various environmental goals should cause electric vehicle demand to accelerate in the coming years. Emerging markets could benefit from this trend, due to their essential nature within the global supply chain. Elevated green commodity prices could also help support many EM fiscal positions, as well as attract further investment into their economies. In conclusion, global EV adoption will likely remain a key driver for EMs moving forward, providing attractive opportunities for investors.

Related ETFs

DRIV – Global X Autonomous & Electric Vehicles ETF

LIT – Global X Lithium & Battery Tech ETF

COPX – Global X Copper Miners ETF

Click the fund name above to view current holdings. Holdings are subject to change. Current and future holdings are subject to risk.

Image sourced from Shutterstock

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

1. United Nations Climate Action. https://www.un.org/en/climatechange/net-zero-coalition. Accessed on 3/7/23.

2. International Energy Agency. (2022, July). The Role of CCUS in Low Carbon Power Systems.

3. Bloomberg NEF. (2022). Electric Vehicle Outlook 2022.

4. Ibid.

5. International Energy Agency. (2021, May). The Role of Critical Minerals in Clean Energy Transitions.

6. Ibid.

7. Trading Economics. https://tradingeconomics.com/commodity/lithium. Accessed on 3/7/23.

8. United States Geological Survey (2023, January). Lithium.

9. Ibid.

10. Ibid.

11. International Energy Agency. (2021, May). The Role of Critical Minerals in Clean Energy Transitions.

12. Ibid.

13. United State Geological Survey. (2023, January). Copper.

14. CNBC. (2023, Feb 7). There Isn’t Enough Copper in the World – and the Shortage Could Last Till 2030.

15. United States Geological Survey (2023, January). Cobalt.

16. China Briefing. (2022, Nov 30). China’s Lithium-Ion Battery Industry – Overcoming Supply Chain Challenges

17. National Defense Magazine. (2022, Aug 3). United States Seeking Alternatives to Chinese Cobalt.

18. International Energy Agency (2022, May). Global EV Outlook 2022.

19. Reuters. (2023, March 1). Tesla Plans Gigafactory in First Mexico Investment.

20. Carbon Brief. (2021, Dec 16). Q&A: What does China’s New Paris Agreement Pledge Mean for Climate Change?

21. United States Environmental Protection Agency. (2023, Feb 15). Global Greenhouse Gas Emissions Data.

22. International Energy Agency. (2021, April). Global Energy Review 2021.

23. International Trade Administration. (2021, Jan 21). Brazil – Country Commercial Guide.

24. Grupo Vamos. Integrated Annual Report 2020.

25. Grupo Vamos. Institutional Presentation Q4 2020.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.