The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

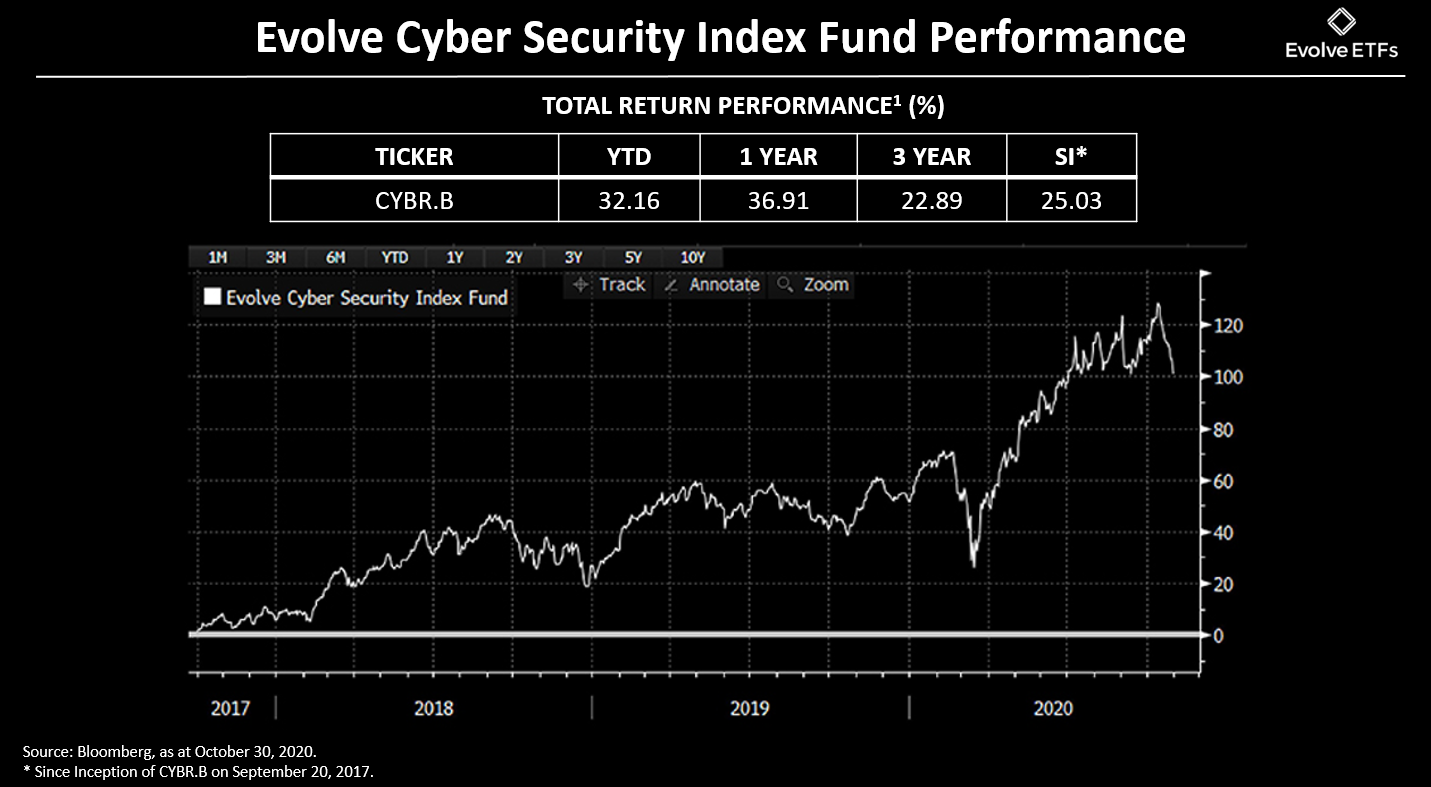

September marked the three-year anniversary of one of Canada’s largest thematic ETFs, the Evolve Cyber Security Index Fund CYBR. During each of those three years, CYBR has roughly doubled in size, growing from $35 million in assets under management (AUM) in 2018 to $68 million in 2019 to over $150 million today.

However, the ETF’s rapid growth rate isn’t a surprise to Evolve ETFs President and CEO Raj Lala, who points to even larger figures surrounding the global cybersecurity industry that helps put CYBR’s AUM growth and performance into greater perspective.

“I think most people underestimate how big the cybersecurity industry really is,” said Lala in a recent investor presentation on CYBR. “Currently, cybersecurity is a $159 billion industry, the entire Canadian banking industry is $160 billion. So it’s about the same size, but growing a lot quicker. It’s expected in the next few years the cybersecurity industry is forecast to be over $200 billion in size. Already it’s about 50-60% larger than the Canadian real estate sector.”

Another figure Lala thinks investors should keep in mind is $6 trillion, which he explains is, according to Cybersecurity Ventures, the estimated total cost of cybercrime to the global economy over the next year. This value is tied exclusively to data, something that is becoming the most valuable commodity in the contemporary world.

These numbers foreground Lala’s and Evolve’s perspective on what CYBR provides investors, which is differentiated exposure to technology that is resistant to the headwinds faced by many other segments of the market. While other industries struggle to adapt to the rapidly changing social, technological and economic circumstances of the 21st century, Lala believes the cybersecurity sector is positioned to not only weather these challenges but thrive within them.

