Zinger Key Points

- The Benzinga Stock Whisper Index highlights five stocks each week seeing an increase in interest from readers.

- A series of acquisitions could have a medical company on the radar of readers.

- Volatility can create massive trading opportunities—if you know how to capitalize on it. On Sunday, March 23, at 1 PM ET, Matt Maley is revealing the strategies behind his recent trades made in this volatile market, which have delivered gains up to 450%. Click to register for free.

Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week of Sept. 20:

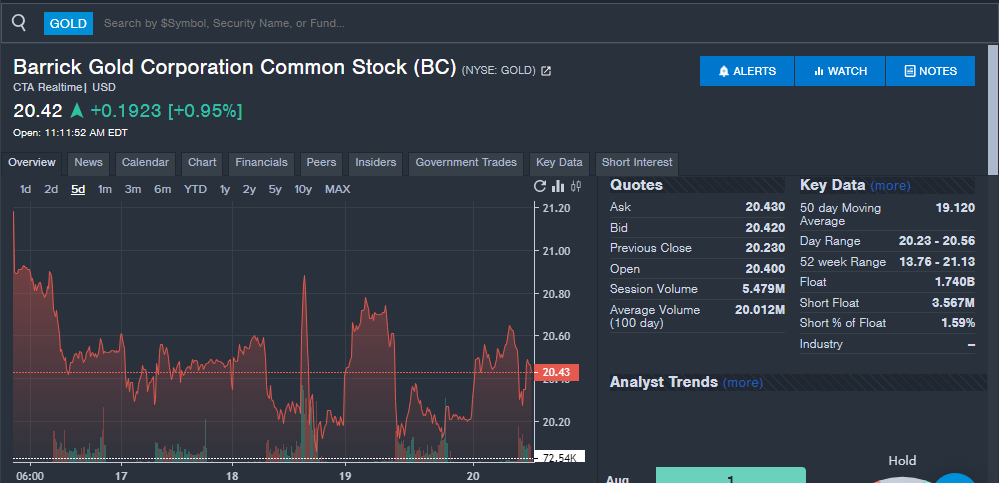

Barrick Gold GOLD: The gold-mining company saw increased interest from readers this week on the heels of a 50 basis point cut to interest rates by the Federal Reserve, which saw gold prices rise. The interest also comes after Barrick Gold CEO Mark Bristow spoke at the Gold Forum Americas earlier this week and said the company expects 30% growth in gold-equivalent ounces by the end of the decade from its existing assets.

Bristow's comments emphasized the company's current mines and those in development, as the industry experiences a surge in merger and acquisition activity. The CEO also highlighted how the company is expanding its copper portfolio, which could be something exciting to watch for investors.

Barrick shares were down 2% over the last five trading days, as seen on the Benzinga Pro chart below. The stock is up 14% year-to-date in 2024.

Galmed Pharmaceuticals GLMD: The biopharmaceutical company saw shares soar during the week after an announcement on drug development activities. Galmed plans to add drug developments that target cardiac fibrosis and colorectal and hepatic cancers. The company will release data from the studies during the fourth quarter.

"The conditions Galmed plans to focus upon in the coming years are major public health problems impacting millions of people worldwide and posing huge financial burden on health providers," Galmed CEO Allen Baharaff said.

Large interest in Galmed saw shares halted several times during the trading week. Helping with volatility in the biopharmaceutical company is the low-float of the stock with around 625,000 shares available according to Benzinga Pro. Low-float stocks can often see high volatility on company announcements.

The stock was up 160% over the last five days and up nearly 100% year-to-date in 2024.

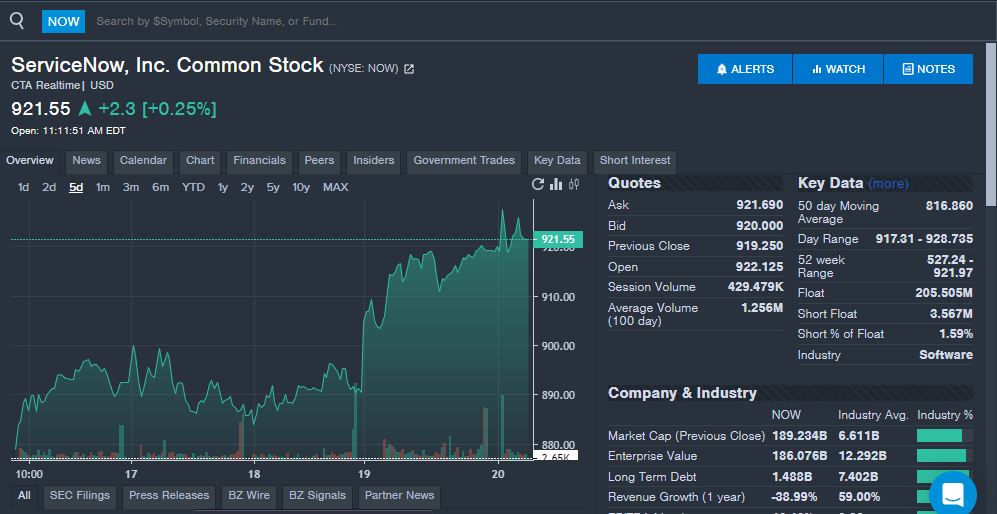

ServiceNow Inc NOW: The software company is seeing a large increase in interest from readers ahead of its third-quarter financial results. Analysts expect the company to report revenue of $2.74 billion, up from $2.29 billion in last year's third quarter.

