Even the experts are starting to understand that there is inflation. It’s been apparent for months. Gas prices are soaring, copper is a multi-year higher, and the price of lumber is the highest that it has ever been.

In general, inflation is bad for investors. Higher prices mean higher costs, and that affects the bottom line.

However, there are ways that investors can hedge their portfolios, and there are even ways to profit. This can be done by investing in ETFs that will rise in price as inflation increases.

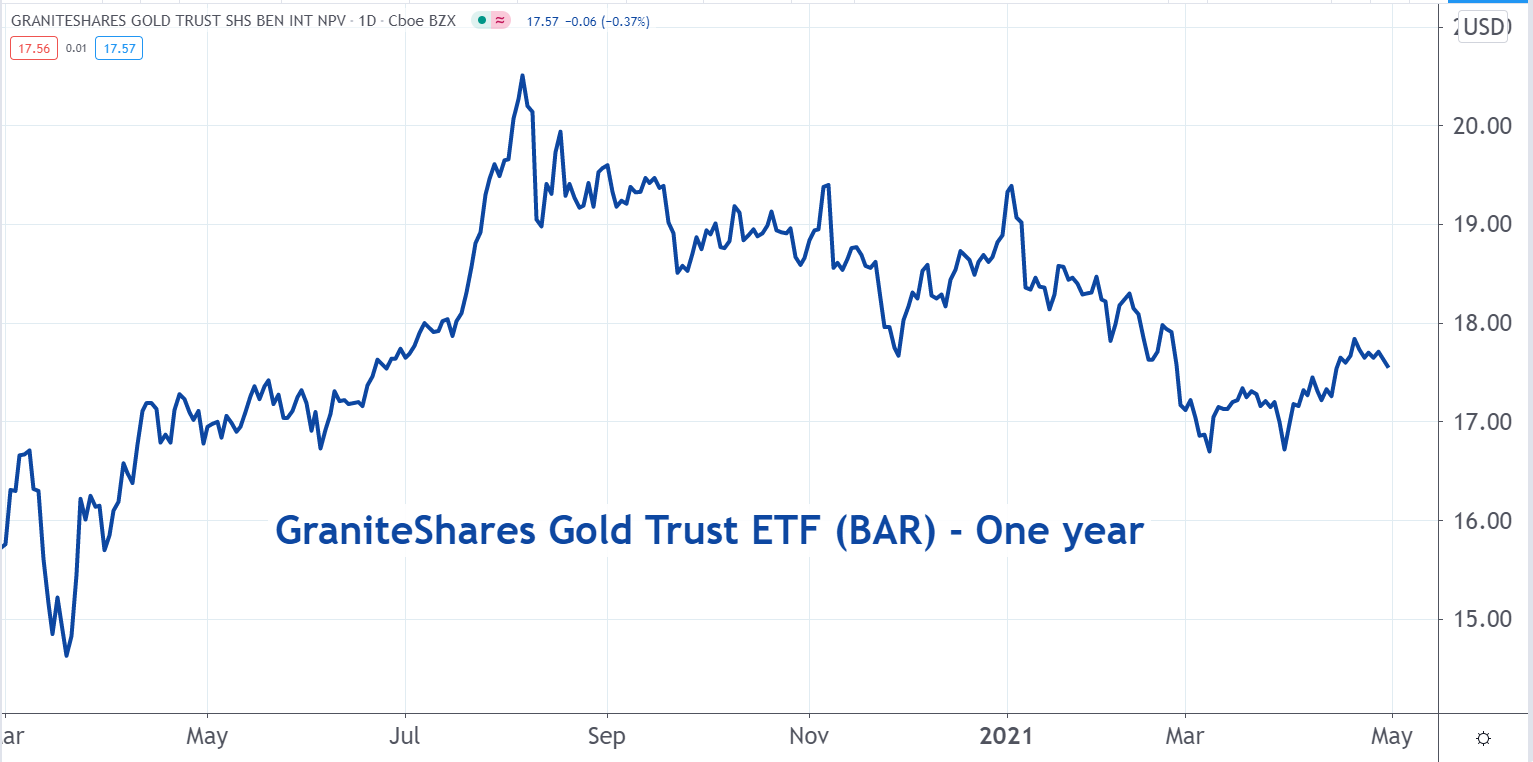

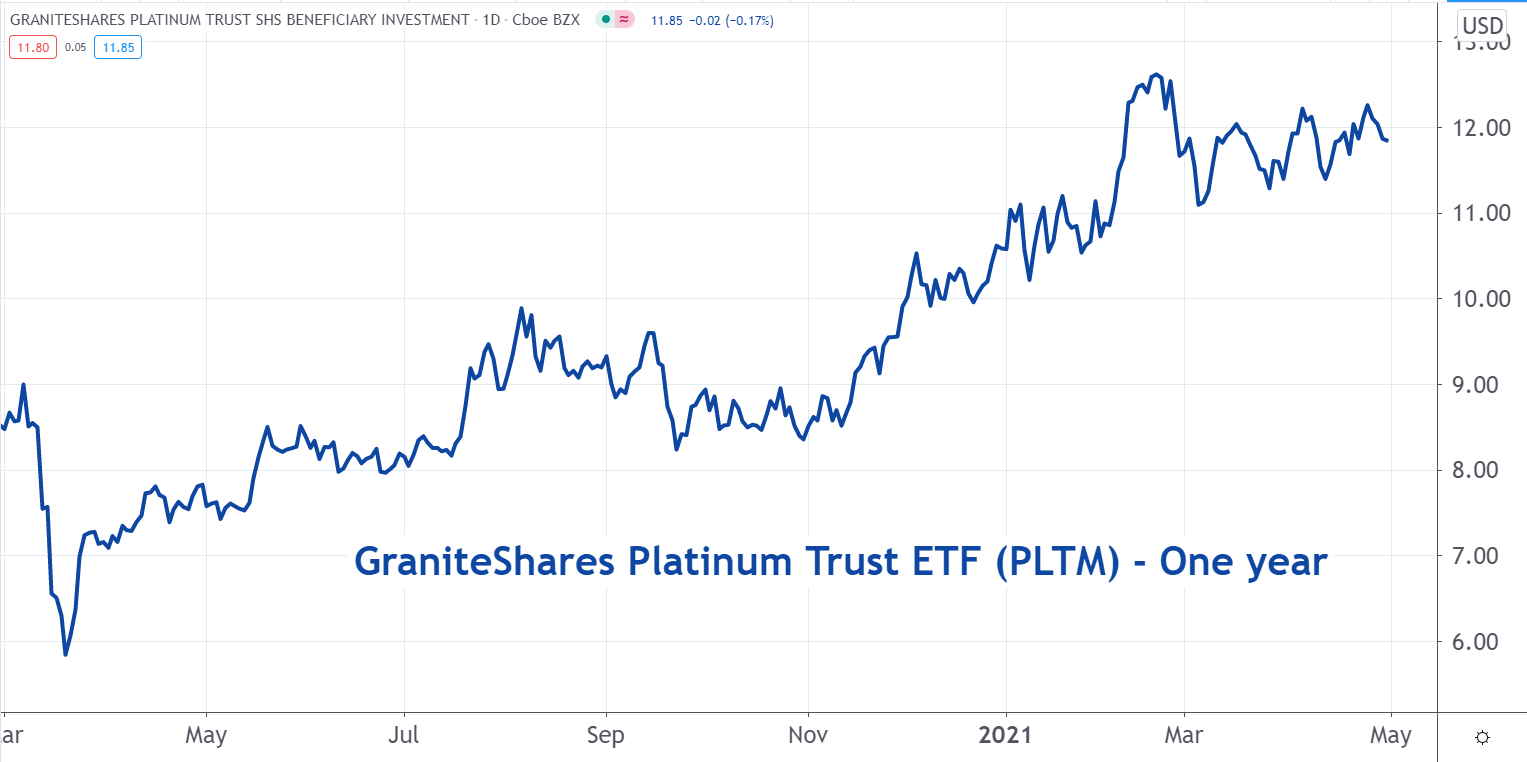

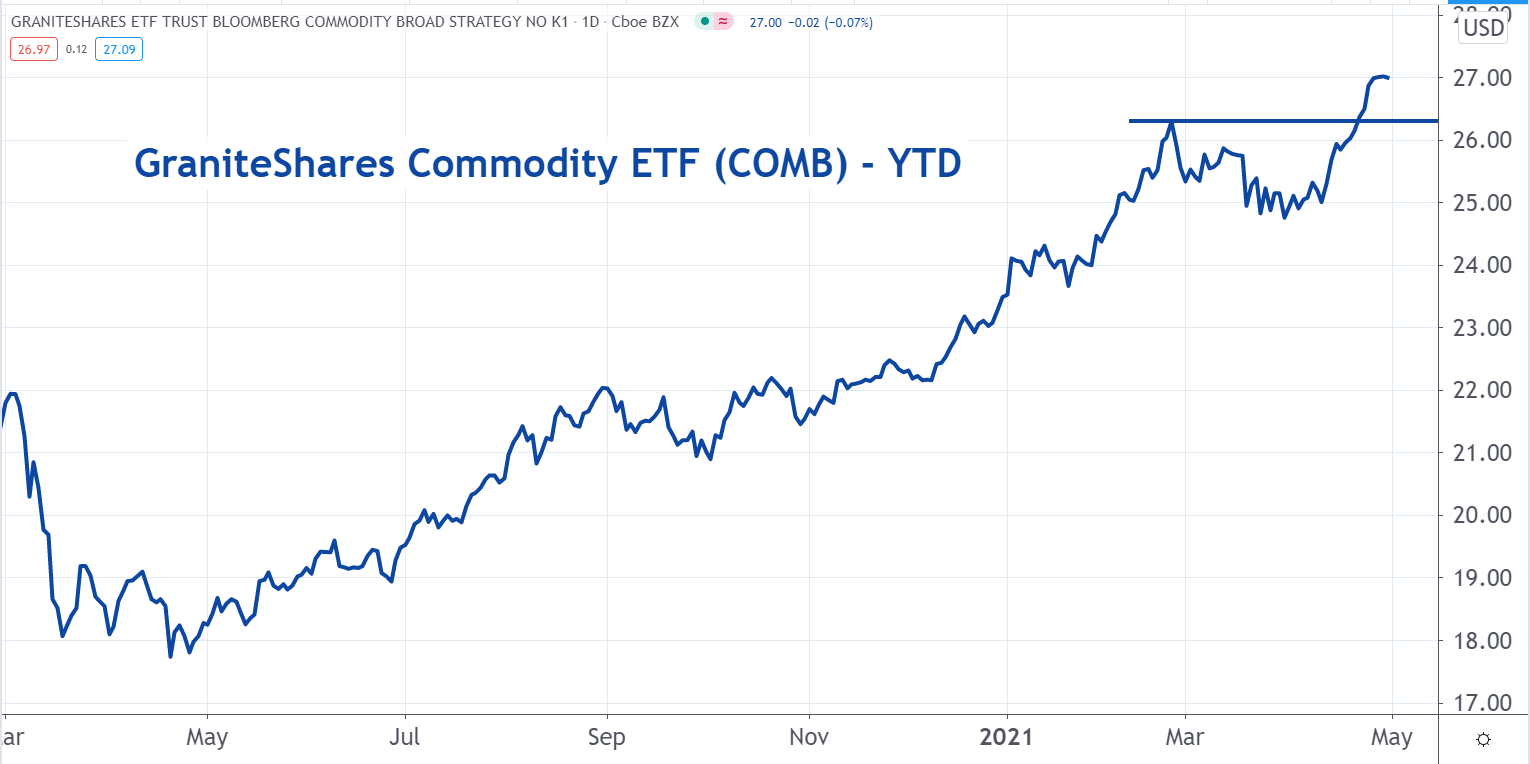

These include the GraniteShares Gold Trust ETF BAR, the GraniteShares Platinum Trust ETF PLTM, and the GraniteShares Bloomberg Commodity Broad Strategy No K-1 ETF COMB. If the price of the assets that these ETFs hold increases, so will their share prices.

See Also: Best Stocks, ETFs and Mutual Funds by Industry

BAR holds gold bars. They are held in a Standard Bank vault in London. Every day the ETF publishes a list of the gold bars that it holds.

PLTM holds bars of platinum. They are also held in a vault in London. Each day a list of the actual holdings is published.

COMB holds a wide range of commodities. They include oil, precious and industrial metals, and agricultural commodities like corn and soybeans.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.