Security In An Insecure Time

Critically for Lala, the headwinds mentioned above are no longer abstract or hypothetical. Due to the global pandemic and the economic privations it has caused, this year has forced businesses and society at large to undergo a rapid shift to online and digital work, a difficult transition made even more harrowing due to the threat of a global economic recession that is either incoming or, in some instances, already well underway.

But despite the slowdown faced by private and governmental organizations as a result of the pandemic, attempted cybercrime experienced no such impediment, increasing by 55% in the first quarter of 2020, according to Lala.

“When COVID kicked in, most organizations asked their employees to go home and hundreds of millions of people went from working in an office to working at home. What that created is an apparent weakness in the corporate infrastructure or, more specifically, cybersecurity infrastructure. It’s one thing to protect your central corporate data within your central servers, it’s another thing to build security and build fences around each one of your employees working from home,” said Lala.

This lends credence to what Lala believes is the primary thesis underlying CYBR and the cybersecurity industry as a whole: its resilience to economic or market shocks. Lala explains that, when the survival of an organization and its management relies on the ability to protect its data, cybersecurity is the last place that an organization would think to cut expenses.

“Whether we’re in a recessionary environment or expansionary environment, organizations continuously have to improve their systems,” said Lala. “Which is why this industry, this sector, has really interesting elements of recession resilience. These are not companies that are creating an online shopping app or a smartphone, these are companies that are providing essential services via hardware, software and consulting to protect all of the largest organizations worldwide.”

An Industry For The Modern Age

Evidence of the mission-critical role played by cybersecurity is fairly abundant within contemporary history. Recent high-profile breaches in Twitter Inc. TWTR and Garmin Ltd. GRMN cost each company millions of dollars while hacks to government entities like the Canadian Revenue Agency and the city governments of Baltimore and Atlanta continue to illustrate the need for digital safeguards throughout all aspects of public and private life.

Meanwhile, cloud security companies like Okta, Inc. OKTA, Zscaler, Inc. ZS and CrowdStrike Holdings, Inc. CRWD continue to see year-over-year revenue growth of 40% all the way up to 80%, even as other tech companies warn of uncertainty and slash their corporate guidance. Much of this growth is in fact driven by a surging contingent of small tech firms who are outsourcing their cybersecurity needs. According to data from IT consulting firm Gartner, roughly 75% of IT spending in 2020 directed to outside firms.

What’s more, hiring and recruitment in the industry or for cybersecurity-focused IT positions is soaring. A conservative estimate from industry analyst firm Cybersecurity Ventures projects there will be 3.5 million unfilled cybersecurity jobs globally by 2021, about a million more than there were in 2014.

However, Lala makes clear that this is not a new or passing phenomenon. He has closely watched the behavior of cybersecurity stocks throughout CYBR’s lifetime and has seen the sector buck larger market trends.

“A couple of years ago, the Nasdaq had a 15% decline between mid-January to early-March of 2018, cybersecurity companies actually had positive performance during this period. It’s definitely shown to be a differentiated form of technology that exists out there with very little overlap to traditional equities” said Lala.

Lala believes that differentiated exposure is a core element of what sets CYBR and all of Evolve’s funds apart from other thematic ETFs. Looking through CYBR’s 51 holdings, investors won’t see names like Microsoft Corporation MSFT, Cisco Systems, Inc. CSCO or IBM Corporation IBM.

Lala explains how this is by design. “Even though they have relevant cybersecurity businesses, those cybersecurity businesses are so small on a relative basis to the rest of their business. What we have done here is we put together a product that allows investors to get pure-play access to cybersecurity companies. Companies that are solely focused on that area of the market, whether it be hardware production, cybersecurity software or consulting.”

More Devices, More Data, More Opportunity

Looking ahead, Lala is convinced that the core catalysts driving growth in the cybersecurity industry will only grow more pressing as the world becomes exponentially more connected and more data-reliant.

He illustrates this point with another pair of large figures. The first is 25 billion, which is the number of internet-connected devices globally, a little more than 3 per person living in the world today. The second figure is 75 billion, which is the current projection for connected devices over the next five years.

“That works out to about 10 per person worldwide,” explained Lala. “The purpose of connectivity is, of course, to make our lives more efficient, more productive and, in many ways, more enjoyable. The downside of that connectivity is it also means there are a lot more entry points for a cybercriminal to actually access our data.”

Given that the current cost of this compromised data is estimated to be higher than the GDP of Japan or Germany, one need only speculate on the potential value of data scoured and collected from every aspect of the lives of nearly 8 billion people throughout the world.

The indicated rates of return are the historical annual compound total returns net of fees (except for figures of one year or less, which are simple total returns) including changes in security value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any security holder that would have reduced returns. The rates of return shown in the table are not intended to reflect future values of the ETF or returns on investment in the ETF.

Commissions, trailing commissions, management fees and expenses all may be associated with exchange-traded funds (ETFs). Please read the prospectus before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. There are risks involved with investing in ETFs. Please read the prospectus for a complete description of risks relevant to the ETF. Investors may incur customary brokerage commissions in buying or selling ETF units.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.