If the market goes down, there's an easy way to profit.

Many investors think the market is overvalued and they may be correct. At 2.9, the price to sales ratio of the S&P 500 is the highest that it has been in at least two decades. By this measure at least, the market is overvalued.

Bearish investors should consider inverse ETFs as a way to protect themselves from, and even profit, if the market heads lower. These ETFs use complicated strategies to inversely mirror the market, but they trade as regular ETFs or stocks. This means average investors don’t need to be concerned with the mechanics.

See Also: Here's Why Stock Valuations Are Still 'Quite Reasonable'

The ProShares Short S&P500 ETF SH moves in the opposite direction of the S&P 500 Index. If the index is down 1%, this ETF should move higher by about 1%.

The ProShares UltraShort S&P500 ETF SDS is a leveraged inverse ETF. It will make an inverse move that is twice the move of the S&P 500. If the Index is down 1%, this ETF will be up by about 2%.

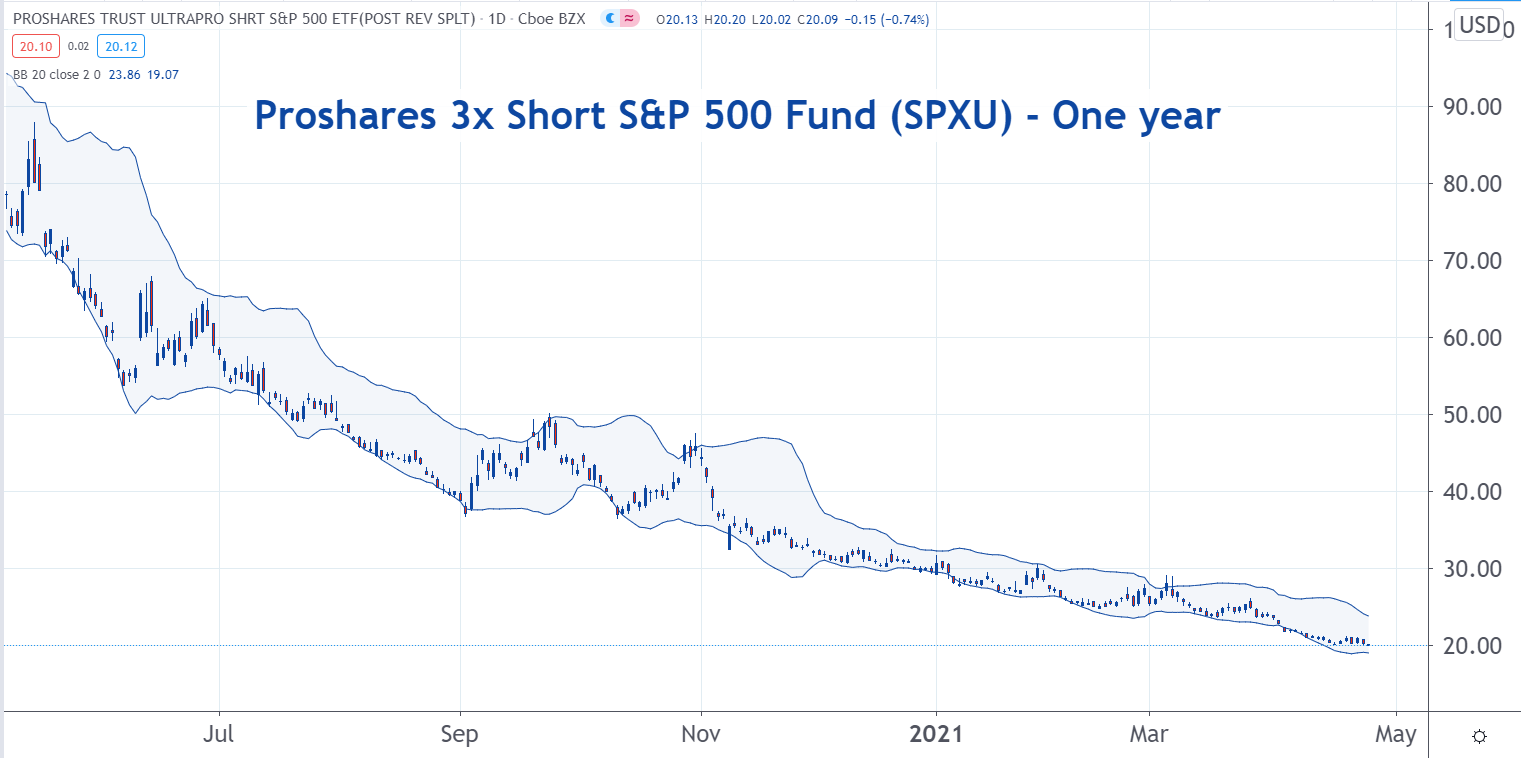

The ProShares UltraShort S&P500 ETF SPXU is highly leveraged. It will move three times the amount of the S&P move in the opposite direction. If the S&P 500 drops by 1%, SDS will appreciate by 3%.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.