The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

In what is now a seemingly annual trend, 2020 looks to have been another record-setting year in the realm of cybercrime. The year saw a rise in both the size, volume and sophistication of cyberattacks, including high-profile data breaches from the likes of Microsoft Corporation MSFT Alphabet, Inc. GOOG and T-Mobile, Inc. TMUS, culminating in December’s massive SolarWinds hack on multiple U.S. government agencies. The breach represents the largest cyberattack of its kind.

The continued rise in cybercrime underlines the critical role cybersecurity firms hold in the contemporary digital world and reinforces the need among businesses and governments to invest in essential cybersecurity infrastructure.

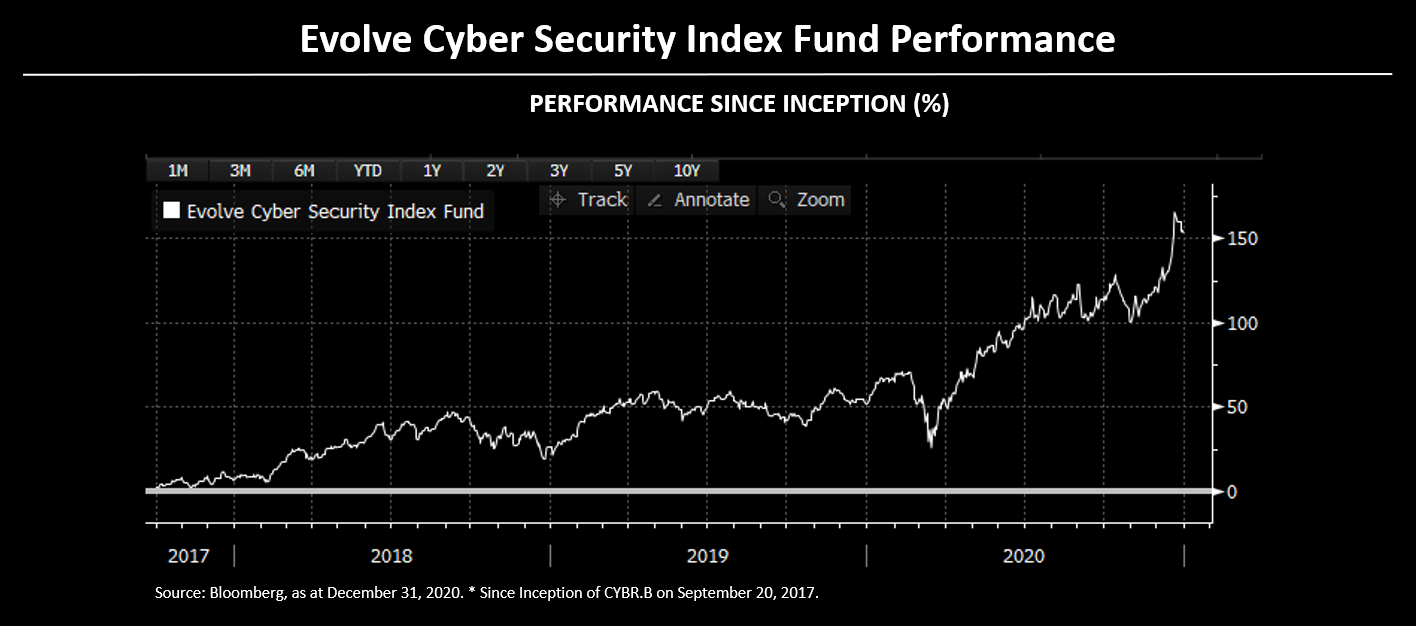

It’s also an increasingly common thesis among traders seeking exposure to the high growth potential of innovative or disruptive industries, a thematic investment trend that is central to Canadian ETF provider Evolve ETFs. Over the three years since its inception, the company’s Evolve Cyber Security Index Fund CYBR has roughly doubled in size annually and remains Canada’s largest cybersecurity fund at more than $200 million in total assets as of the start of the year.

|

Annualized Returns (%) |

|||||

|

ETF |

Ticker |

1YR |

2YR |

3YR |

Since Inception* |

|

Evolve Cyber Security Index Fund (Hedged) |

CYBR |

65.60 |

43.60 |

30.95 |

29.54 |

|

Evolve Cyber Security Index Fund (Unhedged) |

CYBR.B |

66.81 |

41.20 |

33.46 |

32.67 |

|

Evolve Cyber Security Index Fund (USD) |

CYBR.U |

70.16 |

- |

- |

41.77 |

Source: Bloomberg, as at December 31, 2020.

*Since Inception of CYBR and CYBR.B on Sept 20, 2017; CYBR.U on May 16, 2019.

“When we launched our funds just over three years ago in disruptive tech, a lot of investors and advisors didn’t really have a good idea as to how to include them into their portfolios,” Evolve CEO Raj Lala explained in a recent interview with Benzinga. “What we’ve seen over the past four or five months is more and more people recognizing that there’s a place for these types of products in portfolios today.”