The company has beaten analyst revenue estimates in six straight quarters. Analysts expect the company to report earnings per share of $3.46, up from $2.92 in last year's third quarter. ServiceNow has beaten earnings estimates from analysts in more than 20 straight quarters.

The company's earnings report will show investors and analysts whether revenue growth and AI platform demand are continuing to strengthen. The company saw subscription revenue up 23% year-over-year in the second quarter and said it was helping meet demand from CEOs looking for new growth as ServiceNow reinvents "every workflow, in every company, in every industry with GenAI at the core."

ServiceNow shares are up 4% over the last five days and up 34% year-to-date.

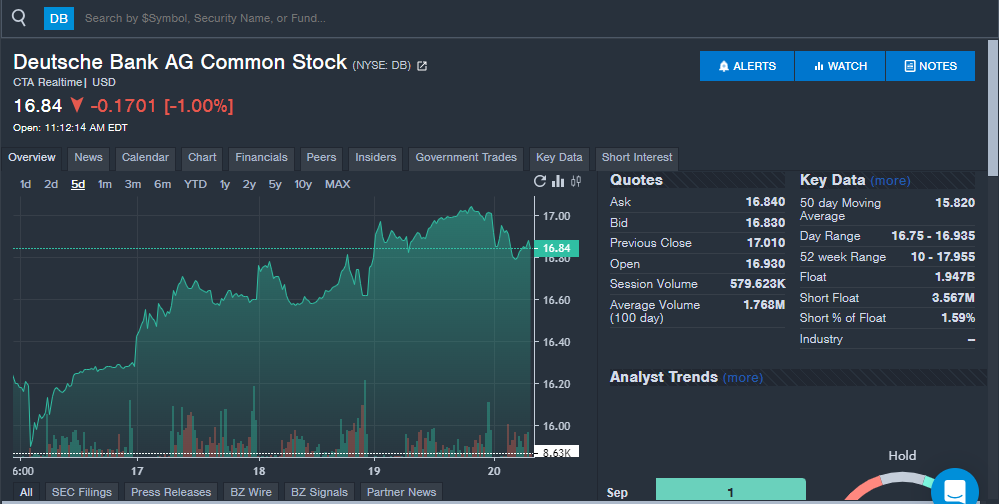

Deutsche Bank DB: It's not every week that a bank stock makes its way on the Stock Whisper Index, but here we are. Deutsche Bank saw strong interest from readers, which could be due to bank stocks getting a lift after the interest rate cut was announced.

The move could see lenders have their balance sheets strengthened going forward and see increased demand for loan activity. Deutsche Bank reports third-quarter financial results in October and could comment on demand and what the future looks like for the company and the sector.

Shares were up 5% over the last five days and 24% year-to-date.

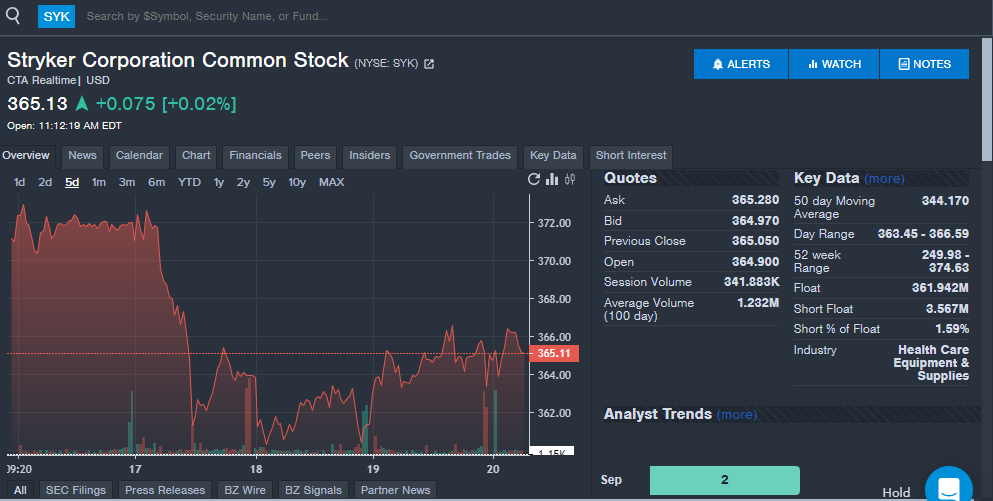

Stryker Corporation SYK: The medical equipment company saw strong interest from readers during the week, which comes on the heels of acquisition announcements, new products and analyst notes.

The company recently unveiled new foot and ankle solutions that can help restore limb length. Stryker closed its acquisition of privately held care.ai, a company helping with AI-assisted virtual care workflows and smart room technology. The company said the acquisition will help accelerate its digital vision and could expand its healthcare IT business.

On Friday, Stryker closed its acquisition of NICO Corporation, a company with a surgery method for tumor and intracerebral hemorrhage procedures. Stryker also announced an acquisition of pain management company Vertos Medical in August. Together, the acquisitions and new products could have investors excited about the company's future and its potential diversification efforts.

Piper Sandler recently maintained an Overweight rating and a $380 price target on the stock. Wolfe Research initiated coverage with an Outperform rating and a $405 price target.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Photo: Benzinga

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.