Benzinga spoke with Lala to hear his impression of where the growth potential in cyber security lies in 2021 and why thematic investments in the space is a compelling option for traders to take advantage of the rapid growth of disruptive industries and technologies.

Mounting Threats Drive The Need

Among the prevailing cybersecurity trends from last year that Lala highlighted were the increased reliance on remote work, the shift to cloud-based digital networks and the increasingly sophisticated and organized manner in which cyberattacks were carried out, generally as part of an organized cabal with ties to China, Russia or other nation-states.

Lala characterizes this latter trend in terms of other kinds of organized or syndicate criminal activity, where state-sponsored cyber attacks are orchestrated and farmed out to decentralized individual cells, masking the source and scope of a digital offensive.

It’s a model of hacking that’s likely to become increasingly common, and one that is already driving firms to invest in more sophisticated safeguards to detect and prevent. Finnish financial website Sijoitusrahastot compiled data that suggests the growing trend of sophisticated cyber attacks is already pushing cybersecurity spending higher by an estimated 20% this year to more than $50B.

“When you look at the increasing connectivity, you also look to cybersecurity and its fundamental importance. We often say cybersecurity has become the utility segment of the technology industry today. Companies and government agencies have to make it a non-discretionary spend. That’s why we expect the theme to continue to resonate from an investment perspective over the next coming years.”

December’s SolarWinds breach is the latest, and largest, example of the existential need for improved cybersecurity, and has prompted President-elect Joe Biden to declare bolstering the nation’s cybersecurity infrastructure a top priority of his administration.

From Lala’s perspective this core demand among global public and private entities is what will define the leaders in the industry and drive innovation in tandem with the rising sophistication of digital networks and cybercrime.

A.I. And Cloud Drive The Trend

Within the cybersecurity industry itself, Lala expects companies that prioritize predictive technology and cloud-based security to lead the industry. He pointed to CrowdStrike Holdings, Inc. CRWD and its Falcon platform as an example of technology built to anticipate and recognize potential threats or gaps in a digital network before they happen.

“From a trend perspective, artificial intelligence and deep learning are going to continue to become more relevant as it relates to cybersecurity,” said Lala. “It’s one thing to have cybersecurity that reacts to a potential breach, it’s another thing to have cybersecurity initiatives where you can actually forecast and anticipate a breach and prevent it from happening.”

According to Lala, the key to this kind of broad, predictive cybersecurity framework is ensuring that firms are protected at all levels of their organization, from individual employees using multi-factor authentication when accessing their workspaces to the array of local and remote networks on which that information is accessed. Increasingly, this means cybersecurity firms placing greater emphasis on cloud-based security infrastructure.

“Given the fact that so much data is being moved to the cloud, that is where the biggest threats could be over the next five years or so. It’s important for a lot of these cybersecurity companies to make sure that they have the proper cloud-based infrastructure or security in place.”

Lala indicated Zscaler Inc. ZS and their collaboration on the Microsoft Azure cloud computing service as among the most prominent companies to position themselves in the cloud security space.

Innovation and Disruption Drive The Growth

While the year has only just started, cybersecurity is already poised to dominate the investment landscape through 2021. In addition to the rising prominence of cyberattacks, equity investment in the cybersecurity space is already on the rise, with financing in private cloud cybersecurity firms like Iboss and Snyk Ltd. promising to only further expand the scope of an industry whose total equity investments topped $12B in 2020.

Lala’s perspective of this dramatic growth is that it’s a result of traders and investors looking to new and disruptive areas of the market where there is still untapped growth potential. It’s a trend, he says, that Evolve has experienced first hand through the growth of CYBR and its stable of innovation-themed funds.

“I think a lot of people are recognizing that a big portion of the growth in the equity markets is going to come from disruptive innovation,” said Lala. “The likelihood that the FAANG stocks have another double or triple yearly return is pretty low, but that is possible with a lot of the companies that are within our disruptive tech ETFs.”

The Evolve Cyber Security Index Fund is available in ETF (hedged, unhedged and USD versions) as well as mutual fund (class A and F). For more information visit https://evolveetfs.com/product/cybr/

Source: Bloomberg, as at December 31, 2020.

The indicated rates of return are the historical annual compound total returns net of fees (except for figures of one year or less, which are simple total returns) including changes in per unit value and reinvestment of all dividends or distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The rates of return shown in the table are not intended to reflect future values of the ETF or returns on investment in the ETF. ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Commissions, trailing commissions, management fees and expenses all may be associated with exchange traded funds (ETFs) and mutual funds. Please read the prospectus before investing. There are risks involved with investing in ETFs and mutual funds. Please read the prospectus for a complete description of risks relevant to the ETF and mutual fund. Investors may incur customary brokerage commissions in buying or selling ETF and mutual fund units. Investors should monitor their holdings, as frequently as daily, to ensure that they remain consistent with their investment strategies.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.